Stealth U.S. Dollar Collapse Possible as King Dollar’s Influence Wanes

The U.S. dollar collapse has been on many people’s radar for, well, forever. The dollar’s remarkable resilience is a testament to the strong relative fundamentals that the American political and socio-economic system enjoys versus the rest of the world. That’s why “King Dollar” is still the world’s reserve currency today.

But what if this narrative is changing? What if degrading fundamentals—including competition from upstart currencies—threaten to tip the balance toward persistent dollar selling? Will the U.S. dollar collapse? It can, if the snowball turns into an avalanche.

Most people are familiar with America’s new-normal slow-growth paradigm. What many don’t realize—although many still cling to the idea—is that the great economic machine known as the “American Dream” isn’t coming back. Not in the way we remember it, at least. It’s essentially a numbers game now, and problems like huge debt levels and workplace automation are only going to increase.

Without the return of economic growth, the dollar is destined for continued debasement through the printing press. The only other option is a U.S. dollar devaluation by way of default, or high inflation. Both will kill the dollar, but through different means.

Adding further pressure to the deficit, President Donald Trump has signaled a very dovish tone toward deficit spending. In Trump’s “Budget Blueprint” released on March 15, 2017, he advocated $1.0 trillion in infrastructure spending and does not include reforms for the real elephants in the room: Social Security, Medicare, and Medicaid. (Source: “America First,” The White House, March 15, 2017.)

Given that Trump has already pledged that Social Security won’t be touched—and that he has said he favors increases in spending on things like veterans’ care—federal government spending is only going up, not down. There’s no inclination that controlling entitlement spending is on anyone’s radar; certainly not from the administration still looking for their first “wins” in Congress.

There’s even an ambitious attempt to raise defense spending by $54.0 billion per year, which is already 10-times higher than the annual budget of America’s next nearest rival. Under these conditions, the federal deficits will only balloon faster than the 150% debt-to-GDP ratio projected by the Congressional Budget Office (CBO) by 2050.

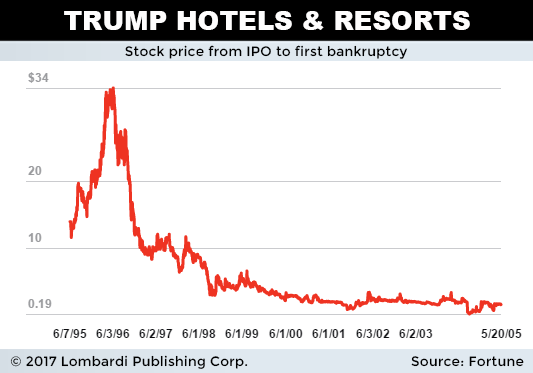

This shouldn’t come as a shock to anyone who is paying attention. After all, they didn’t call Trump the “Debt King” for nothing. Over-indebtedness almost sunk the Trump empire on a couple of occasions; and it actually did in the case of individual assets like Trump Hotels and Casinos Resorts in 2004. Should his policies come to fruition of much lower corporate tax rates (from 35% down to 15%), combined with increased federal outlay spending, it’s practically impossible for tax receipts to bridge the gap.

That is, unless you believe that annual economic growth can be sustained at four percent indefinitely, which it cannot. The average business expansion growth rate has been contracting since the mid-1970s. Not coincidentally, this occurred during America’s industrial manufacturing peak.

Gross Domestic Product (GDP) growth cycles that used to peak at eight percent, then six percent, then four percent, are now barely able to crack two percent growth in a good quarter. America’s workforce is aging and losing productivity, and now something even more ominous is lurking in the background.

Automation is about to enter stage right, and it’s threatening to engulf the workplace. Between 1990 and 2017, industrial robots unleashed in the workplace (around 670,000 in total) eliminated 6.2 jobs for every one job they created. But the real kicker: wages declined between 0.25% and 0.50% for every 1,000 robots that entered a company workforce. (Source: “Six jobs are eliminated for every robot introduced into the workforce, a new study says,” Recode, March 28, 2017.)

Now, imagine the wage deflation assured to take place when dozens of large multi-national companies start laying off workers. Some of these companies employ 250,000 people or more worldwide. If only 10% of these workers get replaced by automation over the next few years, wages could fall 2.5%–5.0% or more for the remaining in-house workers. How is this not monumentally deflationary in nature? Deflation is Kryptonite to high deficits.

Even worse, there are indications that job losses will be much higher than 10%. A recent study predicted that 38% of jobs will be automated by the early 2030s. This includes high-paying financial service positions, which carry a 61% risk rate. All told, four out of 10 U.S. jobs could be eliminated, which will add pressure to the 30-year low labor participation rate currently plaguing the economy. (Source: “Watch out America, robots are coming for your jobs: Report finds 38% of US jobs will be automated by 2030,” Mail Online, March 24, 2017.)

Again, why am I talking so much about automation in a U.S. dollar collapse article? Because, without real organic economic growth, brought about by higher wages and tax receipts, deficit spending can only ramp higher. This will only lead to higher debt servicing costs as interest rates gradually normalize and the debt servicing principal steadily increases.

