The Next Great Economic Crash Is a Formality As Economic Growth Stalls Out

Is the next great economic crash on the horizon? Perhaps, if lasting economic growth doesn’t pick up soon. Real organic growth is anathema to debt and economic collapse; it’s literally the only thing that can pull America out of its fiscal abyss. Sadly though, few such clear indications are on the horizon. The economic data keeps getting softer and reflation expectations look dead in the water. For those recognizing the fact we’ve all been sold a bill of falsehoods, the time to profit is getting closer at hand.

Consider all the hullabaloo about the uptick in U.S. economic growth picking up. It would be great, except for the pesky fact it isn’t true.

The U.S. economy only mustered 0.7% economic growth in the first quarter of 2017, which was the lowest in three years. The main driver for the decline was consumer spending, which continues its tepidness. Considering this accounts for two-thirds of economic activity in the U.S., this is a major problem. Unless wage growth and employment quality (not to be confused with the employment rate) pick up considerably, consumers will continue to rely on debt to fuel their purchasing. This is a shaky foundation for a sustained recovery.

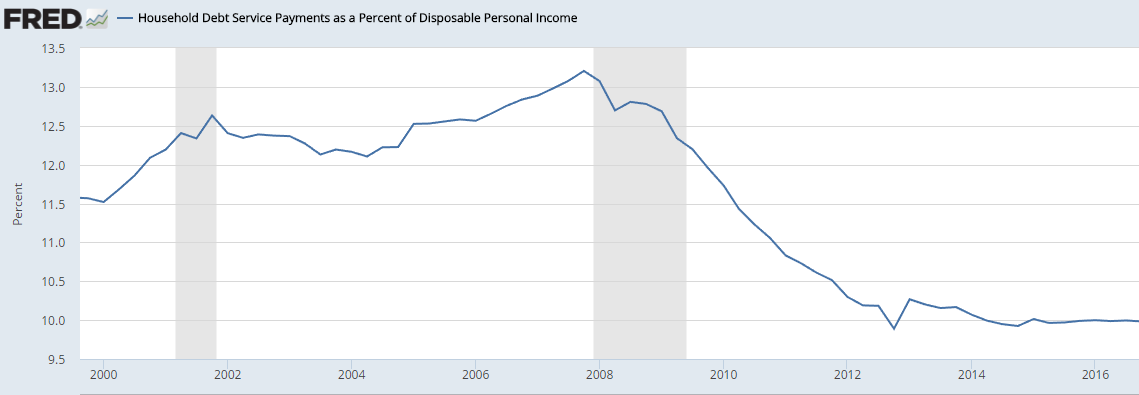

This latter point is important since consumer spending is eating up about 10% of consumer finances. This may not be historically alarming as this percentage has fluctuated between 10% and 13% over the past decade, and is currently resting in the low end of the range. The difference? The 10-Year Treasury rate was hovering around five percent in mid-2007 versus the low two-percent range today. Of course, the 10-Year Treasury Note is the benchmark rate in which mortgage, lending, and commercial rates are all based.

(Source: “Household Debt Service Payments as a Percent of Disposable Personal Income,” Federal Reserve Bank of St. Louis, last accessed May 25, 2017.)

Put another way, if households today were burdened with four- or five-percent interest rates of yesteryear, do you think debt servicing as a percentage of income would be this low today? We can’t say for certain, but it would be much higher than the 10% we see currently (see chart above). It would likely be close to 20%, and the forced deleveraging would begin in earnest.

This is an example of what I call “tame” data—data which doesn’t look unusual or alarming because historically low rates are masking underlying problems. But strip away the suppression in the bond market and the data gets infinitely more scary. In other words, it’s “all good” until it isn’t, and consumers will really find out what this means if the financial alchemists lose control.

Then there’s the expectations of future tax cuts—one of the primary drivers for the sustained strength in the stock market. In April 2017, Trump proposed extensive tax reform by simplifying the brackets and, more importantly, lowering the highest-tier corporate tax bracket from 35% down to 15%. Corporate America loved it, but the problem is, it isn’t going to happen. Reducing tax receipts by this much would create rising national debt unlikely to be balanced by increased economic growth. Only fools believe this would be “revenue neutral.”

Not only would a cut this large be immensely difficult to achieve in normal times, these are, well, not ordinary times. There remains a significant “Never Trump” faction of Republicans that will oppose anything he wishes to achieve. There are the fiscal hawks who would not appreciate the extreme revenue loss such a cut represents. In short, tax cuts as currently proposed are a pipe dream which the jubilant stock market has yet to figure out. When it does, it won’t be pretty.

That’s actually quite an understatement. It could be a downright bloodbath when the market wakes up to the reality that they’ve been played all along. The failure of a significant tax reduction means significant future growth is dead in the water. The United States hasn’t grown at three percent since 2005, and we’re to believe it’s going to happen now without structural reforms, rollback of globalization, and a national debt that’s 130% higher?

