Another Investment Bank Sounds the Alarm on Investor Apathy; Expects Market Turmoil

In what’s becoming commonplace, yet another bank is calling for market turmoil. JPMorgan Chase & Co. (NYSE:JPM) Global Head of Macro Quantitative and Derivatives Strategy and Senior Analyst Marko Kolanovic cites many of the themes we talk about on Lombardi Letter; mainly, pervasive overvaluation.

“Receding monetary accommodation… will soon begin removing some of the main factors that have supported the high valuations across financial assets,” Kolanovic said. (Source: “It’s time to brace for ‘market turmoil’, warns JPMorgan,” Financial Times, June 23, 2017.)

We wholeheartedly agree.

The Federal Reserve is currently attempting to normalize its balance sheet by selling bonds on the open market and neglecting to reinvest in maturing Treasury bonds. The next effect: liquidity being sucked out of the system, as the Fed attempts to let the market fend for itself. But if the market could really make it on its own, why did the Fed leave interest rates so low for so long?

Spoiler alert: it can’t. At least, not in a way which can deliver targeted growth and inflation expectations. Despite the positive headline numbers, there’s much more instability than meets the eye.

Also Read:

Stock Market Crash 2017? This Could Trigger a Stock Market Collapse

Warren Buffett Indicator Predicts Stock Market Crash in 2017

Kolanovic’s remarks also echo other mainstream investment banks like Bank of America Merrill Lynch. Previously, this line of thought had been relegated to “contrarian” analysts and blogs like Lombardi Letter. Showing we were ahead of the curve (yet again), analysts are swinging to our way of thinking. Mainly, the economy is really not that strong. Strip away low interest rates, unsustainable loan growth, and the drip I.V. the Fed has been providing markets, and a stealth fragility exists.

Relationship Between Suppressed Volatility And High Equity Prices

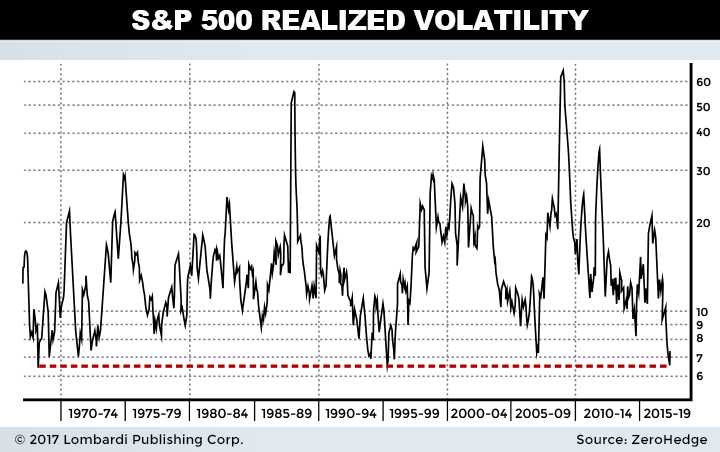

Volatility is a broadly covered, yet unappreciated aspect of today’s stock market. When most people think of “volatility,” they think extreme price moves in either direction. While it’s a byproduct of price movement when volatility is high, it doesn’t tell the whole story.

Over the past several years, volatility suppression has been much a much bigger force on market prices. That is, historically low volatility has allowed equity prices to melt higher by subjugating sell-side orders before they have a chance to trigger.

They say the market goes up like an escalator, and down like an elevator. In this equation, volatility is the elevator. That is, selling tends to come in acute waves in response to a negative catalyst or corrective wave to rebalance market equilibrium. But what happens if the elevator is grounded? The result is a corrective wave which never arrives. That’s exactly what is happening.

It’s not on purpose either. The classic Wall Street axiom, “Buy low and sell high,” has been replaced by “By high and sell high; don’t liquidate until necessary.” Because all sorts of buy-side algorithmic trading programs will liquidate en masse only when volatility and technical damage reach a certain threshold, by selling volatility, buy-side programs become perpetual dip buyers instead of net sellers. The market magically levitates as a result. Any heavy, multi-day selling is kept at bay, and market indicators remain positive. This keeps investors and buy-side programs purchasing stocks in a virtuous cycle.

The old concerns of market valuations, fundamental investing, and even earnings matter not. However, nothing lasts forever in the market, and what has been discarded will be rediscovered soon enough. At least, that’s what Marko Kolanovic believes: “It is clear to us that the current macro environment does not warrant all-time low volatility.” (Source: Ibid.)

Should the most crowded trade on the planet—short volatility—unwind, this will cause intense selling in equity markets. Taken in context with rising interest rates, quantitative tightening by the Fed, an inverting yield curve, and valuation bubble in equities, the odds of a prolonged period of rising volatility are strong.

Market turmoil is about to become the new buzzword again, give or take a few months. Taking the proper steps to fortify their portfolios is the smartest move investors can make in this environment.