Will Political and Economic Uncertainty Bolster Silver Prices?

Silver was one of the biggest winners in the first quarter of 2017, rising 14.3% and closing out March at $18.26 per ounce. By comparison, gold prices increased 8.6% in the first quarter to $1,251 per ounce, and the S&P 500 advanced 5.9%. Thanks to geopolitical and economic turmoil, the silver price forecast for the next three months looks bullish, with even more explosive gains coming in the second half of 2017.

Silver and gold bugs were stuck on a roller coaster ride in 2016, as precious metals failed to find solid traction in the latter part of the year. It didn’t start out that way; by early August, silver prices had soared 50% year-to-date, hitting an intra-day high of $20.83 per ounce on August 2.

Chart courtesy of StockCharts.com

In the second half of the year though, silver bulls were in for a rough ride. Silver prices tumbled on the heels of a strong U.S. dollar and, at the time, a hawkish tone from the U.S. Federal Reserve.

Precious metals like silver and gold are used as a hedge against economic and political uncertainty. Rising rates and a strong U.S. dollar suggest that the U.S. economy is recovering and that there is little need for a hedge when everything is, according to the Fed, going swimmingly.

As a result, rising interest rates and a strong Greenback are bearish when it comes to silver prices. Rising rates make non-interest-bearing assets like silver and gold less attractive. Rising interest rates also tend to boost the value of the U.S. dollar.

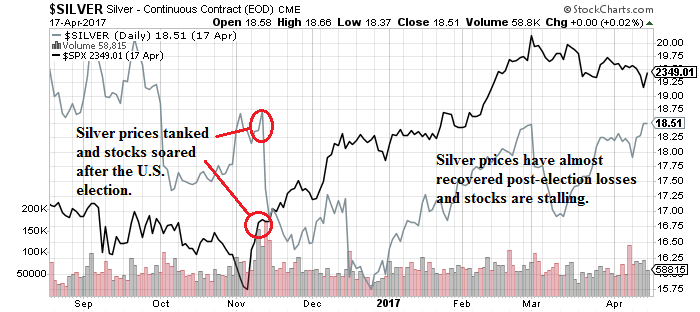

It got even worse for silver bugs after the U.S. election in November 2016. Silver prices tumbled in the days following that election. Investors and Wall Street decided that President Trump’s pro-growth economic policies would help boost corporate profits and put money into the pockets of everyday Americans.

Chart courtesy of StockCharts.com

Silver prices might have ended 2016 up 15% at $15.98 per ounce, but it was on a sour note; silver prices had spiraled almost 25% from August highs of $20.83 per ounce. At the start of 2017, Wall Street was calling for silver prices to hit a brick wall, as Trump’s policies took effect, and to retrace to multi-year lows of $12.00 per ounce.

That didn’t happen either. The soaring optimism about what a Trump presidency would look like started to tarnish when it appeared that Trump might not have an easy time enacting his campaign promises. Economic data which suggests that the U.S. economy is stalling has also been a tailwind for silver prices.

Silver prices are getting additional support in the second half of 2017 on growing uncertainty about Brexit and the snap election called in the U.K. for June 8, 2017. There are also concerns about the French election and calls for that country to leave the European Union (EU).

Finally, silver prices will climb higher as investors seek safe-haven investments from geopolitical chaos surrounding the U.S. and North Korea, Russia, Iran, and Syria.

Chart courtesy of StockCharts.com

For technical traders, silver prices are closing in on an important inflection point. Silver prices are trading well above the 50-day moving average, and the 50-day moving average is close to overtaking the 200-day moving average. This is a bullish indicator called the “golden crossover.” Should trading volume increase, investors should expect to see silver prices break out to $19.00, with resistance near $20.00 per ounce.

Longer-term, the silver price forecast for 2017 remains bullish, with a year-end outlook near $25.00 per ounce.

Silver to Rise on Geopolitical Tensions in the U.S.

