Interest-Rate Victims Emerging Already and Things Could Get Worse

The Federal Reserve is raising interest rates. This could hurt the U.S. economy severely. We already see victims emerging, and more could follow.

Look at the housing market, for example. It’s getting impacted by the rising interest rates.

Consider the existing home sales figures (sales of already-built homes). They have been declining for three consecutive months. In May, sales of existing homes declined three percent from a year earlier, and 0.4% from a month ago. (Source: “Existing-Home Sales Backpedal, Decrease 0.4 Percent in May,” National Association of Realtors, June 20, 2018.)

Why are higher interest rates harming the housing market? Remember, as the Federal Reserve raises its interest rates, mortgage rates go higher as well. And this hurts affordability for home buyers.

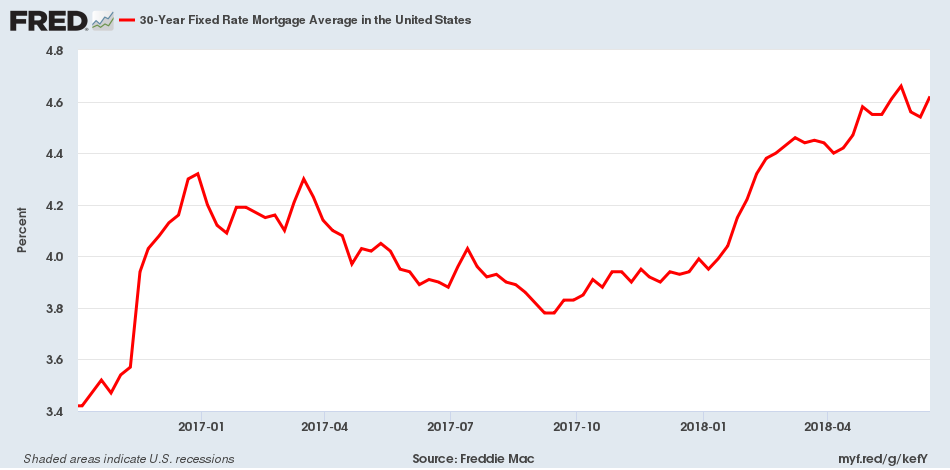

Over the past few months, mortgage rates in the U.S. economy have surged. Look at the chart below to get some perspective.

(Source: “30-Year Fixed Rate Mortgage Average in the United States,” Federal Reserve Bank of St. Louis, last accessed June 20, 2018.)

Regarding what’s happening with home buyers, the chief economist at the National Association of Realtors, Lawrence Yun said, “The abrupt hike in mortgage rates this spring, along with price appreciation and competition being the strongest in the entry-level part of the market, is why first-time buyers are not as active as they should be and their participation remains below its historical average.” (National Association of Realtors, op cit.)

Here’s the worst part: the housing market could face severe headwinds ahead. Home prices could fall.

You see, mortgage rates are very closely correlated with bond yields, and we have been seeing bond yields surge. With this said, it’s reasonable to assume that mortgage rates could soar further. This could really dampen the demand in the housing market and cause prices to drop.

So, if you are a homeowner or real estate investor, or you own homebuilder stocks, you should be very careful.

An Uncanny But Major Victim of Soaring Interest Rates

Another victim of higher interest rates? The U.S. government.

This may sound like an unconventional victim, but know that the U.S. government pays interest on bonds it issues in order to fund its budget deficit.

So far in fiscal-year 2018, the U.S. government has paid over $318.0 billion in interest. In the same period a year ago, this amount was $285.2 billion. That is an 11% increase year-over-year.

This is a problem because budget deficits by the U.S. government are expected to increase. There is no budget surplus in sight in the next decade at least. This means the U.S. government will have to borrow more at a higher rate. This opens a major can of worms.

A major crisis could follow. We could see a much higher U.S. national debt. This could lead to a lower dollar and staggering inflation.

All Things Leading to a Crisis Ahead?

These days, rising interest rates are taken very lightly.

The U.S. economy remains fragile. As rates go higher, problems are brewing. Give it some time, and we could see these problems starting to impact the economy.

I am not too optimistic. Whenever the Federal Reserve has raised interest rates, an economic crisis has followed. This time around, we could see the exact same thing.