Interest Rates Impacting U.S. Housing Market Already, More Misery Could Follow

Long-term readers of Lombardi Letter have been warned several times already that as the Federal Reserve raises interest rates, it will have consequences. And now, we are seeing victims emerge.

Why will higher interest rates have consequences? Because the U.S. economy has gotten so used to low rates. Higher rates could cause a massive halt in spending, business investments, and so on.

One of the biggest victims of higher interest rates is one we are tracking closely: the U.S. housing market.

The housing market is inversely correlated with interest rates. It increases when rates go lower and headwinds foretell times of rates rising.

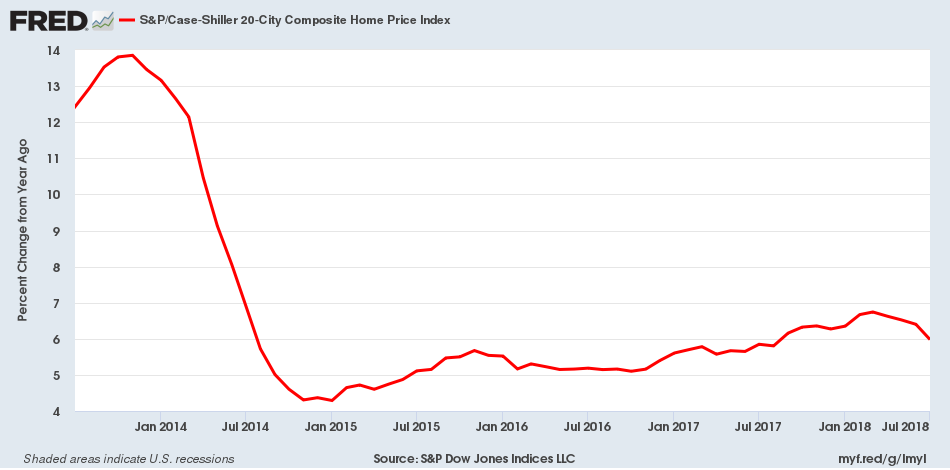

(Source: “S&P/Case-Shiller 20-City Composite Home Price Index,” Federal Reserve Bank of St. Louis, last accessed September 26, 2018.)

To give you some perspective, consider the year-over-year change in the S&P/Case-Shiller 20-City Composite Home Price Index. This index gives an idea of how home prices look in the U.S. Notice something?

In recent years, especially since the Fed started raising interest rates in 2015, home prices haven’t moved much higher. In 2012 and 2014, home prices in the U.S. were increasing by over 10%; now, this rate has dropped to below six percent.

In recent months, we have seen the home price growth rate take a hit. In March 2018, home prices in the U.S. were increasing by 6.74%; this dropped to 5.97% in July. Sure, it doesn’t sound like much, but that’s a deceleration of over 11% in a matter of a few months.

Home Prices Could Fall Further

Thanks to higher interest rates, one could expect home prices to go down further. We are seeing leading indicators of the U.S. housing market suggest that.

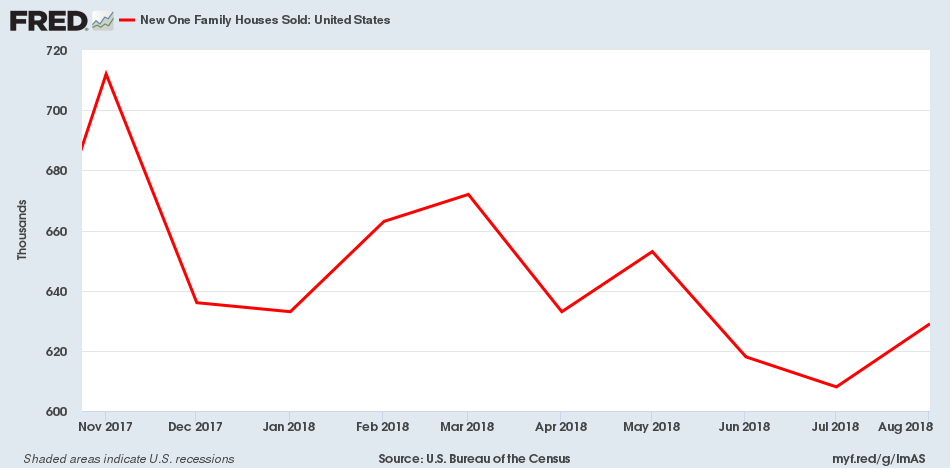

For example, look at the sales of new homes in the U.S. The demand is dissipating.

(Source: “New One Family Houses Sold: United States,” Federal Reserve Bank of St. Louis, last accessed September 26, 2018.)

In November 2017, the annual rate of new home sales was 712,000, while in August 2018, it was 629,000. That means that new homes sales in the U.S. housing market have decelerated by close to 12% in less than a year.

Why Does the Housing Market Matter?

As interest rates go higher, home prices could decline.

You see, homes are considered a form of retirement savings for many Americans. If home prices decline, they don’t even have to be close to retirement for dropping prices to take a toll on their sentiment.

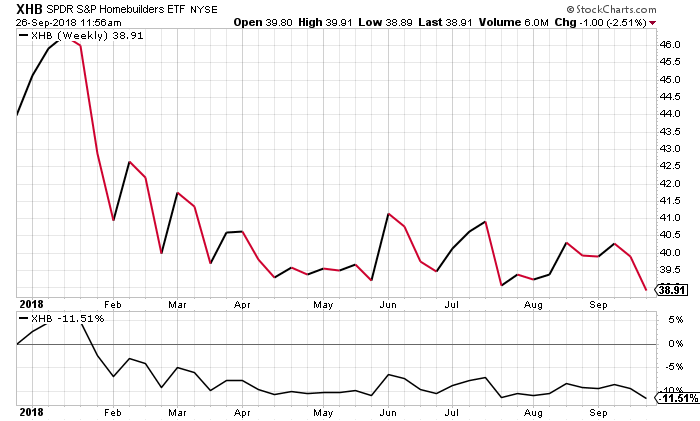

What’s more, a dismal housing market takes a toll on home builders as well. If there’s really no demand, they make fewer homes. This impacts construction jobs, as well. And obviously, an anemic housing market also impacts their profitability and stock prices.

Chart courtesy of StockCharts.com

The chart above is of the SPDR S&P Homebuilders ETF (NYSEArca:XHB), an exchange-traded fund (ETF) that tracks the performance of homebuilder stocks. Year-to-date, the ETF has dropped over 11%. As the housing market faces headwinds, homebuilder stock prices could drop further.

Don’t ignore the rising interest rates. They are already impacting the U.S. housing market. And that’s just one area; more misery elsewhere could be ahead.