While there is plenty of geopolitical and economic chaos happening around the world, American investors don’t need to look outside our borders for reasons to be bullish on silver prices in 2017. The ideal economic conditions (statement in Washington, rising interest rates, overvalued stock market) in the U.S. will help propel silver prices higher in 2017.

Silver prices will get a boost from the White House in 2017 because Americans are not entirely certain that Trump will be able to turn his campaign trail promises of prosperity into reality.

There were many reasons why voters ushered Trump into the White House, but one of the big draws was Trump’s economic action plan. Trump said it was too difficult for corporate America to operate in the U.S. and make money. To make the U.S. more business-friendly, Trump promised to slash taxes, increase spending, and cut red tape.

He also said he would levy tariffs against China, Mexico, and frankly—when it comes right down to it—anyone who imports anything into the United States. Moreover, he would renegotiate the North American Free Trade Agreement (NAFTA) and exit the Trans-Pacific Partnership (TPP).

It all sounds really good. But just like a newly elected high school president, you can’t simply make your campaign promises come true because you want them to. Trump is learning it takes a lot of non-loggerhead negotiating to get anything done in Washington.

1. Gridlock in Washington

Case in point: in the run-up to the November election, Trump called Obamacare a failure and said he would put something in place that was much better. Trump tabled the American Health Care Act (AMHC) in March, but it was pulled after it became clear that the House didn’t have enough votes for the bill to pass.

Getting the AMHC passed was supposed to be low-hanging fruit. On March 25, Trump tweeted the following:

ObamaCare will explode and we will all get together and piece together a great healthcare plan for THE PEOPLE. Do not worry!

— Donald J. Trump (@realDonaldTrump) March 25, 2017

That hasn’t happened yet. And that’s part of the problem. If Trump can’t get something that was supposed to be easy, like the AMHCA, passed, how can the American people trust that any of his campaign promises will become reality?

Trump’s economic policies are supposed to help the U.S. return from abysmal annual gross domestic product (GDP) growth of two percent to four percent. That’s going to be impossible if he can’t get his tax reforms and infrastructure spending through.

We know he can’t rely on Barack Obama’s economic legacy to jolt the U.S. economy into gear. During Obama’s eight years in office, U.S. GDP growth averaged two percent. That’s the average. In 2016, his last full year in office, GDP growth was 1.6%. Obama is the only president to have never achieved annual GDP growth of at least three percent.

Failing to get his economic policies accepted means that the longest economic recovery since World War II will continue for the unforeseeable future. That will have serious consequences on consumer confidence, which will see investors seek a safe haven in silver.

In addition to barely-there economic growth, Trump inherited a national debt of $19.89 trillion and a deficit approaching $600.0 billion. Both of these numbers will balloon under Trump’s economic policies. These numbers will also be exacerbated if he can’t get U.S. GDP and the U.S. economy moving.

Cutting taxes and increasing spending in an environment of weak economic growth is a recipe for disaster for both Wall Street and Main Street. This would essentially put an end to any chance of seeing annual GDP growth of four percent, which means weak corporate profits and the end of the bull market. For Main Street, it means no wage growth, no job security, higher debt, and fewer savings.

This uncertainty will drive investors to silver, which will increase demand and send silver prices higher.

2. Rising Interest Rates

Speaking of “higher,” the Fed has started to raise interest rates because it believes that the U.S. economy is strong enough to support the rate hikes, and it hopes to make sure the so-called hot U.S. economy doesn’t overheat.

But premature rate hikes can derail the already-fragile U.S. economy. It happened as recently as December 2015. The Fed raised interest rates for the first time in a decade, and the markets decided that the U.S. economy wasn’t ready yet. In early 2016, stocks plunged while silver and gold soared.

The Fed raised rates again in December 2016, but investors were so optimistic about how Trump was going to save the U.S. economy that stocks just soared to record levels. Silver and gold took a dive. That euphoria has taken a back seat to reality though. Silver prices have been much higher since the start of 2017, and the once-roaring stock market rally has stalled.

