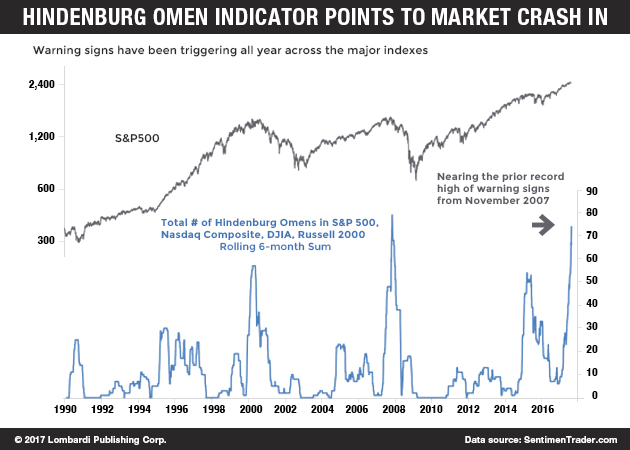

Hindenburg Omen Indicator Signaling Towards a Possible Market Crash in 2017

The tech industry has plummeted and is now in a very strong position, while Apple Inc. (NASDAQ:AAPL), Amazon.com, Inc. (NASDAQ:AMZN), Tesla Inc (NASDAQ:TSLA), and Facebook Inc (NASDAQ:FB) reach the highest historic level by pushing Wall Street to new records. But how long can this euphoria last? This strange context gives rise to a technical—or statistical—signal that could scare the markets. They call it the “Hindenburg Omen” indicator, and it is signaling a possible stock market crash.

What is the Hindenburg Omen? The name Hindenburg should prompt many of you to recall the May 6, 1937, horrific fire and crash of a large airship in Lakehurst, New Jersey. That’s a hint. Indeed, when certain technical factors used to monitor Wall Street’s performance align—according to the inventor of the signal, Jim Miekka—they point to an imminent market crash.

Also Read: Stock Market Crash 2017? This Could Trigger a Stock Market Collapse

Here’s how it works. The signal appears when the daily number of ups and downs on the NYSE exceed 2.8% advances and declines on the same day. It is valid for 30 trading days after it occurs. A Hindenburg Omen might be best observed when there’s a quick increase in the amount of new lows in the wake of a fast-rising market. (Source: “Hindenburg Omen,” StockCharts.com, last accessed August 18, 2017.)

Over the year, the number of values achieving new higher values should not be more than twice the number of values making new lower ones. The same factors have aligned every time before a crash since 1987. Now, they are saying that a stock market crash in 2017 could be ahead.

Of all the tools that analysts might use for stock market crash predictions, the Hindenburg Omen is literally the most ominous. It doesn’t just measure the “temperature” of the markets, it goes straight for the jugular. However, market behavior has a poor reputation for predictability, let alone reliability.

We Might Be Already Staring at the Next Stock Market Crash

Will the stock market crash in 2017? Before we even consider the Hindenburg Omen, the markets have been oozing with crash predictions for some time. Price-to-earnings ratios are simply too high to justify the market capitalizations of some leading stocks. The level of speculation is excessive, while the overall risks—economic or political—are rising daily.

Thus, consider the reappearance of the Hindenburg Omen as an additional reason to exercise caution in your investment strategy. A more balanced way to consider the Hindenburg Omen is that this ominous signal indicates that the probability of a stock market collapse is higher than normal.

Or, if you prefer, the Hindenburg Omen suggests that the probability of a significant market decline is high. This Omen appeared in front of all stock market crashes, or panic disasters, over the last 25 years. No sell-off panic (more than 15%) has occurred in the last 25 years without being preceded by a Hindenburg Omen.

Also Read: Warren Buffett Indicator Predicts Stock Market Crash in 2017

The Hindenburg Omen is but one indicator. The White House has announced that Steve Bannon is out; he too has been fired. What’s next? Nobody can know for sure, but the chances of Trump resigning or being forced to do so, given the departure of a key strategic advisor like Bannon, have only increased.

That, and the technical chart analysis pointing to a Hindenburg Omen, should be hinting that it might be a good time to lay off the market for a while and consider assets such as gold instead. Doubtless, the stock market forecast for the next three months has become increasingly preoccupied with bad omens. Therefore, if you are among the many wondering if the stock market will crash in 2017, you might want to ask when it will crash instead.

The continued liquidity injection from central banks has doped and distorted everything. Indeed, such has been the effect of low-interest rates that they have entrapped the Federal Reserve. If it raises interest rates now, it will cause a massive stock market crash, the likes of which could spark a terrifying recession.

If it keeps them at the present level, it will encourage the bull market to continue rising, defying reason and economic gravity. That will produce its own crash eventually. This is a time when investors should be building their defenses. The generous liquidity that has “saved” the market in recent times is running out of steam. The Fed might decide to bite the bullet and pursue a less expansive market attitude. The Fed might be willing to sacrifice the current market rally to avoid a more devastating crash later. Thus, as the Hindenburg Omen suggests, investors should build their financial defenses to reduce the risk of burning their assets in the fall.