Is 2017 the Start of a Gold Bull Market?

It would have been difficult to predict what precious metals like gold and silver were going to do in 2016; gold started out strong, but Donald Trump’s unexpected election win in November weighed down gold prices for the remainder of the year. It’s a different story in 2017. The next gold bull market is here, one that will last at least until 2020.

The gold bull market of 2017 will be just the second gold bull market of the last 37 years. But if history is any indicator, the strong 2017 gold bull market, which is just in its infancy, will provide gold bugs and contrarian investors with massive gains.

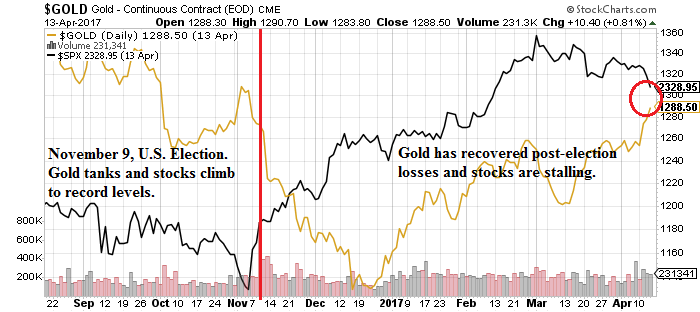

Chart courtesy of StockCharts.com

The last gold bull market ran from November 2000 to September 2011. Over this time frame, gold prices advanced 625% from approximately $265.00 per ounce to $1923 per ounce. Those who like investing in gold mining stocks did even better. The NYSE ARCA GOLD BUGS INDEX (INDEXNYSEGIS:HUI) soared approximately 1665%. The S&P 500, meanwhile, fell by around 10%.

Gold prices peaked in September 2011 and the 10+ year gold bull market came to an end. Over the next four years, gold bulls faced a prolonged precious metals bear market as stocks climbed higher and higher and economic indicators pointed prematurely to a strengthening U.S economy. As a hedge against economic uncertainty, these factors will kill any gold bull market.

That changed in 2016, a year that can only be categorized as a roller coaster for gold bulls. At the beginning of 2016, gold prices soared on fears of a global recession and economic indicators that the Fed had prematurely raised its key interest rate. By August 2016, gold prices had climbed nearly 30% to around $1061 per ounce. The HUI was up more than 151%.

Even in a best-case scenario, it would not be out of the norm for a stock to give up ground to profit taking after experiencing a triple-digit gain. The profit taking led to a broad-based sell-off, with gold giving up much of its year-to-date gains. While gold ended the year up more than nine percent and the HUI up 60%, it was still a far cry from where physical gold and gold miners were just a few months prior.

Gold prices took a beating after Donald Trump won the U.S election. Wall Street decided Trump’s pro-business, pro-growth tax cuts and infrastructure spending would be good for the U.S. economy. This, in conjunction with soaring stocks valuations and a strong U.S. dollar was not good for gold. The year started out well for gold, but by the end of 2016, gold’s outlook had tarnished.

2017 Gold Price Forecast Bullish

At first blush, it looked like gold was about to start another unpredictable year in 2017. Investor optimism around Donald Trump remained strong at the beginning of the year; maybe too strong.

A Washington outsider, no one really knew what a Trump presidency would look like. All investors had to go on was his America First campaign promises and the notion these pledges would become reality and would jolt the U.S. economy and corporate balance sheets. Recall if you will, Trump said his economic plans would generate annual gross domestic product (GDP) of four percent. This is in sharp contrast to the 1.6% GDP rate Obama steered the country through in his last year in office.

Still, investor optimism was strong and the outlook for gold in 2017 wasn’t exactly bullish on January 1. Despite the excitement about President Trump, investors turned their attention back to gold on the heels of disappointing GDP data, a dovish Fed, and the state of the U.S. economy.

Division in the Trump administration and the failure to pass the American Health Care Act (AHCA) in March has also caused problems. Getting the healthcare bill tabled was supposed to be an easy task. It didn’t work out that way. It was shelved. This has left many wondering if Trump will be able to realize all of his election campaign promises; promises that are the cornerstone of getting U.S. annual GDP growth to four percent.

