The Gold Price Is Rising on Growing Geopolitical Risk Momentum

The gold price has started to show some favorable movement. After a promising start to the year, as the stock markets tumbled in early February, the gold price per ounce has hesitated. It has remained stuck in a range between $1,320 and $1,330 for most of 2018.

However, it seems that gold prices have found their stride, hanging on to gains and moving toward a new ceiling of $1,500 per ounce.

There are many factors that are converging and encouraging investors to seek safe havens. The stock markets, while occasionally still capable of rebounds, appear to be headed into bear territory.

The overall geopolitical picture has become even riskier. There are many pitfalls. The Trump administration and other allied governments are stumbling over all of them.

While there are interesting prospects for a comprehensive peace between South Korea and North Korea, it remains to be seen if the terms are acceptable to the United States. For starters, China would have to be involved. Thus, if any U.S. interests in East Asia are to be preserved, it’s difficult to see how Donald Trump might pursue a trade war with China without making significant compromises.

Apart from the Korean peninsula—which poses a whole new set of problems (for example, will South Korea absorb millions of potential refugees from the North if peace is reached?)—Syria remains the fuse that could light World War III. The United States and Russia have become the two main players in the proxy war in Syria.

The West Will Not Accept Assad’s Victory in Syria, Prolonging Tensions

The Iranian- and Russian-backed Syrians have won the ground war. Having taken Ghouta, the Syrian army has broken the source of regular missile attacks into the capital Damascus. The “rebels” (that is, radical Islamists) are now confined to Idlib in the north.

Despite this seemingly favorable scenario and the end of the conflict well in sight, the United States and its allies (the U.K., France, Israel—and Turkey) will interrupt the “peace.” Tehran and Moscow insist on maintaining Syria’s territorial integrity, even if a new federal arrangement is found. Washington, London, and Paris want to break Syria in pieces.

The April 14 NATO strikes against claimed chemical weapon facilities, among other things, were intended to deliver that message. It told the Syrians and their allies that, no matter what progress they achieve on the field, they will have obstacles in returning to a pre-war status quo. This clearly raises the potential for trouble.

Note that Syria and Russia are most probably counting on China to help in Syria’s reconstruction. (Source: “In the Competition over Syria’s Reconstruction, China Is the Likely Winner,” Defense One, March 2, 2018.)

Meanwhile, Trump (if not his gung-ho European allies) has added to the volatility mix. He has decided to postpone more sanctions against Russia. There are also some 2,000 U.S. troops in Syrian territory.

Thus, if he’s sending an intransigent message on one hand, he’s sending a conciliatory one on the other. If such moves confuse diplomats, imagine investors in the stock market! This is one negotiation that Trump cannot win.

Syria Will Be Harder to Accept Than the “Tie” in Vietnam

The stock market will try to remain positive with every step away from a major conflict. That’s certainly the sense at the time of this writing.

It’s a phenomenon best described as sweeping the problem under the carpet. It will return to bite strategists (who are reluctant to concede that the Russians have won) and investors alike. Even the mighty defense stocks, which have been the true outperformers in the market, might suffer from the embarrassment.

When the U.S. finally relinquished Vietnam to its inevitable fate, a period of economic and existential crisis followed in the United States. Conceding a loss in Syria—which would effectively compromise any gains that the Americans achieved in Iraq—could prove to be a more bitter medicine to swallow.

China and the United States may have temporarily averted a trade war. China has compromised, suggesting it might relinquish its foreign ownership restrictions in the automotive (and maybe aerospace) sector.

Still, the U.S. will also have to concede something; as Trump probably knows, negotiations are about give and take.

China will not take kindly to obstructions in Syria. Nor will the markets respond favorably, which will likely interrupt the Federal Reserve’s plans to lift interest rates, weakening the U.S. dollar. In this context, even if stocks recover, many investors will rush toward safe-haven investments.

Gold Thrives on the Perception of Risk

The gold price is often a function of the U.S. dollar’s trend. And it’s even more a function of geopolitical and trade tensions.

In 2017, there was an anomaly, which has extended in 2018. The Trump tax cuts appealed to a collective greed, which allowed the stock markets to achieve ridiculous valuations. Yet, the Dow has proven unwilling to resume the unprecedented highs of January 2018. Stocks have posted what might be best described as a hesitant recovery.

