Reasons Why Gold Prices Could Hit $2.500 An Ounce

Think long-term when looking at gold prices and ignore short-term noise. As bold as it may sound, we could see gold at $2,500 in matter of few years.

In the past few weeks, gold prices have come under fire from investors. The main reason behind this is that investors are convinced that the Federal Reserve will raise interest rates; holding gold is a bad idea as rates rise.

Here’s what we have to say; yes, in the short-term, there could be some correlation with higher interest rates and gold prices. But in the long term, this is not the case.

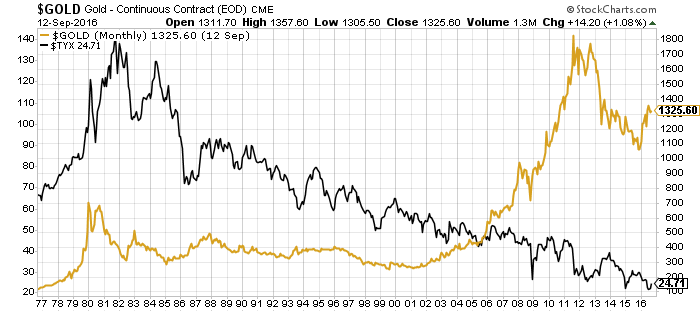

Look at the long-term chart below for example. It compares gold prices (golden line) and the yields on 30-year U.S. bonds, a measure of interest rates (black line). Pay extra attention to what happened to gold prices between 1980 and 2000.

Chart Courtesy of Stockcharts.com

If interest rates and gold prices moved in the opposite direction, then we would have seen the yellow precious metal shoot through the roof as interest rates plunged lower starting in the 1980s. But instead, we didn’t see this happen for 20 years.

Go back a little, to between 1977 and 1980, when interest trades moved higher and gold prices increased as well. So saying higher interest rates could impact gold prices should only be taken with a grain of salt when thinking long-term.

Credits: Flickr.com/401(k)2012

Even if we assume higher interest rates are bearish for gold prices, there are many more reasons to be bullish.

One of the biggest would have to be the demand for the precious metal. Don’t just look at gold in terms of U.S. dollars; think globally. Consider the British pound, for example, which is down over 10% year-to-date, and more declines could be ahead.

Now, let us ask a question: won’t investors in Great Britain be looking to hedge themselves against uncertainty and currency devaluation? They could be buying gold, and a lot of it, if they haven’t started already.

Also, central banks remain big buyers of gold bullion for their reserves, as they know they need the precious metal. There are wild currency fluctuations across the globe, with banks’ reserves being mainly consisted of currencies. These same banks know that gold could reduce volatility in their reserves.

Also Read:

Investors are jumping in to buy gold as well. For instance, in the first two quarters of 2016, we have seen a huge amount of gold go into exchange-traded funds and similar products. More could follow.

All of this is happening on the back of very weak supply. Lower gold prices over the past several years have forced mining companies to cut exploration. Now, when gold is needed, they can’t produce fast enough. In addition to this, the number of discoveries have declined substantially as well, so future production is very questionable.

Gold Prices Outlook: Bullish If You Own It

Dear reader, look at gold prices from just a basic economics-based point of view. The basic supply and demand says we could see much higher gold prices in future.

How high could gold prices go? I will be bold here and say this: fundamentals of the gold market are looking better than they did back in 2011, when gold prices hit close to $2,000. It wouldn’t shock me whatsoever if we go beyond that level, so I am not ruling out $2,500 gold in the next few years.