Three Reasons Why Gold Prices Could Soar

Truth be told: we are moving toward a complex global economy. Pay attention to gold prices. The yellow precious metal could be the biggest beneficiary.

Here are three things that are currently taking place that could have significant positive impacts on gold prices. They shouldn’t be ignored by investors, whatsoever.

1. Disparity Among Central Banks

Not too long ago, the U.S. Federal Reserve increased its interest rates again. Going into 2017, we are told that there will be several more rate hikes. Don’t for a second think that this will go without consequences.

The Federal Reserve is the only central bank among major central banks that is raising its rates. Others are keeping them low and/or printing more money. For example, the European Central Bank (ECB) and Bank of Japan (BoJ) have both set their benchmark rates below zero (in negative territory) and are printing new money with no clear end in sight.

This disparity among central banks could be very dangerous. We could see severe volatility as a result, and investors could find refuge in the yellow precious metal, hence much higher gold prices.

Disparity among central banks could cause capital outflows from low-interest-rate countries to higher-interest-rate countries, and a significant amount of capital dislocation.

2. Central Banks Constantly Buying Gold

Central banks used to be known as institutions that hated gold. Their sentiment since the financial crisis of 2008-2009, however, has changed completely. The central banks that didn’t have gold before the crisis have been buying it. Those that already had significant amounts of gold are hoarding it.

In the first three quarters of 2016, central banks purchased 271 tonnes of the yellow metal. In 2014 and 2015 combined, central banks purchased over 1,150 tonnes of gold for their reserves. (Source: “Gold Demand Trends Q3 2016,” World Gold Council, November 8, 2016.)

Why are central banks buying gold? Know that gold brings down the volatility in their portfolios (foreign reserves). Central banks also have huge buying power, and they could take gold prices much higher.

3. Volatility in Currency Market

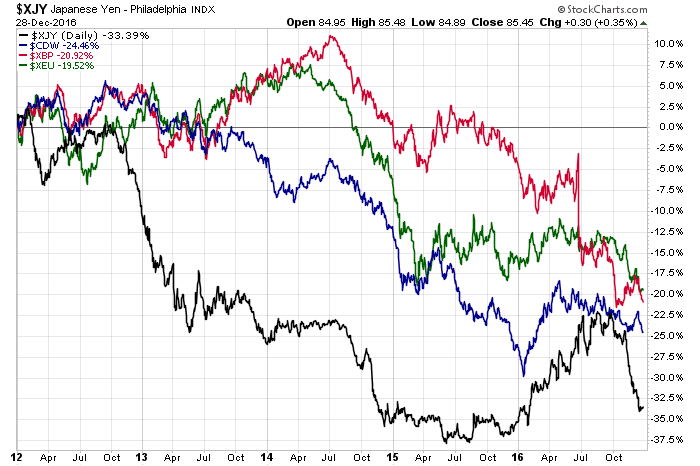

If you haven’t noticed yet, it may be time to pay attention now: currencies around the world are witnessing wild swings. Look at the chart below, showing the performance of major currencies: the Japanese yen (black), the Canadian dollar (blue), the British pound (red), and the euro (green).

Chart courtesy of StockCharts.com

Just by looking at the chart above, you see that investors and consumers in Japan, for instance, have lost roughly 35% of their buying power since 2012. Won’t they be looking to find a place that protects them from a downside? Gold could do this.

Don’t look at gold prices from a U.S. dollar perspective alone. Think global when looking at the precious metal. Lower currency value could lead to much higher demand for gold.

In addition to this, pay attention to the emergence of new currencies like Bitcoin (BTC). They could have an impact on gold prices as well.

Gold Prices Outlook: Why $2,000 Gold Remains Possible

I will be bold and say this: for every day that gold prices remain subdued, the precious metal becomes an even better opportunity.

Looking at the fundamentals of the gold market, over the past few years, there has been a significant amount of improvement. And, there have been new developments that suggest gold could have a much brighter future ahead.

If you listen to the mainstream media, it will have you convinced that gold isn’t even worth a look. Ignore this rhetoric.

Keeping everything in mind, I am not ruling out $2,000/ounce gold prices in the next few years. It’s possible.