Gold too has been hesitant. Nonetheless, as investors sober up from the stock market hangover, a few will notice the combination of risks that could hold stocks back while driving gold higher.

The gold price appears to be ready to move from its current range. Investors are looking for safe havens or alternatives—as demonstrated by the hesitant recovery of Bitcoin in the week of the attacks on Syria.

The gold price appears to be ready to move from its current range. Investors are looking for safe havens or alternatives—as demonstrated by the hesitant recovery of Bitcoin in the week of the attacks on Syria.

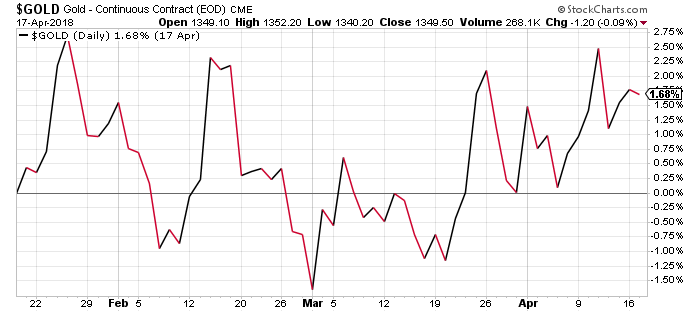

As for Bitcoin, it has its own problems to worry about. As the gold price chart shows below, gold is gradually increasing its floor price, now steadily moving toward $1,340 per ounce:

Chart courtesy of StockCharts.com

The wide spectrum of geopolitical risk will act as the fuel for a gradual increase. The gold price moves when investors have little confidence in future outcomes—the opposite of stocks. Tensions look set to escalate.

Historically, gold prices have risen during wars and geopolitical instability. It’s a long-established trend. As the saying goes, we can always rely on death and taxes. The argument could be made to include gold in that popular saying.

Indeed, what could be more secure than the oldest form of money? Gold has survived from ancient times as an indicator of value.

When currencies emerged and money was invented, it was also based on goods considered precious in individual societies. In ancient Mesopotamia, for example, beer or grain helped back the equivalent of currency. Eventually, gold took over all other forms of backing a currency.

Gold Delivers Unparalleled Security

In other words, gold has acquired the kind of familiarity that delivers an unparalleled sense of security. Gold also functions independently from all other financial products. It does not respond to the whims of the market and its value cannot drop to zero. Relatively speaking, gold is a rare element even in outer space.

Should Elon Musk ever set up his colony on Mars, it would make sense to use gold as the backbone of any eventual money. Of course, gold remains better than currency—including digital currencies.

The latter’s value is based on a form of “agreement” and fluctuates in relation to a country’s economic and geopolitical strength. Until not long ago, gold was a major factor in determining that very power. Such is the power of gold that, should the Euro collapse, the main Eurozone powers of Italy, France, or Germany for example, will still be able to count on their gold reserves.

It’s no wonder that Russia has been increasing its gold bullion over the course of the sanction-riddled past few years. (Source: “Russia overtakes China in gold reserves race to end US dollar dominance,” RT, March 28, 2018.)

The Russian experience proves, if nothing else, that gold becomes critical in times of financial uncertainty and even more so when crisis and geopolitical uncertainties abound. Nothing beats gold in times of crisis. And while investors appeared to have brushed the many international risks aside in 2017, they will not be able to ignore them in 2018.

Markets are now much more volatile. The risk of a derivative implosion is high, rather than going away for good, given that many banks have increased their exposure to these financial equivalents of napalm after making an especially unwelcome contribution to the 2007/2008 financial crisis.

In times of growth, gold offers a hedge against inflation. And when growth is precarious—as it still is now—it’s a hedge against economic collapse.

One of the world’s most influential leaders, Turkish President Recep Tayyip Erdoğan, asked the G20 countries (of which the U.S. is a member) to use more gold. He suggested that international loans be made in gold. (Source: “Int’l loans ‘should be based on gold, not dollars’: Erdoğan,” Hurriyet Daily News, April 16, 2018.)

Erdogan synthesized the advantage of gold and why it will always have value. He explained that the dollar puts too much pressure on countries to rely on foreign exchange. Gold, on the other hand, cannot be an instrument of pressure. In other words, for economically weaker countries, gold avoids the currency fluctuations that add additional burdens on loan payments.