Is There Really a 70% Chance of Global Recession in the Next Five Years?

Investors, pensioners, retirees, bankers, and economists, lend me your ears. There’s big trouble ahead. No, it’s not because President Donald Trump has withdrawn America’s support from the Paris climate accord. While many liberal pundits have presented that logical move as if it were the first of the seven signs of the Apocalypse, that’s not it.

Unlike carbon dioxide, this is a much more imminent threat. A global recession in 2017 has become more likely, even if the world still hasn’t fully recovered from the last one.

After seven years of continuous growth, the prospects for the world economy are pessimistic. So much so that experts from Pacific Investment Management Company, LLC (PIMCO), a subsidiary of Allianz SE, believe that there’s a 70% chance of a global recession over the next five years. There are three major risks that signal the upcoming global recession: the high level of debt, the depletion of monetary policy, and the rise of populism. (Source: “Secular Outlook,” PIMCO, last accessed June 5, 2017.)

There’s no doubt that these are problems faced by the world in general, not just the United States. China’s debt is much larger than people think. In fact, Moody’s Corporation (NYSE:MCO) downgraded its outlook in April. Japan’s debt is over 200% of its gross domestic product (GDP). The European Union (EU), meanwhile, is a mishmash of economies without rhyme or reason. Germany has thrived, while others, even once-mighty France, have suffered. The risk of Italy (a G7 member), Spain, and Greece defaulting on their debt remains high.

Such risks have fueled a sentiment that many have—perhaps erroneously—described as “populism.” But, in fact, this so-called populism is merely the last resort for people to voice their genuine and valid concerns to politicians, who seem not to be listening—or more accurately—are choosing not to listen. These results have manifested themselves already. Who would have thought that Great Britain would opt for Brexit or that Donald Trump would become President of the United States?

In truth, only the “ostrich” people, with their heads stuck in the sand, would have failed to grasp the high degree of dissatisfaction with the ruling classes. World leaders of every stripe, from politicians to business magnates, appeared to have willfully ignored the financial and psychological hardship that the 2008 financial crash and its related economic depression have left in their wake.

Central Banks Have Exhausted Their Bag of Tricks

Central banks have tried all kinds of tricks to stimulate the economy, as it were. They’ve resolved to go with a monetary policy of low interest rates, such that they have approached zero. That has been their only prescription to boost growth. Meanwhile, most people’s savings have suffered, as have salaries. That means debt has continued to fuel consumption. Is it any wonder that there are debt bubbles everywhere? Meanwhile, there’s little room for this monetary policy to continue, unless it moves into negative interest rates.

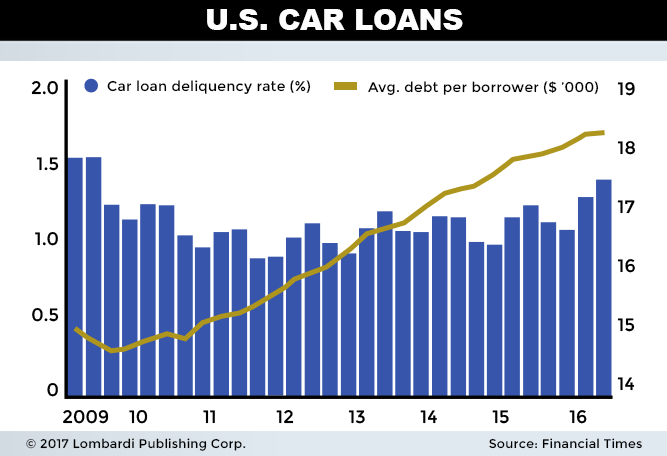

Housing prices are increasing again in many parts of the United States and the rest of the world—just look at Canada or the United Kingdom, for starters. Then there’s the problem of student debt and car loan debt. Indeed, one of the triggers of the next stock market crash is the subprime auto loan. And the U.S. economy remains integrated enough with the rest of the world to trigger a global economic recession.

If—or rather, when—the next U.S. recession arrives, the U.S. government and the White House (whether the president is Trump or Hillary Clinton, or someone else entirely) will not be able to do anything. The president would have only limited opportunities to counteract the symptoms of another recession at the monetary level. Meanwhile, the president and the Federal Reserve would also have to confront a shortage of options because of high indebtedness.

As it happens, except maybe for Germany, most developed economies would experience a similar deficiency of responses. EU countries have adopted the same zero-interest-rate quantitative easing (QE) monetary policy as the United States.

The Global Economy Is Like a Plane in Mid-Flight Without Controls

Most EU member states have used up all of their QE cards as well. There’s nowhere to go. This is perhaps the most troubling issue. When, in 2008, Lehman Brothers imploded and the subprime mortgage debacle was exposed, central banks had some margin for maneuver. Interest rates were high. That meant they still had some control.

