Oil & Gas Penny Stocks 2017

What are the best oil and gas penny stocks to watch? It hasn’t been easy to find the best oil and gas penny stocks. In fact, oil and gas stocks in general have suffered from supply gluts and tumbling oil prices. Even in early 2016, when oil prices rebounded off a 13-year low near $27.00 per barrel, they found resistance near $50.00 per barrel in the second half of the year. Even though oil and gas prices remain depressed, positive global growth signals suggest it’s a great time to invest in oil and gas penny stocks.

If you’re looking for solid oil and gas penny stocks with great potential, you’ll find an oil and gas penny stock list at the bottom of this article.

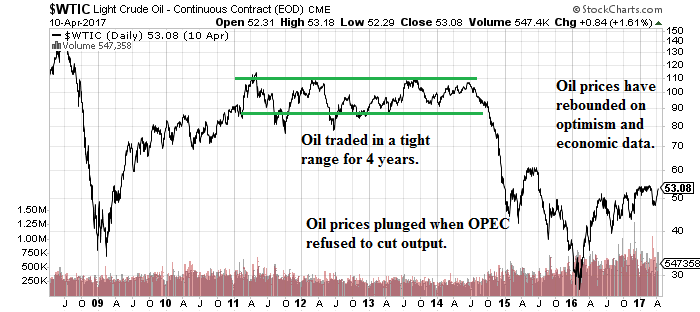

In 2007, just before the financial crisis, oil prices hovered around $140.00 per barrel, with many economists predicting oil would top $200.00 by the end of the year. It didn’t happen. Oil prices tanked as the world faced the biggest economic slowdown since the Great Recession. By February 2009, oil prices had spiraled down by more than 70%, and oil was trading at a five-year low near $35.00 per barrel.

But oil and gas prices rebounded, along with the broader market, as the extent of the sell-off was seen as overblown, even in light of China’s slowing economy. With research and development (R&D) budget cuts, expansion plans shelved, and production cutbacks from the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC producers, energy supplies tightened as the global economy showed modest signs of life.

By 2011, oil and gas prices were at the highest levels since before the 2008/2009 stock market crash, with West Texas Intermediate (WTI) crude oil averaging $98.47 per barrel, a $15.00 increase over 2010.

Oil and gas prices got support in the first half of the year from the Arab Spring and the civil war in Libya. In fact, the civil war in Libya took 1.5 million barrels of oil per day out of production from mid-February to early March. Thanks to the low production capacity and OPEC’s inability to close the gap, oil prices climbed.

Chart courtesy of StockCharts.com

Demand from emerging economies like China and those in the Middle East also helped drive crude oil prices higher in the years following the financial crisis, which also benefited oil and gas penny stocks.

For much of the next three years, oil prices traded in a pretty tight range between $90.00 and $110.00 per barrel. Then oil prices started to feel the pressure again in the second half of 2014, due to increased supply of North American shale and weak global economic data. At the time, the International Energy Agency (IEA) warned that, unless global oil producers cut production, oil prices would continue to fall through the first two quarters of 2015. (Source: “Oil price set to fall further in 2015, IEA predicts,” CBC, November 14, 2014.)

Oil and Gas Penny Stocks Slammed by OPEC

Instead of heeding the warnings, OPEC surprised the world when it announced in November 2014 that it would not reduce its output. It was no secret that OPEC (controlled by Saudi Arabia) wanted oil prices to fall further, in the hopes that non-OPEC oil-producing regions, namely U.S. shale producers, could not remain profitable and would shut down. This would then lead to higher oil prices and more Saudi control over the oil industry.

Even financially-desperate Russia—a country that gets half of its government budget from oil and natural gas and was, at the time, about to tumble into a recession—sided with Saudi Arabia and agreed to not cut production. Russia kept its production stable at 10 million barrels per day. (Source: “Cheap Oil Threatens Russia With Recession, Deficits and Oil Output Falls,” The Moscow Times, November 27, 2014.)

The Saudis blamed the low oil prices on speculators, not weak demand and record supplies. Quite certain that Saudi Arabia could bring the U.S. shale industry to a standstill, Ali al-Naimi, the Saudi oil minister in 2014, said that if other non-OPEC countries wanted to cut production, they could go ahead. But Saudi Arabia was never going to cut production. “That position, we will hold forever, not just 2015.” (Source: “Saudi Arabia: We’ll never cut oil production,” CNN, December 22, 2014.)

Chaos ensued in the immediate aftermath. By January 2015, oil prices had plunged to around $43.00 per barrel; by February 2016, oil prices had fallen to $26.00 per barrel. Over that time, many oil and gas stocks lost 50% or more of their value, with many onetime market giants falling into penny stock territory. While this created huge investing opportunities, many investors waited on the sidelines as the volatility and unpredictable nature of OPEC was simply too great.

