Interest Rates Are Rising, Will Automakers Feel the Pain?

Higher interest rates could be deadly for automakers. If you hold automaker stocks, it may be time to pause and reflect.

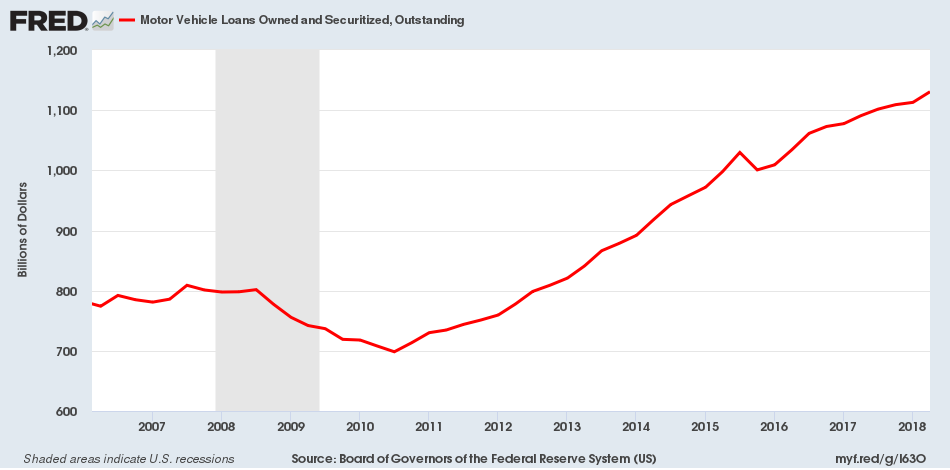

When interest rates were low, a lot of auto loans were issued. For instance, in the third quarter of 2010, outstanding auto loans amounted to little over $698.0 billion. But more recently, in the second quarter of 2018, auto loans stood at $1.13 trillion; that’s an increase of close to 62%.

(Source: “Motor Vehicle Loans Owned and Securitized, Outstanding,” Federal Reserve Bank of St. Louis, last accessed September 6, 2018.)

The chart above highlights this increase, while the one below plots the annual rate of car sales in the U.S.:

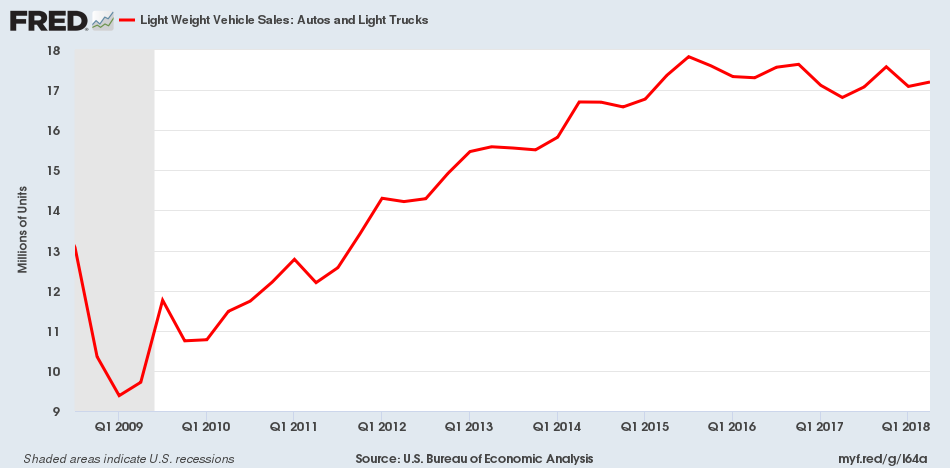

(Source: “Light Weight Vehicle Sales: Autos and Light Trucks,” Federal Reserve Bank of St. Louis, last accessed September 6, 2018.)

As you can see, between the third quarter of 2010 and the second quarter of 2018, the annual rate of car sales in the U.S. grew by over 46%.

So What?

Fast forward to now, when the Federal Reserve has made it very clear that it wants to raise rates. According to Fed estimates, the most basic rate, the federal funds rate, is expected to go as high as 3.50% by 2020.

So it won’t be shocking to see rates on auto loans going much higher; in fact, we already are. If you were to have gotten an auto loan at a commercial bank in the U.S. for 48 months in August 2017, it would have had an interest rate of 4.42%. But in May 2018, the rate stood at 5.05%. (Source: “Finance Rate on Consumer Installment Loans at Commercial Banks, New Autos 48 Month Loan,” Federal Reserve Bank of St. Louis, last accessed September 6, 2018.)

Rates on auto loans have increased 0.63%, or from a percentage perspective, by 14%.

Why Does It Matter for Automakers?

With higher interest rates, cars all of a sudden could become more expensive for Americans, who may not buy as many as they did before as a result.

If you look closely at the car sales chart above, the annual rate has been declining. Between September 2017 and July 2018, the annual rate of car sales in the U.S. declined by close to eight percent.

If there are fewer cars sold, do you really think automakers will be able to report decent financials? It’s very unlikely.

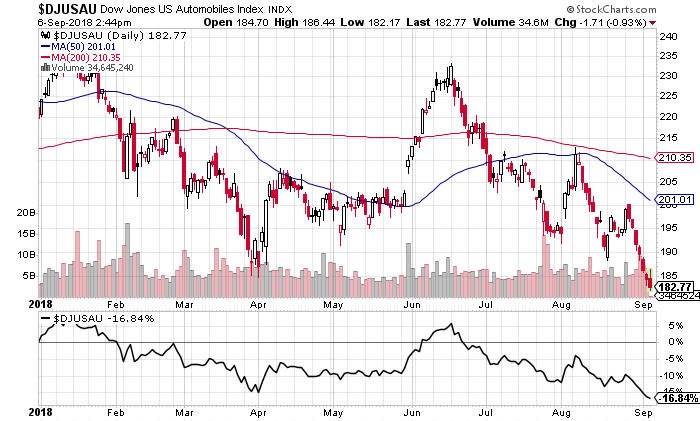

While only time will tell, investors are already turning pessimistic. Just look at the Dow Jones U.S. Automobiles Index, which essentially tracks the performance of automaker stocks:

Chart courtesy of StockCharts.com

Year-to-date, this index has declined close to 17%. It also trades below its 50-day and 200-day moving averages. This tells us that in both the short term and long term, trends are pointing downward and bearish sentiment is prevailing.

In the end, automakers could just be one of the victims of higher interest rates. Don’t take the rate hikes lightly.