The next global recession, however, would be the equivalent of an airplane flying over the ocean suddenly losing it engine, rudder, flap, and aileron commands; the pilots would not even have the option to try to save the passengers. Well, the global economy now is that plane.

In light of these forecasts, savvy investors will likely take advantage of every stock market gain to build up liquidity—perhaps to buy gold or other precious safety-net commodities—ahead of dark times. Perhaps those with the right experience might try their hand at investing in emerging markets. Except for China, some offer good prospects for profitability. But that also involves being aware of the risks. It’s not a solution for everyone.

Another global recession now could send the economy back a few decades, when measured in Dow Jones points. Donald Trump’s policies do have something to do with it, but blowing away the hot air from the Paris climate deal is not one of these. Steen Jakobsen, a Danish investment bank economist, sees Trump as a catalyst for a new reality, one in which hope is replaced by doubt and growing recession risk based on extremely negative global liquidity. (Source: “Saxo’s Jakobsen: Trump Increases Chance of U.S. Recession,” Bloomberg, January 25, 2017.)

Such factors will clearly increase geopolitical risk. Some already have. The world’s banks, still struggling with the problems of debt and low interest rates related to the efforts to manage the effects of the recent recession, will have to struggle with the effects of Trump’s chaotic and rather tentative presidency.

Overall, there was no other direction for the world economy to go but up. After all, it collapsed after the financial crisis of 2008. Jakobsen and many other economists fear that the new isolationist American policies, from foreign affairs to the environment, will take a protectionist bent when it comes to the economy.

Economic protectionism has never done well for growth and prosperity. Then there are the fears that Trump’s strategy could also boost inflation, which could lead to increased pressure on the Federal Reserve and monetary policy. More than four months into Trump’s presidency, foreign policy has been chaotic, but it has hardly reached anything close to being isolationist.

Has the U.S. Really Abandoned World Leadership?

Trump has taken a direct stance against Iran, signing a $110.0 billion (potentially $300.0 billion) arms deal with Saudi Arabia. Trump has also demanded that NATO partners put more money into the trans-national defense organization. In Syria, the U.S. president launched a direct attack against a Syrian government airbase.

In the Pacific, Trump has sent aircraft carriers and battleships to participate in military exercises with Japan’s forces. This was meant as a show of force in the face of North Korean missile tests.

Therefore, Trump’s foreign policies are not the source of the economic and financial risks. But, Trump has taken one major step to shake up politics and economic. The President has pulled the United States out of the Paris Climate Agreement. European leaders, with the new French president Emmanuel Macron leading the charge, have used Trump’s move as an opportunity for grandstanding.

Macron’s reaction has served to highlight a growing rift between Europe and the United States. The media has intensified the rhetoric, speaking of an American withdrawal from global problems and world affairs. Basically, they have suggested that the age of American leadership is coming to a close.

But this is rather exaggerated, even if not quite as exaggerated as those who have accused Trump of committing nothing short of murder. (Source: “Donald Trump’s Withdrawal From the Paris Accords Is a Crime Against Humanity,” The Nation, June 1, 2017.)

Yet, pulling out of the climate deal may have been Trump’s best move.

The Paris Agreement proposed penalizing policies made up of the usual shortsighted combination of limits and prohibitions, which would have had an enormous impact on the economy and competitiveness of many developed economies. These are the same economies that are still struggling to emerge from the last recession, and risk falling into another one now. For the past 25 years or so, countries have adopted policies that generate costs, but without having any effect whatsoever on temperatures—or CO2 emissions, for that matter.

Indeed, by pulling out of the climate deal based on bureaucratic measures and financial incentives to inflate the bubble of carbon credits, Trump may have encouraged a more growth-oriented approach.

Trump has merely pulled out of a flawed deal. But this leaves American entrepreneurs, even the likes of Tesla Inc (NASDAQ:TSLA) owner Elon Musk, room to develop technologies. By focusing on developing technologies to improve energy generation, which reduces emissions in practice, rather than through artificial limits, CO2 emissions can start dropping.

The technology does not have to be limited to wind or solar. Choosing technology means that all forms of energy generation, whether gas, clean coal, nuclear, or renewables can participate. But technology involves real investments and real responsibility. It shifts the climate argument from the hysteria of the social and political pressure groups to the engineers on the ground. They would be free to work with realistic goals instead of impossible ones.

Still, the biggest risk is that the Paris climate deal will distract the world from a real crisis happening before our eyes: debt. One wonders if our leaders have learned the lessons of the 2008 global financial crisis. Can such a catastrophe happen again? Everyone wants to be reassuring. Banks are supposedly better equipped to handle the risks, and governments are looking out for us.

Yet, while everyone worries about the weather, fewer than 10 years after a bigger economic crash than in 1929, the world’s debt has multiplied. So, yes, a global recession can happen again and sooner than anyone expects.