Inflation Running at its Fastest Pace Since 2011

Inflation in the United States could become a much bigger problem. If you aren’t feeling it yet, give it some time.

Don’t ignore it. Inflation could impact the wealth and buying power of Americans. Prices in the U.S. economy are already rising at a fast pace.

In August 2018, the Consumer Price Index (CPI)—the official measure of inflation—increased by 0.2%. In the first eight months of 2018, CPI increased by 1.5%, the fastest since 2011.

In the trailing 12 months, inflation in the U.S. economy has amassed to 2.7%. (Source: “CPI-All Urban Consumers (Current Series),” Bureau of Labor Statistics, last accessed September 13, 2018.)

If 2.7% is the final number for inflation in 2018, it would be the fastest pace since 2011.

Keep in mind, the Federal Reserve aims to keep inflation between two percent and three percent. It’s getting awfully close to the upper end of that range.

Expect Prices to Increase Further

Here’s the thing: it’s really hard to believe that inflation will remain at 2.7%. It wouldn’t be shocking to see it jump to over three percent in no time.

Why?

Putting it in simple words, there’s too much monetary inflation already. It’s going to affect the general level of prices.

This shouldn’t be new information to long-term Lombardi Letter readers.

We have a lot of money in supply (monetary inflation). It was sitting in the banks for a while because interest rates weren’t attractive enough for banks to actively lend it out.

Now, interest rates are going higher. And with this, we are seeing money gain momentum. This could create a lot of price inflation.

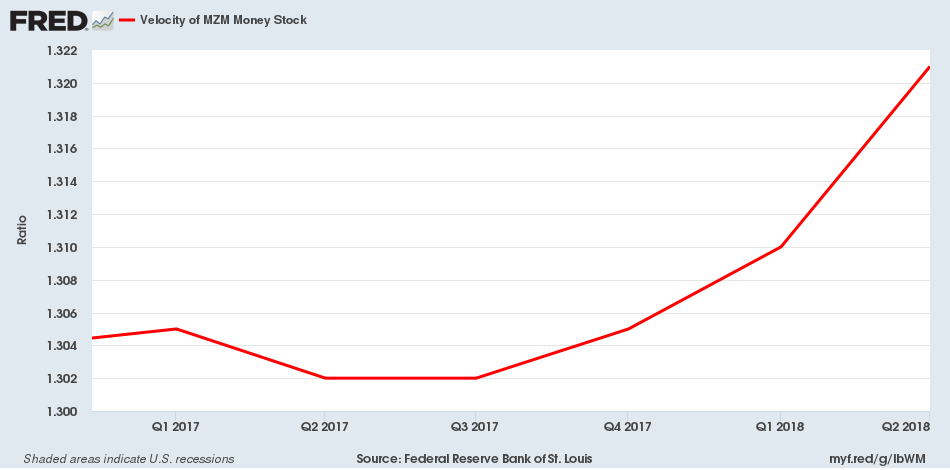

For some proof, look at the chart below. It plots the velocity of the money supply in the U.S. economy. Velocity is essentially an indicator of how much each dollar is used. The faster the velocity, the higher that inflation could go.

(Source: “Velocity of MZM Money Stock,” Federal Reserve Bank of St. Louis, last accessed September 13, 2018.)

Over the past few quarters, there has been an increase in the velocity of money. Admittedly, it has not been a big increase, but know that there’s a lot of money in supply. As per the most recent data, the U.S. money supply was roughly $15.6 trillion. (Source: “MZM Money Stock,” Federal Reserve Bank of St. Louis, last accessed September 13, 2018.)

So, if it moves a little and changes hands, it could do a lot of damage.

How high could inflation surge? Don’t be surprised to see an inflation rate of three percent to five percent sooner rather than later. Obviously, with time we will know more.

Why Bother About Inflation?

Dear reader, beware. Inflation is deadly to portfolios. If we assume that we will see inflation of five percent in the coming years, your portfolio would have to grow by at least that much for you to break even.

It’s the same case with buying power; your income has to grow by that amount as well in order for you to keep your purchasing power. If incomes don’t rise while inflation soars, consumption be hurt immensely.

I am watching gold prices in the midst of all this. Gold is a hedge against inflation; it provides stability to portfolios and preserves buying power.