Saudi Arabia’s Oil & Gas Gambit Failed Miserably

Over the long run, though, Saudi Arabia’s gamble failed miserably. Necessity is, they say, the mother of invention. Thanks to American ingenuity, technological gains significantly reduced shale production costs, and the entire shale industry simply became more efficient.

The same cannot be said for Saudi Arabia and other OPEC nations. The 50% reduction in oil prices removed $410.0 billion in revenue from OPEC coffers. In 2014, OPEC nations generated $745.0 billion. By 2015, that number had fallen to $350.0 billion and was projected to be just $338.0 billion in 2016.

More specifically, Saudi Arabia burned through $209.0 billion in reserves. The country’s reserves, which stood at over $520.0 billion, are projected to fall to $460.0 billion by the end of 2017. (Source: “Thousands of layoffs and half a trillion in revenue losses: OPEC’s two-year price war has added up,” Financial Post, November 29, 2016.)

Never say never. In an about-face to its initial bravado, Saudi Arabia announced in November 2016 that OPEC and non-OPEC oil-producing nations, including Russia, Mexico, and the Kingdom of Bahrain (but not the U.S., Canada, or the U.K.) would be lowering their production levels for 2017. In the following weeks, oil prices rebounded, climbing from around $43.00 per barrel to $54.00 per barrel.

The temporary production cuts raised oil and gas prices, but only so far. Drilling in the U.S. and stockpiles undermined any production cuts.

Will Donald Trump Be Good for Oil and Gas Penny Stocks?

Moreover, the North American oil and gas industry got an additional boost when Donald Trump won the U.S. election in November 2016.

Trump was a vocal supporter of the oil and gas industry and said he wanted to cut any red tape that hindered U.S. oil and gas production. To that end, Trump said he would open onshore and offshore leasing on federal lands, tap America’s $50.0 trillion in untapped shale, oil, and natural gas reserves, and pledged to advance the Keystone XL and Dakota Access pipelines. (Source: “An America First Energy Plan,” Trump Pence, last accessed April 11, 2017.)

The reduction in oil production from OPEC and its allies has not had the desired long-term effect. Oil prices climbed to around $50.00 per barrel but has failed to find sustained traction beyond that.

That doesn’t mean oil and gas prices won’t surge higher. Oil and gas prices could climb to much higher levels if tensions between the U.S. and Russia, North Korea, and Syria escalate.

Where Saudi Arabia wanted to destroy the U.S. shale industry, all it did was create a greater sense of urgency to find more U.S. oil reserves and develop technologies that help the U.S. become less dependent on politically unstable countries like OPEC.

In 2014, the breakeven price for major oil producers in the U.S. was above $80.00 per barrel. By 2017, both shale and major oil companies pushed breakeven oil prices to below $40.00 per barrel.

While the downside to lower breakeven prices is that major oil and gas companies make less money, on the upside, it presents greater opportunity for oil and gas penny stocks to get back into the game.

Case in point, one of the most successful oil and gas penny stocks over the last number of years is EOG Resources Inc (NYSE:EOG). Houston-based EOG Resources is an independent oil and gas company, and for years, it traded for under $5.00 per share. But in 2000, it broke through a resistance near $5.00 and has traded significantly higher ever since. In fact, it ended 2016 trading at around $101.00 per share.

This doesn’t mean every oil and gas penny stock has that kind of room to run, but it does show the kind of moves an excellent oil and gas penny stock can make.

What We Look for in Oil and Gas Penny Stocks

As the Oracle of Omaha, Warren Buffett once said, invest in what you know, nothing more. No truer words could be said when it comes to investing in oil and gas penny stocks in 2017.

It’s imperative to do as thorough a fundamental and technical analysis as possible before investing in any oil and gas penny stock. It can mean the difference between finding the next EOG Resources and wildcatting with your retirement portfolio and coming up with dirt.

Instead of throwing your money at any old oil and gas penny stock and hoping for the best, it’s better to properly evaluate a company’s current position to determine future trends.

Size Matters?

For most investors, when it comes to oil and gas stocks, bigger is better. Solid, reliable growth! But this is not always the case. Many small-, medium-, and large-cap oil and gas stocks got hammered during the downturn in oil prices and many investors took a major hit. When it comes to investing in oil and gas, there are a lot of excellent penny stocks that with tremendous upside potential.

Types of Oil and Gas Investments

When it comes to the oil and gas industry, there are four types of investments. Each one comes with different risks, rewards, and tolerance levels.

- Exploration – Exploration companies buy or lease land and invest money in drilling. If they strike oil, the payoff can be huge: a ten bagger is not out of the question for an oil and gas exploration penny stock. If it doesn’t strike oil, investors could lose everything. Best suited for penny stock investors with a high tolerance for risk.

