Rediscovery of Safe-Haven Asset to Drive a Higher Gold Price Trend

Gold has a momentum problem. Stuck smack-dab in the middle of a five-year price range, it’s been sputtering for a long time now. And, to be honest, with quantitative easing (QE) winding down, a relatively “okay” economy, and much higher returns found in equities, there hasn’t been much of a reason to own gold lately.

But, as Bob Dylan once sang, “the times they are a-changin”—words that could be quite apropos for gold bugs soon. My gold price forecast for Q3 2017 recognizes the winds of change, which are just beginning to get whipped up.

So what are these “winds of change” that I speak of? Hidden beneath the morass of back-and-forth price action is the fact that gold prices have held up in “decent” economic conditions. One would expect that, with very low unemployment, low inflation, and a weakening U.S. dollar (USD), the price of gold would be falling. But gold prices are hanging in, even if they are stuck in neutral. (Source: “The Outlook for Gold amid Volatility,” Market Realist, May 18, 2017.)

In my gold price forecast for 2017, I see clear positive catalysts that could allow gold prices to break free.

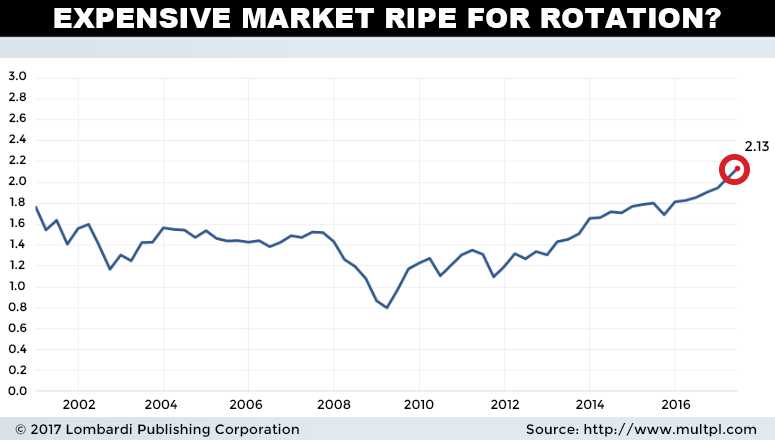

For one, the ridiculous valuations ascribed to equities (the cyclically adjusted price-to-earnings (CAPE) ratio recently moved above 30!) lend themselves to a major correction. Should this correction become a firestorm, odds are that gold will again see flight-to-safety interest by investors.

Hundreds of billions of dollars have flowed into tech stocks and exchange-traded funds (ETFs) over the past nine years, and the money not removed from the market will need a safe place to go. Precious metals (and some alternative assets like cryptocurrencies) will likely absorb much of this safe-haven money.

There are also signs that a recession looms in the not-too-distant future. Should equities get crushed, a new round of stimulus or QE is likely to materialize. While it’s debatable how effective government intervention will be this time around, the U.S. dollar is likely to get crushed if the intervention is large enough. A lower dollar (especially if it stokes domestic inflation) will support gold that is priced in USD, and also support everything else along the commodity complex.

Of course, geopolitical risk keeps ramping up at a frenetic pace. The stock market hasn’t paid much attention while climbing the “wall of worry,” but this may change along with shifts in sentiment. Once volatility—as measured by the volatility index (VIX)—starts veering into higher ground, the market will pay more attention. North Korea, Syria, Ukraine, and the South China Sea are all major flashpoints with the potential to escalate quickly.

I predict that the new buzzword when equity-market calamity strikes will be “rotation.” As in, sector rotation into over-inflated and crashing equity prices, as well as into safe-haven assets like gold. There are many reasons for this. All that’s needed is the trigger.

Analysis of Gold Prices for Q3 2017

Although brighter days may be approaching, it won’t be clear sailing. While the odds of a recession are creeping up, along with a flattening yield curve, a recession isn’t a given. Even if a recession does come, it may not materialize until 2018, so the gold price trend may languish further. A test of $1,200/ounce (or perhaps $1,060/ounce) is a distinct possibility if the economy appears more resilient than many expect.

There’s also the risk that Donald Trump somehow unites Congress and pushes through pro-business policies like corporate tax cuts and offshore capital repatriation, which would help economic growth. That looks unlikely now, but it’s a possibility. Anything that keeps the economy flowing, even at stall-speed, won’t encourage institutional money to dive in. Without institutional money, paper gold can, and will, be capped and maneuvered in place.

My Gold Price Forecast for 2017

In summary, my gold price forecast for 2017 reflects my belief that the catalysts I’ve mentioned will gradually take hold. If not in Q3 2017, then somewhere shortly down the line, I see $1,500/ounce gold. The time is coming when the market will once again re-discover gold’s amazing capital-preserving characteristics. I believe this will coincide with a sizable market decline and a falling U.S. dollar (due to more stimulus spending).