The United States national debt stands at about $20.0 trillion today. It’s a figure that is bound to go higher, and that will have a major long-term negative impact on the U.S. dollar.

The U.S. government has incurred a budget deficit of $587.41 billion in the first 11 months of its current fiscal year. This is 34% higher than the first 11 months of fiscal year 2015, when the U.S. government had a budget deficit of $439.09. (Source: “Final Monthly Treasury Statement,” U.S. Bureau of the Fiscal Service, last accessed October 27, 2016.)

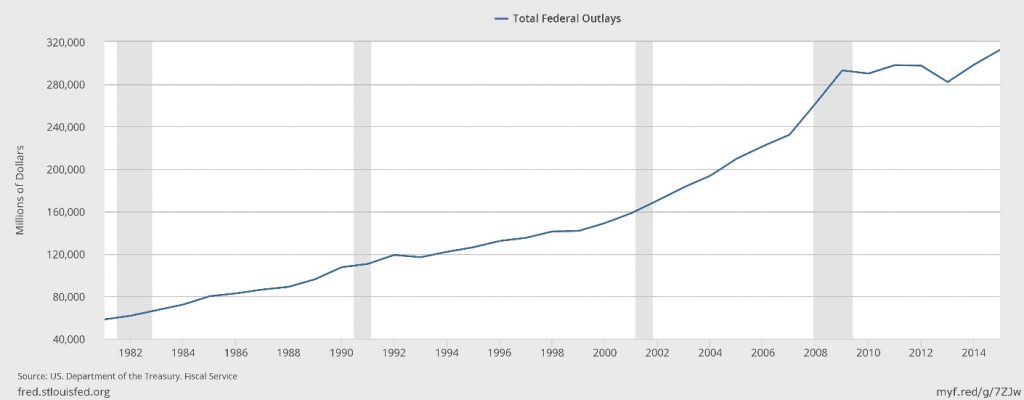

The chart below shows the total annual expenses for the U.S. government going back to 1982. In 2015, U.S. government spending was the highest ever recorded. This year, we are on track to post a new record for government spending.

(Source: “Total Federal Outlays,” Federal Reserve Bank of St. Louis, last accessed October 27, 2016.)

The sad part, dear reader, is that there are no annual budget surpluses forecasted for the next 10 years. So, this current $20.0 trillion national debt figure will explode in the years ahead. I have said it several times: I expect the national debt to go to $34.0 trillion within 10 years’ time.

And the higher the national debt, the bigger the interest payments on that debt. Year-to-date, the U.S. government has paid $429.60 billion in interest on its debt. In the same period a year ago, this figure was $402.18 billion. As the interest rate rises, the interest expense on the U.S. national debt will also rise.

Rising U.S. National Debt Impact on the U.S. Dollar

The chart below is of the U.S dollar index; it’s the U.S. dollar compared to major global currencies.

Chart courtesy of Stockcharts.com

Over the past few years, the U.S. dollar has increased significantly in value, relative to other major currencies. There are three main reasons for this.

- The U.S. Federal Reserve increased its benchmark interest rate in December 2015 and will likely do so again this December. This is happening at a time when other countries have not raised interest rates, and are even opting for negative rates.

- The Federal Reserve has stopped printing paper money. Other countries are still creating new paper currency.

- The eurozone continues with its political and economic problems. The viability of the euro and the European Union itself, as evidenced by the recent Brexit poll, is placing pressure on the euro, which is a major world currency.

In the short term, I expect the U.S. dollar to continue to be a safe-haven currency. It will continue to rally against other major currencies. But long-term, as our national debt continues to rise, it will be a different story.

For a currency to remain stable, and increase in value, you need solid economic fundamentals behind it. And that’s a problem for the greenback.

The skyrocketing national debt is a major issue for the U.S. dollar. If we look at Japan as an example, Japan’s national debt ballooned relative to the country gross domestic product (GDP) and its currency eventually collapsed. The U.S. economy is also slowing again. So unless inflation becomes a major problem, the Federal Reserve may be limited on how many times it can raise interest rates in 2017.

How do you protect your assets as the U.S. national debt continues to rise; possibility undermining the long-term strength of the U.S. dollar? There’s only one currency I know that has a long history of holding value when paper currencies collapses. Of course, I am talking about gold. Long-term, the U.S. dollar will depreciate and the gold bullion will appreciate. That’s why I see the shares of senior gold mining companies as a bargain at current prices.