Charts Indicate That Oil Prices Could Drop a Lot

As the COVID-19 pandemic began in 2020, oil prices collapsed. A barrel of oil traded at prices never seen before. Since those lows, the price of oil has have recovered by a lot. Recently, West Texas Intermediate (WTI) crude oil traded as high as about $77.00 per barrel.

Now, the big question: Where could oil prices go next? Sadly for oil investors, there’s a chance they will face headwinds.

First, look at the following short-term chart of WTI crude oil prices. Pay close attention to the 50-day moving average. Notice something? The price of oil recently dropped below its 50-day moving average. Also, this is the first time something like that has happened in 2021.

At its core, this says the short-term trend for oil prices has changed direction and is now pointing downward.

Chart courtesy of Stockcharts.com

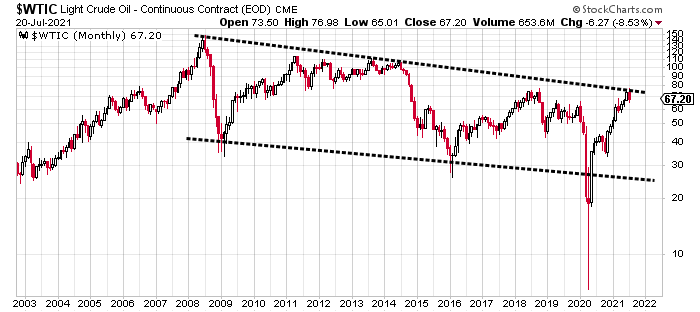

It’s also important to pay close attention to the long-term chart of oil prices:

Chart courtesy of Stockcharts.com

Since 2008–2009, oil has been trading in a downward-sloping channel (assuming the move we saw in 2020 was an anomaly). Not too long ago, the price of oil reached the top of this channel and dropped. Could oil be headed toward the bottom of the channel? If that’s the case, it would mean oil would have to drop below $30.00 per barrel. That would be a decline of more than 50%!

Here’s something else worth mentioning; if oil prices break out of this bearish channel and move above $80.00, it wouldn’t be shocking to see them go above $100.00 per barrel. It could even test the highs made in 2008.

Basic Economics Say Price of Oil Setting Up to Drop

Looking from a fundamental perspective, there’s a giant mountain ahead for oil prices to climb.

You see, oil is a growth commodity. In the second half of 2020, expectations for global economic growth shot through the roof. This was all due to the immense money-printing by central banks around the world and governments spending huge amounts of capital. Economic growth followed. The start of 2021 was solid, too. But now it’s starting to look like global economic growth could stall in the next few years. We could be going back to sluggish growth rates like in the 2018–2019 period.

That isn’t all.

With higher prices, oil producers have a lot of incentive to produce more. So, with oil prices at multi-year highs, it’s possible that we will get more supply in the oil market. Guess what happens when global economic growth slows and oil production increases? The price of oil could fall.

What to Do if Sluggish Oil Market Follows

Dear reader, I don’t want to be the bearer of bad news. I love it when everyone is making money. However, if you own oil or oil-related investments, it may be time to pause and reflect.

I don’t expect an absolute collapse in the price of oil. However, some weakness is certainly possible. Not all oil companies behave similarly. During sluggish times in the oil market, the best place tends to be with the major oil producers.

Why? Major oil producers can operate in tough economic conditions (they have access to capital if there’s a need for it), they are diversified, and they could preserve wealth. Smaller companies could get hurt, since they might not be able to sustain their operations and they might not be profitable.