U.S. GDP growth for 2016 came in at an underwhelming 1.6%, and the International Monetary Fund (IMF) has basically said that the U.S. economy will continue its moderate growth rate. This is not stellar news. Again, U.S. economic growth has been abysmal; we’re knee-deep in the slowest economic recovery since World War II, and Trump’s economic plans have not come to fruition. Add it up and there is simply nothing there to, as Trump is wont to say, “get the economy going again.”

The IMF’s projected U.S. GDP growth rate for 2017 of 2.3% is better than the 1.6% rate in 2016, but it doesn’t bode well for Trump, who promised four percent annual GDP growth. Admittedly, the IMF says the rate could go higher or lower depending on what the Trump administration does with key economic issues like taxes, spending, and deficits. But, as we have seen, he can’t do much right now, which points to continued risk to the downside. (Source: “World Economic Outlook April 2017,” International Monetary Fund, last accessed April 18, 2017.)

Increasing the interest rates prematurely could seriously undermine U.S. economic growth in 2017 and see the U.S. plod ahead with GDP growth under two percent again. Should the U.S. economy throw up weak economic data in the midst of rising interest rates, you can expect to see once-optimistic investors run from the markets and the once-rising consumer sentiment plunge. This will drive investors back into silver.

Silver prices could also soar if consumer sentiment plunges due to rising inflation rates. March inflation slipped to a seasonally adjusted 0.3% for a year-on-year inflation rate of 2.4%. This is down slightly from the February reading of 2.7%, which happened to be a five-year high. (Source: “Consumer Price Index Summary,” Bureau of Labor Statistics, April 14, 2017.)

Inflation is only running at 2.5%, but a few years ago it was basically nothing. Higher inflation means that products and services are more expensive. This isn’t a problem when well-paying, secure jobs are aplenty. But they’re not.

In the coming months, investors should expect to see consumers pull back on consumer spending, which will undercut economic growth. That’s something Trump needs desperately. It could get worse in the third and fourth quarters of 2017 as inflation and interest rates rise in conjunction with growing household debt levels..

The silver price trend in 2017 will continue upward as geopolitical tensions in the U.S. gain steam. If history is any indicator, the silver bull market is still in its infancy, meaning there will be explosive growth in the coming quarters and years.

3. Overvalued Stock Market

Despite terrible GDP growth and a fragile U.S. economy, optimistic investors have propelled stocks to record levels. The S&P 500 is less than two percent from its record levels, and the Dow Jones Industrial Average (DJIA) is 2.5% from its record highs.

Keep in mind, the U.S. reported 2016 GDP growth of 1.6%, and it averaged 2.0% during the Obama years. At the end of 2016, the S&P 500 emerged from the longest earnings recession on record. Investors are pinning their hopes on strong first-quarter results but, as we have seen, no one expects U.S. GDP to move higher in 2017.

But, stocks are at record levels. Why? Artificially-low interest rates and financial engineering. Revenues have been down for years, but we’ll streamline operations and buy shares back to boost earnings. Voila. Investors are happy. Investors will only chase momentum and technicals for so long. Eventually, investors will want to see real revenue and earnings growth.

How else to justify sky-high stock prices, which, as you will see, are significantly overvalued?

According to the cyclically adjusted price-to-earnings (CAPE) ratio, the S&P 500 is overvalued by more than 80%. The ratio compares current prices to average earnings over the last 10 years. The ratio is currently at 28.85 and the long-term average is 16. The CAPE ratio has only been higher twice: in 1929 it was at 30, and in 1999 it was at 45. (Source: “Online Data Robert Shiller,” Yale University, last accessed April 17, 2017.)

Those who think that Yale professor Robert Shiller is a little too contrarian can take solace in knowing that Warren Buffett’s favorite valuation indicator also shows that stocks are significantly overvalued. The market-cap-to-GDP ratio is referred to as the “Warren Buffett Indicator” because Buffett believes “it is probably the best single measure of where valuations stand at any given moment.” (Source: “Warren Buffett on the Stock Market,” Fortune, December 10, 2001.)