Chart courtesy of StockCharts.com

In the first quarter of 2017, gold prices increased almost nine percent. Gold prices have also increased three percent in the first two weeks of April and recovered all of the lost ground that came after the U.S. election.

Chart courtesy of StockCharts.com

There are a number of reasons why the gold bull market will only get stronger in the second half of 2017 and blow past its 2016 resistance level near $1380 an ounce. From a technical perspective, gold remains bullish and recently experienced a breakout above $1260 an ounce. Moreover, gold prices are trading well above the 50-day moving average and is close to overtaking the 200-day moving average; a bullish indicator called the Golden Crossover.

Beyond this though, there are a number of reasons why gold will remain bullish throughout 2017 and 2018 and surge considerably higher. A gold price forecast for 2017 broaching $1500 an ounce is certainly within reach.

Stalemate in Washington

The future of gold prices in 2017 is in the hands of President Trump and his administration. And by the looks of things, Trump will be personally doing some of the heavy lifting. It didn’t start out that way though.

On the campaign trail, Donald Trump said he would jolt the U.S. economy into gear, something President Obama hadn’t been able to do. Trump pledged to cut red tape, slash taxes, and increase spending; all of which would help return the U.S. to four percent annual GDP growth.

During the Obama Presidency, U.S. GDP grew, on average, two percent. In his final year in office, U.S. GDP was a paltry 1.6%. In the 10 previous economic recoveries, real GDP grew, on average, 4.3%.

Will Trump be able to reach his goal of four percent GDP? It’s going to be a tough haul. First, Trump inherited the worst economic recovery since World War Two. The national debt is at a whopping $19.89 trillion and the national deficit is approaching $600.0 billion.

We’re less than 100 days into the Trump presidency and the wheels of progress are a little sticky. Again, the president’s AMHC reform was shelved and many are questioning whether or not Trump can get his tax cuts and fiscal spending passed.

On top of that, Trump has backtracked a little on some of his biggest campaign issues. The biggest being his tax cuts. This was supposed to usher in an era of growth and prosperity and was one of the reasons why Americans helped usher Trump into the Oval Office.

The White House is trying to determine the best way to cut corporate and individual taxes and concedes it does not have a set deadline to announce its tax-cut plan. The Trump administration has also said the size, scope, and timing of any tax cuts are up in the air.

Not only that, President Trump is said to be considering ideas that differ from what he championed from the podium: to cut the corporate tax rate to 15% from 35% and to cut the top individual rate to 33% from 39.6%.

If Trump cannot get his pro-growth, America First platforms passed it will derail any chances for a real economic recovery, strong corporate earnings, and GDP of four percent. This could derail the current stock market bull rally, which at eight years, is the second longest in history and showing its age.

With stocks significantly overvalued, this kind of economic uncertainty could send stocks over the precipice. Even the signs of a correction will send investors running back to gold.

Stock Market on Shaky Ground

It’s been five months since the U.S. election in November and the Dow Jones Industrial Average and S&P 500 continue to trade near record levels. That said, the long-in-the-tooth bull-market wasn’t born and raised on strong earnings and revenue growth, it’s been propped up by artificially low interest rates.

Since the U.S. election, investors have been afraid to miss out on any gains and continue to trade on momentum and technicals, not once tried and true things like fundamentals. This has made the S&P 500 seriously overvalued.

According to the cyclically adjusted price-earnings (CAPE) ratio, the S&P 500 is overvalued by 80.3%. The ratio compares current prices to average earnings over the last 10 years. The ratio is currently at 28.85; the long-term average is 16. The CAPE ratio has only been higher twice, in 1929 it was at 30 and in 1999, it was at 45. (Source: “Case Shiller P/E Ratio,” Yale University, last accessed April 17, 2017.)

This does not mean that stocks are going to crash any time soon. Investors are still optimistic about Trump and are willing to take a wait-and-see approach. But that investor optimism and patience will only last for so long. They will want to see results. And if earnings don’t start to match valuations, investors could start to quietly sell-off; just like they did in March 2000, when the markets peaked and the dotcom bubble started to burst. There was no warning. It just started.

