Restaurant Collapse May Be the Ultimate Harbinger of Things to Come

Americans love dining out. But the nation that invented fast food with its patriarchal founder McDonald’s Corporation (NYSE:MCD), is facing a serious problem. A restaurant collapse is currently unfolding. If we’re reading the tea leaves correctly, this portends quite badly for the state of the U.S. economy, and U.S. stock market further downstream.

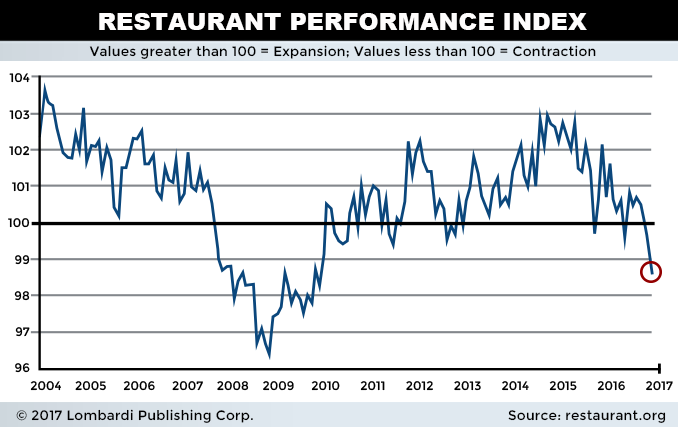

According to new industry research, the restaurant industry just suffered its sixteenth consecutive month of decline, the longest streak since the U.S housing bubble. Same store sales fell one percent, while foot traffic declined three percent. Overall, sales retrenched in 150 markets while only growing in 45. Worse still, industry analysts see no growth catalyst in sight. (Source: “US Restaurant Industry Stuck In Worst Collapse Since 2009,” Zero Hedge, July 15, 2017.)

Also Read:

U.S Housing Bubble 2017 Is No Black Swan because It’s Predictable

Underscoring all this core weakness was the lack of pricing power within the industry. Average check amounts rose about 2.2% from 2.8% a year ago. Black Box Intelligence Executive Director Victor Fernandez characterized the industry as “reluctant to implement significant price increases given the current environment.” (Source: Ibid.)

Another thing this negative data shows is that the serial decline in retail sales isn’t just an aberration. It isn’t happening simply because Amazon.com, Inc. (NASDAQ:AMZN) is stealing market share. To my knowledge, Amazon doesn’t own a single restaurant or fast food chain. This data solidifies the fact that consumers are pulling back on non-essential purchases of all types. It’s endemic.

Now ask yourself, would negative sales growth occur if the economy was really robust? That’s a rhetorical question of course, but people sometimes neglect to connect the dots. Since eating out is a discretionary activity, it’s among the first activities on the chopping block when people pull back on spending. But because of taste and convenience, doing so is mostly involuntary.

Ultimately, this retrenchment is telling us that people are losing ground financially, trying to save when and where they can. The question people should be asking themselves is why this is happening now. Remember, we’re riding an eight-year period of moderate economic expansion that’s supposedly peaking. But these numbers indicate that something’s not right. There’s a profound disconnect between how strong the economy actually is, and how strong we’re told it is.

In terms of purchasing power, I call this the expansionless expansion. People are getting squeezed from all sides: tax creep, non-existent wage growth, low unemployment fueled by temporary and low paying jobs, large debt loads only kept at bay by ultra-low rates. Yet, these are supposedly good economic times in America.

If that’s indeed true, we’d hate to see what recessionary times bring us. It could be nothing short of disaster.

How Slowing Restaurant Sales Affect the Stock Market

I have yet to come across hard data indicating a correlation between the ongoing restaurant collapse and the U.S. stock market. Outside of a few dozen food and restaurant stocks, both entities seemingly have little in common. But can negative restaurant growth indicate a “shadow” weakness in the U.S. economy that could spill over to equity prices downstream? Common logic indicates it might.

After all, if consumers are reluctantly dining out, it suggests that Americans might be pulling back on other discretionary purchases. That drive-through coffee in the morning could transition to a semi-regular affair; this could hit stocks like Starbucks Corporation (NASDAQ:SBUX) and Tim Hortons Inc. (NYSE:THI). That semi-annual vacation might be pared down to yearly or bi-yearly; this would affect companies like Expedia Inc (NASDAQ:EXPE) and Priceline Group Inc (NASDAQ:PCLN). We already have witnessed the first pangs of what some analysts are calling “Carmeggedon.” That is, declining year-over-year sales of automobiles despite record incentives and manufacturer price wars.

Some might argue that a discretionary spending slowdown may not affect core equities responsible for the market’s huge gains. But is that true? From my perspective, it is not.

For example, is it more reasonable to assume people will continue purchasing new-generation $800.00 “iPhones” with minor feature upgrades, or is it more reasonable to assume people will hold on to their current iPhones a little longer? Is it more reasonable to assume people will rush to upgrade the newest Microsoft Corporiation (NASDAQ:MSFT) desktop software, or hang on to their older versions a little longer? Will companies continue to splurge on very costly “Google Adwords” programs, or retrench on par with the consumer?

Ultimately, I’m arguing is that there’s no escape from the wrath a consumer spending slowdown will bring. Whether you’re a home builder, tech company, appliance manufacturer, or computer hardware company, all will be ensnared. Consumers are incredibly crafty at substituting for cheaper goods, and stretching life-cycles of older products.

Ultimately, slowing discretionary spending is the canary in the coalmine for slowing profits. S&P earnings have barely budged since 2012, but the corporate maneuvering is nearing an end. With such pervasive consumer price sensitivity, it won’t take much for the demand-side of the equation to deteriorate fast. When it does, recession won’t be far off. And we all know the historically-overvalued stock market will get killed if profits collapse.

When you think about it, how many things do consumers purchase which are absolutely necessary? When folks are flush with cash, marketing departments can think of ingenious ways to keep people spending on frivolous things. When people are broke, not so much. Convincing Americans to keep spending will be corporate America’s biggest challenge going forward, but we suspect limits are close at hand. It’s hard to squeeze blood from a stone.

There’ll be nowhere for the market to hide if they fail.