- Developing – A developing oil and gas penny stock plays the numbers. They drill near proven reserves hoping to locate overlooked reserves. While not as speculative as an exploration oil and gas penny stock, there is no guarantee that a piece of property adjacent to one with a one-billion barrel reserve will have any oil.

- Income – An income oil and gas penny stock acquires plots of land, either buying or leasing, over proven reserves, and looks to generate a steady income stream. This tends to be the safest way to invest in oil and gas and is less a speculative play and more of an income play.

- Services and Support – You can dig for gold or sell shovels. These kind of penny stocks service the oil and gas industry. It can include shipping and logistics, drilling, construction and rigging, pipelines, equipment manufacturers etc. These kinds of companies do not necessarily rely on higher oil and gas prices to remain profitable. But their services are in less demand when oil and gas prices are low.

Location, Location, Location

Obviously location is important for exploration, developing, and income oil and gas properties. You should be able to find on a company’s website where their operations are and what the reserves are for the different properties. Failing to do this basic due diligence could lead to buying shares in a company that has a long history of drilling dry holes.

Reserves

Sure, you want to invest in an overlooked oil and gas penny stock, but what is the quality of its reserves? Beyond looking at the company’s research report that provides production and reserves (barrels of oil equivalent), find out what its primary assets are. Is it mainly sweet crude or natural gas? This will affect revenue and profits. If the information isn’t available on the company’s website, call. Chances are good, because it’s a penny stock, that you’ll be able to phone the company and talk to management.

Assets

Always pay attention to a company’s assets. Does the company lease or own its reserves? Does it have storage and transportation facilities, pipelines, trucks, storage tanks, or oil tankers?

Growth Trends

Most oil and gas penny stock investors do not want to wait four years to see results. Their money could be put to better use elsewhere. Is the oil and gas penny stock making money? Does it have a proven history of increasing revenue? Does it provide a long-term outlook and/or expect to meet its future revenue and earnings projections?

Balance Sheet

Oil and gas penny stocks tend to be small. So it’s extremely important that they have enough money to move the company forward. If it’s saddled with a lot of debt, chances are good it will have difficulty moving forward with its drilling program.

Best Oil and Gas Penny Stocks to Watch

The following Best Oil and Gas Penny Stocks list features some of the best oil and gas penny stocks to watch.

|

Stock |

Ticker |

Industry |

| Whiting Petroleum Corp | NYSE:WLL | Oil & Gas Drilling & Exploration |

| Granite Oil Corp | TSE:GXO | Oil & Gas Exploration & Production |

| Weatherford International Plc | NYSE:WFT | Oil & Gas Equipment & Services |

| Advantage Oil & Gas Ltd. | NYSE:AAV | Oil & Gas Drilling & Exploration |

| High Arctic Energy Services, Inc. | TSE:HWO | Oil & Gas Services |

| Birchcliff Energy Ltd. | TSE:BIR | Oil & Gas Exploration & Production |

| TransAtlantic Petroleum Ltd | NYSEMKT:TAT | Oil & Gas Exploration & Production |

| Blueknight Energy Partners L.P. | NASDAQ:BKEP | Oil & Gas Pipelines |

| Evolution Petroleum Corp | NYSEMKT:EPM | Independent Oil & Gas |

| Gran Tierra Energy Inc. | NYSEMKT:GTE | Independent Oil & Gas |

| Canacol Energy Ltd | TSE:CNE | Industrial Metals & Minerals |

| Chesapeake Energy Corporation | NYSE:CHK | Independent Oil & Gas |

| Surge Energy Inc | CVE:SGY | Independent Oil & Gas |

| Gastar Exploration Inc | NYSEMKT:GST | Independent Oil & Gas |

| Kelt Exploration Ltd | TSE:KEL | Independent Oil & Gas |

| ENSCO PLC | NYSE:ESV | Oil & Gas Drilling & Exploration |

| Cloud Peak Energy Inc. | NYSE:CLD | Industrial Metals & Minerals |

| Seadrill Ltd | NYSE:SDRL | Oil & Gas Drilling & Exploration |

| Comstock Resources Inc | NYSE:CRK | Independent Oil & Gas |

This list is geared toward penny stock investors who have a high risk tolerance threshold. It is not an oil and gas penny stock list geared toward conservative buy-and-hold investors.

As a result, not every oil and gas penny stock on this list is appropriate for all investors. Readers should do their own due diligence and consult a professional financial advisor before making any investment decision.

While a penny stock once referred to any equity trading for under a dollar, thanks to inflation, that term is a little out of date. When it comes to oil and gas penny stocks in 2017, we selected stocks trading for under $10.00 per share.