Again, just because stocks are this overvalued does not mean a crash is imminent. But, history does show us that when stocks get this overvalued, it never ends well.

Keep in mind, the stock market is only as strong as the underlying stocks that make up the index. In the midst of overvalued stocks, investors need to contend with economic indicators that show the U.S. and global economies are still in trouble.

Again, the U.S. is in the slowest economic recovery since World War Two and GDP is anemic. President Obama is the only President to have never helmed one year of three-percent GDP growth; average GDP under Obama was two percent. During President George W. Bush’s economic recovery, GDP growth averaged 2.7% while for Clinton, it was 3.5%.

U.S. GDP growth is flat-lining, wage growth is marginal at best, most of the jobs created during the so-called economic recovery were part-time, low-paying jobs that provided little security. Six million more Americans are in poverty than when President Obama entered the Oval Office. Further, 44.2 million Americans rely on food stamps, a 68% increase over the 26.3 million Americans who received food stamps before the economic-recovery started. (Source: “SNAP Participation and Costs,” United States Department of Agriculture, last accessed April 17, 2017.)

Even the once powerful middle class is vanishing. Debt levels are approaching pre-Great Recession levels, half of Americans could not afford a $400.00 emergency, and nearly half of all Americans have no retirement savings.

Is it a real surprise to hear that consumer sentiment is at a 16-year high but no-one is really spending? Voters are optimistic about Trump and his pro-growth strategies, but aren’t ready to sell the farm and jump in with their credit cards just yet.

Globally, the economy is uncertain as well. In late March, U.K. Prime Minister Theresa May triggered Article 50, a clause that begins the two-year processing of leaving the European Union.

In France, there’s Marine Le Pen, president of the National Front, a right-leaning party that, if elected, is determined to take the same path as the U.K. Should she win the May 7 election, this will create additional uncertainty in the markets.

Lest we forget the militarily charged and unstable relations between the U.S. and Russia, Iran, Syria, and North Korea.

Japan’s economy remains unstable. And the European Union, while in a state of recovery, isn’t doing much better than the U.S.; though admittedly, it is doing better than the U.S.

As a hedge against economic and political uncertainty, all of this bodes well for a strong gold price prediction for next three months. And for the gold bull market to trend higher in 2018 and 2019.

Inflation

A precious metal analysis will also show that rising inflation will send gold prices higher in 2017. Inflation eased in March by a seasonally adjusted 0.3%, the first and largest decrease since January 2010. Over the last 12 months, inflation slowed to 2.4% in March from a five-year high of 2.7% in February. (Source: “Consumer Price Index Summary,” Bureau of Labor Statistics, April 14, 2017.)

Inflation may only be at 2.5%, but it was essentially nonresistant just a few years ago. And the reversal in March is not expected to be the start of a trend. It is widely believed that the inflation rate will climb again next month as many of the declines are seen as temporary.

Despite the slight decrease, inflation is still running near a five-year high. Higher inflation means things are more expensive, which, in a low-paying, wage-stagnant, debt-laden society, means people will cut back on spending, curbing economic growth.

Economic growth is what Trump needs to keep the economy and stock bull market going. This will bleed into corporate profits, which will spook the markets if second-quarter results are worse than expected.

The core inflation rate (which strips out food and energy costs) has increased two percent in the past 12 months, the smallest gain since the fall of 2015. The core rate is viewed by the Fed and Wall Street as a better gauge of underlying inflationary trends because of the monthly swings in food and energy prices.

Because the lower core inflation rate is being blamed on temporary events like gas prices and wireless telephone services, it is widely expected that the Fed will raise rates again in June. The Fed could also raise rates two more times in the second half of 2017.

Raising rates prematurely, as we have seen, can hurt the U.S. economy and corporate profits.

In December 2015, the Fed raised its key lending rate for the first time in a decade. Stocks plunged in early 2016 and gold and silver soared. The same thing might have happened in January and March 2017, but investors are simply too optimistic about what Trump may be able to accomplish.

If he can’t come through with his campaign promises, you can expect to see panic in the markets, which will send gold prices higher.

There are a lot of reasons why 2017 is the official start of a new gold bull market; one that is still young and one that will reward precious metal investors with massive gains over the next three years.