Thus, from a supply-side perspective, the die has already been cast. The upcoming dollar collapse is a mathematical certainty; all that’s remaining is a demand-side catalyst. We believe one might have arrived.

Signs of a U.S. Dollar Collapse in 2017

The U.S. dollar collapse scenario hasn’t happened yet, but more signs keep pointing in that direction. The scenario will truly occur when all the “collapse” pieces are in place, which hasn’t happened yet. One important piece will be shifting worldwide interest and necessity away from the dollar. Some rival currencies—most notably of the digital variety—are starting to pose a serious challenge.

Bitcoin’s rise to preeminence has been astonishing. As of this writing, it’s trading at all-time highs of $1,460, having risen 1400-fold in just five years. That’s what real growth looks like.

Major industrialized nations like Japan and Russia are just starting to recognize Bitcoin as legal tender. Such a move would signal a huge step toward eventually recognizing bitcoins as legitimate central bank assets.

Also, because cryptocurrencies are not centrally managed, America’s rivals would have a huge incentive to accumulate cryptocurrencies as reserves instead of recycling U.S. dollars. From a foreign perspective, breaking up the dollar’s reserve currency status would serve to knock out America’s ability to finance its war machine; something that Russia and China both crave.

In fact, it seems Russia and China are not waiting around for blockchain’s rise to take matters into their own hands. The Russian Central Bank opened a Beijing-based bank in March 2017, signaling its intent to forge alliances with China, with the ultimate intent of establishing a gold-backed system of bilateral trade. This would bypass the need to use the U.S. dollar altogether, as an Eastern gold standard gradually forms. (Source: “Moscow and Beijing join forces to bypass US dollar in world money market,” South China Morning Post, March 18, 2017.)

Once the G20 industrialized nations stop requiring U.S. dollar in trade, one of the main drivers of demand dries up.

Various other nations are working bilaterally as well to circumvent the dollar’s dominance in foreign trade: Iran, Argentina—and Libya during the Muammar Gaddafi years (some believe his desire to bypass the dollar by trading in gold ultimately led to his demise).

This trend is unstoppable, as more nations attempt to break free from the dollar shackles. On the road to ruin, the U.S. dollar collapse timeline requires the underpinnings of support be severed. Critical mass will be achieved when enough countries choose to ditch the dollar and trade with another currency.

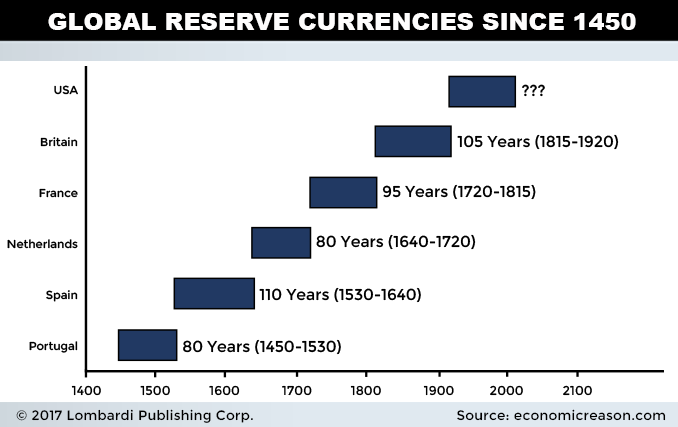

Aside from all of these negative events, perhaps the U.S. dollar’s time has simply come. Nothing lasts forever. The world changes, and the balance of power ebbs and flows through the decades. America is no longer the economic superpower it once was. It’s a graying, uber-mature, hollowed-out economy with financial debt and social security obligation it can never pay back.

The weakening dynamics playing out in America are no different than those of the Roman Empire, which gradually diluted the amount of minted silver in its coins to five percent of their original value. Why? To pay for such things as defense against the barbarians and pork-barrel projects for their over-indulged monarchy. Surely, this sounds familiar.

As a testament to the “nothing lasts forever” meme, numerous different countries have both held and relinquished the world reserve currency mantle over the centuries. The average period of reserve currency dominance is around 90 years (since 1450), and the U.S. is right up against this timeline now. We simply may be approaching the time where the U.S. economy is too mature and its indebtedness too great for the world’s currency power structure to shift somewhere else.

When will the dollar collapse? U.S. dollar collapse predictions are notoriously tough to pin down. My best guess is that it will be a gradual process, rather than a single event. It’s the fraying at the edges which will gradually eat away at dollar supremacy.

The catalyst to really kick-start a crisis might be a credit downgrade or an unforeseen catastrophe. But, if history is any guide, the dollar’s reserve currency status is lying on quicksand and, once it sinks, the dollar’s value will careen lower. Again, think gradual timelines, picking up pace as the crisis wears on.

It’s the inevitable result when a mature economy gets complacent, coupled with huge liabilities it can no longer avoid.