The market-cap-to-GDP ratio, which compares the total price of all publicly traded companies to GDP, is at 129.7%. A reading of 100% suggests that stocks are fairly valued. The ratio has only been higher once since 1950; during the dotcom bubble in 1999, it was at 153.6%.

This does not mean the stock market is going to crash. It still has a little room to run, if for no other reason than investors are willing to give President Trump a pass to see if he can indeed, “get the economy going again.”

But patience will wear thin if there are no signs of sustainable growth in the coming months. Also, it’s important to remember that, when stocks get this overvalued, it never ends well. There is no example in history of stocks that are this overvalued levelling off in a controlled manner.

Just like there are few, if any, examples of investors not running back into physical silver and silver stocks when stocks experience a correction or crash.

Snap U.K. Election Breeds More Uncertainty

On June 23, 2016, the U.K. voted in favor of leaving the EU, with the “exit” side taking 51.9% of the vote. The effects of the historic vote, and the impending uncertainty of what the U.K. will look like without the economic clout of the EU, was felt around the world.

In the opening minutes of June 24, $170.0 billion of value evaporated from U.K companies on the London Stock Exchange (LSE). The FTSE 100 closed the day down four percent. In the U.S., stocks opened sharply lower, with the S&P suffering its worst opening since 1986.

Silver, meanwhile, soared almost 15% in the weeks following the Brexit vote, from $17.38 an ounce on June 23 to $19.95 an ounce on July 13. In the days following the two-day stock market plunge, investors poured billions of dollars into silver and gold exchange-traded funds.

Almost one year later, and uncertainty still remains. On March 29, British Prime Minister Theresa May triggered Article 50 of the Lisbon Treaty, formally starting the two-year process of negotiations to leave the EU. May has said that leaving the EU will make the U.K. stronger, but that certainty is still open for debate.

And the U.K. will be debating the issue a lot. On April 18, Prime Minister May called a snap election, sending the U.K. to the polls on June 8. The snap election is a total surprise when you consider that the country just went to the polls in May 2015, and the next scheduled vote is in 2020.

May’s Conservative Party is leading in the polls, and calling a snap election is expected to help her win a huge majority over the Labour Party. A strong win would be a vote of confidence for the Brexit vote.

But, as President Trump is learning, winning the election on a strong mandate does not guarantee a seamless transition or execution.

There are also growing concerns about the upcoming French election. Marine Le Pen, president of the far-right National Front party, has pledged to take the same path as the U.K. if she wins the May 7 election. France is the third-largest economy in the EU, right behind the U.K. (second) and Germany (first).

Should both France and the U.K. leave the EU, it will open up the world’s largest economic region to economic uncertainty. It could also jeopardize the economies of France and the U.K.

Even if France doesn’t vote Le Pen in, the seeds are sown all over the EU. It’s just a matter of time before another country takes the leap of independence.

Geopolitical Tensions Rife with North Korea, Russia, and Syria

No precious metal analysis or forecast for silver prices in 2017 would be complete without delving into how silver prices will soar if tensions escalate between the U.S. and North Korea, Russia, Syria, and Iran.

Silver and gold prices have been firming up as investors seek a flight to safety over rising tensions with North Korea. The country’s April 9 missile launch test may have failed, but tensions are escalating as President Trump continues to take a tough stand with Pyongyang.

If you combine the simmering tensions between the U.S. and North Korea’s Kim Jong-un with the unknowns arising from Russia, the recent combings in Syria, and the always-tense relations with Iran, there are plenty of reasons why investors will send silver prices higher in 2017.

There is a lot to power silver prices higher in 2017: gridlock in Washington, rising interest rates, an overvalued stock market, uncertainty with Brexit, the snap election in the U.K., and boiling tensions with North Korea and Russia.

These issues may not drive silver prices sustainably higher in the near-term, but they will provide silver bulls with both excellent short- and long-term opportunities. Silver bulls understand that silver prices can whiplash higher and lower. The key is being able to identify the key issues and take advantage of what is out there.