Turning Investor Sentiment Suggests That a Stock Market Crash Is Looming

This may sound like a very bold prediction, but a stock market crash could be looming in the United States. Stock investors should beware of potential losses ahead in 2018.

One of the biggest things that investors must watch out for these days is how earnings are being treated. It tells us that investor sentiment is turning and that a stock market crash could nearing.

You see, we are in the midst of earnings season for the first quarter of 2018. Earnings so far have been simply stellar, but investor reaction hasn’t been very exciting.

Consider this: so far, six percent of the S&P 500 companies have reported earnings for the first quarter of 2018. The earnings growth rate for those companies is around 17.1%, which is the highest it has been since the first quarter of 2011. (Source: “Earnings Insights,” FactSet Research Systems Inc., April 13, 2018.)

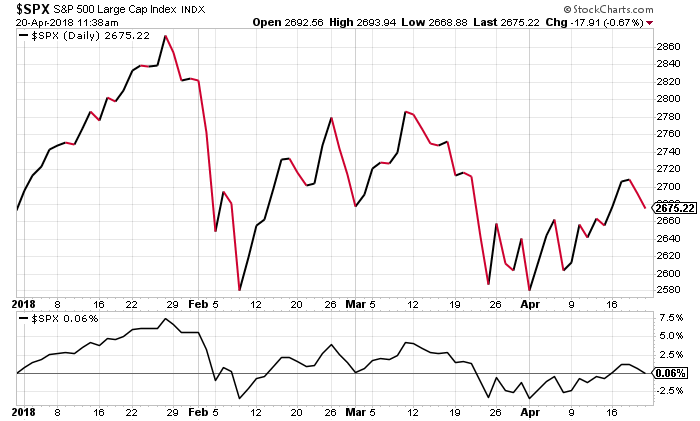

Looking at earnings alone, one would think that stock markets must be soaring. This is not the case, however; look at the chart below of the S&P 500.

Chart courtesy of StockCharts.com

Year-to-date, the S&P 500 is up just 0.06%. In early April, the S&P 500 was down for the year. And if you follow the price action closely, it says that indices are finding it very difficult to go higher.

Digging a little bit deeper…

Companies that have been reporting better-than-expected earnings are being punished. This tells us that investors are looking for excuses to sell. In the financial sector, this has been prevalent this quarter, but it’s not the only place where investors are looking for excuses to sell.

Know this: with the S&P 500 companies that have reported better-than-expected earnings, their stock prices have dropped 2.3% in the four-day period of earnings (two days before earnings and two days after earnings).

This is well below the five-year average. In the past five years, on average, when S&P 500 companies reported better-than-expected earnings, their stock prices jumped 1.1%.

What’s Ahead for the Stock Market?

Dear reader, if you listen to the mainstream media, there’s a very high chance that you won’t hear about pessimism building up. Remember, investor sentiment is what really drives the stock market. If investor sentiment becomes pessimistic, we will see a stock market crash follow.

While the stock price action is saying that investors want to sell, there is other data that suggests this too. Consider the inflows and withdrawals of U.S. long-term stock mutual funds and exchange-traded funds (ETFs).

According to the Investment Company Institute (ICI), in February, U.S. long-term mutual funds and ETFs witnessed withdrawals of over $41.3 billion. This was the biggest withdrawal since at least January 2016. (Source: “Long-Term Mutual Fund and Exchange-Traded Fund (ETF) Flows,” Investment Company Institute, last accessed April 20, 2018.)

We don’t have the final March monthly data yet, but looking at that month’s estimated weekly data, these funds witnessed withdrawals of almost $21.4 billion in March.

With all this in mind, it can’t be stressed enough: capital preservation could be the best investment strategy. Investor sentiment taking a wrong turn could cause a stock market crash. The last thing that investors want is to get caught in a sell-off and give away gains that they have generated—or outright lose money.