What Could the Upcoming Economic Collapse Look Like?

Economic crash predictions vary. They range from the dire “Mad Max” scenario, which predicts scary barbarian clans patrolling the countryside, to the more traditional predictions of stock market collapse. But what about a multi-tiered scenario where the collapse happens in stages: slow at first then snowballing into something far more sinister? Contrary to popular belief, economic collapse isn’t necessarily a binary event. The American economy is complex and resilient, so the next economic collapse should be thought of as a process rather than an event.

Short of a devastating environmental or terrorist event, a “death by a thousand paper cuts” scenario is more likely to cause a financial crisis than anything else. This could be something like a credit rating downgrade, which causes a domino effect.

First interest rates spike. Then the U.S. dollar loses value. This leads to a spike in consumer defaults and destroys consumer discretionary spending. Gross domestic product (GDP) falls, leading to a broader national recession. Think small processes which lead to more consequential outcomes downstream.

We’ve seen this movie before, but the problem is that this time, there’s no fiscal headroom or interest rate leeway to deal with the problem. The Federal Reserve’s balance sheet is already four times its normal size, the federal government is $20.0 trillion in the red, and the Fed Fund’s rate is already at one percent. The Fed is furiously attempting to raise rates not because the economy is strong, but in order to possess headroom to cut rates for the next economic crash they know will come.

In other words, this economic collapse may not seem much different than a normal recession, but there will be less ability to slow it down once it comes. The problems are too big and the government too indebted. Instead of a bazooka, the Fed has a pop-gun. Should the next “recession” get out of control, expect double-digit unemployment, a much weaker dollar, a crashing stock market, state tax increases, and evaporating underfunded private and state pensions. Income presumed safe and unending will no longer be so. Standards of living will plummet for the average American.

This time around is likely to witness increased social instability from the tens of millions of people who have failed to gain economic traction since the U.S. housing bubble collapse. These are the workers who have been decimated by globalization and the financialization of markets. Many of these people have nothing to lose, because they’ve had everything taken from them. It will be a new chapter in American history many hoped would never transpire.

When Could the Upcoming Economic Crisis Happen?

This is the burning question in everyone’s minds. Many people can literally feel the palpable sense that the economy is on the wrong track, yet quite can’t figure out why. They know debt (both personal and national) is spiraling out of control; they know their paycheck buys a little less every month despite the mainstream media telling them all is dandy; they know bubbles all around them (auto/student/housing/stock market/bond market) will explode eventually, leaving absolute carnage in their wake. They know.

Predicting an end to this glacially slow market melt-up is mind-numbingly difficult. The truth is, nobody has the exact answer as to when. It will likely only be through the prism of time which we’re able to determine the cause of the carnage. But just because the catalyst isn’t obvious doesn’t mean investors shouldn’t get in front of the curve… yesterday. There are plenty of upcoming economic collapse catalysts which could ignite the soon-to-be dumpster fire. Most of these could come sooner than you think.

Let’s start with the underrated quantitative tightening campaign the Federal Reserve is embarking on. The Fed has printed almost $4.0 trillion since the U.S. housing bubble, and now wishes to reduce its balance sheet. Trying to sell this many bonds in a market where you’re the biggest buyer is no easy task. Not only could interest rates be pressured higher, the Fed has little ability to expand its balance sheet further should another recession occur tomorrow. Higher interest rates raise the odds of a negative credit event occurring.

A credit downgrade is another strong possibility. Should the major credit rating agencies (CRAs) downgrade America’s credit rating a notch or two, there’s a real risk of spiking bond yields and a dollar sell-off. A credit rating downgrade has already occurred this decade, briefly roiling stock markets to a significant degree. Either way, both scenarios would hurt consumer spending, increasing the risk of recession. And if recession comes, all bets are off.

Political risk is also particularly high since Trump took office, showing no signs of slowing down. There’s been widespread talk of impeachment, which would torpedo any tax cut talk, or at minimum, act as one giant distraction. There’s a budget proposal which bears little semblance of reality. There’s also a looming government shutdown which could occur in fall 2017 if Congress doesn’t hammer out a deal. This type of risk will be ongoing throughout his first term in office—if he lasts.

The point is not trying to predict which snowball starts the avalanche, but recognizing that a few snowballs are rolling down the cliff at once. If one of them catches the right snow drift, watch out.

The Bottom Line on Economic Collapse

There are two things we can say with certainty regarding the next economic collapse:

- There’s no avoiding one.

- The next economic collapse will be epic.

The timing of the collapse could be in ten days or ten years, while the force behind it will be breathtaking (that is, unless the government uses more monetary tomfoolery to yet again delay the inevitable).

But with multiple asset bubbles, a highly inflated stock market, a ridiculously overvalued bond market, China debt issues, and political instability everywhere, a market(s) collapse could happen sooner rather than later.

Are you prepared?