The stage is now set for an interest rate hike in March. While some might argue that a 25-basis-point jump in the Federal Funds Rate is not a big deal for the U.S. economy, especially after so many years of low interest rates, I beg to differ.

Economics 101 tells us that higher interest rates cool down economic conditions. But, as it stands, the U.S. economy is very fragile. There isn’t real economic growth. Even the U.S. Federal Reserve projects that the U.S. economy will grow by just 2.1% in 2017, grow by two percent in 2018, and then have even less growth than that in 2019.

How Could Higher Interest Rates Affect the U.S. Economy?

For starters, higher rates will impact economic growth. The 2.1% figure that the Fed is counting on to make the economy grow in 2017 could be slashed significantly. (In recent history, Fed economic projections have been revised lower.)

The higher that interest rates go, the more expensive it becomes for businesses and consumers to borrow money. And then there is the impact that rising interest rates will have on the U.S. dollar. In 2015, 44% of all the revenue for the S&P 500 companies came from outside of the United States. (Source: “S&P 500: Global Sales,” S&P Dow Jones Indices, last accessed March 6, 2017.)

As interest rates go higher, the U.S. dollar could rise even further. Companies with operations outside the U.S. have to eventually convert the local currencies in the markets they operate in into the U.S. dollar. This will cause declines in their revenue and earnings.

Interest Rates & the U.S. Dollar

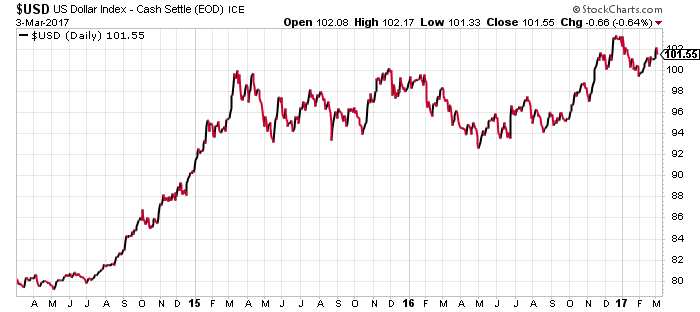

The chart below is of the U.S. dollar index. It tracks the value of the U.S. dollar relative to other major currencies. You can see how aggressively the U.S. dollar has risen against other world currencies, starting in the summer of 2014.

Chart courtesy of StockCharts.com

I wouldn’t be surprised to see a large number of U.S. companies start talking about “currency fluctuations” during their upcoming quarterly conference calls, as higher interest rates will surely send the greenback higher.

American companies are responsible to their shareholders. So, as higher interest rates put a damper on profits, these companies will look to alternative measures for making their earnings look better, such as reducing their workforce…which again puts pressure on the U.S. economy.

Since the financial crisis of 2008, the U.S. economy has grown on the backs of zero-interest-rate policies and newly created paper money, both courtesy of the Federal Reserve. There isn’t more to it than that. The Fed raised the Federal Funds Rate by one quarter point in December of 2015. The economy didn’t collapse (the U.S. dollar rose in value), and this month the Fed will raise interest rates by another quarter point (and likely, the U.S. dollar will rise in value again).

I will be bold here and say this: the second half of 2017 may not be as pleasant as many anticipate. It’s not just higher interest rates that will cool the stock market, the housing market, and the economy. A higher U.S. dollar, fueled by higher interest rates, will have a negative impact on the economy.