Julian Robertson States the Obvious: “We’re Creating a Bubble” in Stocks

That legendary value manager Julian Robertson believes there’s a market bubble is no big revelation. Almost everyone in the industry does, whether they care or not. It’s his impeccable track record that should make investors sit up and listen.

Known famously for predicting the tech bubble formation in the late 1990s, Robertson knows a bubble when he sees one. His conviction was so ardent back then, he refused to participate in over-inflated tech stocks. That didn’t look good at the time but it paid off after the market bubble burst.

Also Read: Warren Buffett Indicator Predicts Stock Market Crash in 2017

In a recent interview, the now 85-year-old Robertson opined on today’s stock market. He stated what many other Wall Street colleagues have said: that stock market values are “high.” “The market as a whole is quite high on a historical basis,” says Roberson, stating the glaringly obvious. (Source: “Tiger Management’s Robertson says ‘we are creating a bubble’ in stocks,” CNBC, September 12, 2017.)

Robertson believes record-low interest rates are largely responsible for the valuation expansion. It’s hard to disagree. But interest rates have been low for prolonged periods before, and we’ve never had a market melt-up quite like this.

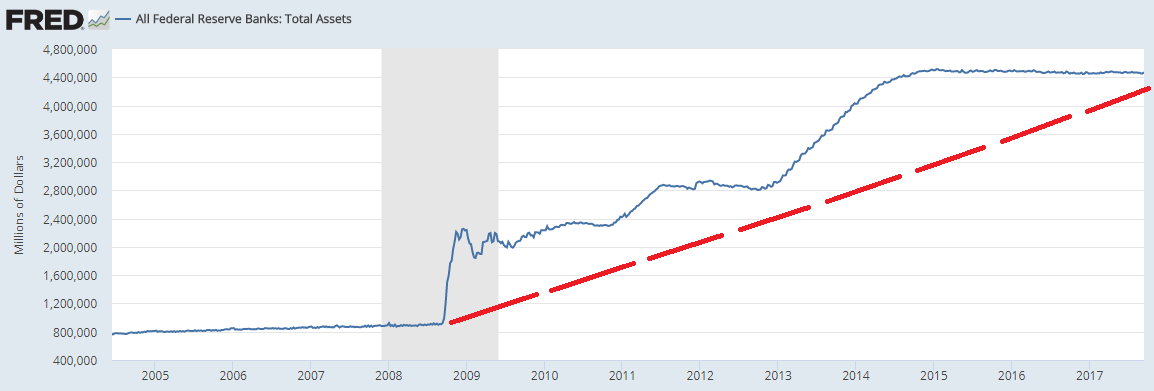

Perhaps low interest rates are just one part of the equation. I would assert that low rates combined with central bank intervention is the real culprit of the market bubble. Pull-forward private sector investment and consumption can only go so far. The real driver of stock market inflation is continuous central bank assets purchases and stimulus.

Consider that according to Bank of America Corp (NYSE:BAC) analyst Michael Hartnett, world central banks have purchased $1.96 trillion in financial assets in 2017 alone. He reasons that central bank balance sheets have grown by $11.26 trillion since the Lehman Brothers Holdings Inc. crisis to $15.6 trillion. (Source: “Central Banks Have Purchased $2 Trillion In Assets In 2017,” Zero Hedge, September 8, 2017.)

If you’re looking for the No. 1 reason why the stock market continues to defy all logic, that’s it. Sure, there are some other factors responsible as well (record ETF inflows, for example). But it all starts and ends with central bank liquidity and low interest rates.

No “Competition” from Other Assets

If central bank liquidity is the straw that stirs the drink, lack of competition from other assets is the glass. As Julian Robertson rightfully noted, “There’s no real competition for the money other than art and real estate.” (Source: Ibid.)

Of course, Robertson is spot on.

Low interest rates are a double-edged sword in that they provide no yield. Bonds look very expensive from a historical standpoint. Even things like sovereign Eurozone debt and junk bond hardly pay any yield! It doesn’t even matter if they have a dubious credit rating or not. Investors looking for any real return must play at the casino known as the stock market.

The one saving grace for market bulls is that Robertson does not apply his “the market is expensive” meme to leading tech stocks. Quite the contrary. Robertson believes they actually might be inexpensive based on their profit potential.

We’ll leave it to others to judge the rationale behind that statement. Regardless, if Robertson is right about the market being expensive, no one will be spared. Not even tech stocks.