Short-Term Outlook for Gold Prices

Over the past few weeks, there have been several interesting developments in the price of gold. It’s important that investors know what’s happening.

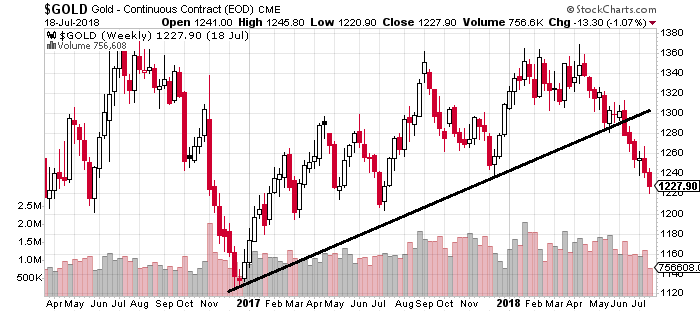

First, look at the weekly gold prices chart below to get an idea of what could be ahead in the short term. You see, in December 2015, an uptrend began in the price of gold. That continued until two weeks ago, when the price broke below the uptrend level.

In technical analysis, there’s a rule that “the trend is your friend until it’s broken.” So, going forward, as the uptrend is broken, we could see the selling of gold in the short term.

Chart courtesy of StockCharts.com

How low could gold prices go?

When a trend breaks, prices usually fall to the nearest support level. If the nearest support level isn’t able to sustain the prices, then they will drop to the next support level. This continues until sentiment changes and buyers come in.

The support level for gold was $1,240, but the price moved below it very quickly. The next support level isn’t until $1,200, so it wouldn’t be surprising to see gold reach that low.

Mind you, $1,200 is a major support level. Previously, we saw a lot of buying activity around there.

If $1,200 breaks, then the next support level isn’t until $1,125. Below that, the support level is $1,050. If gold goes down to those levels, then all the gains made over the past few years would be wiped out.

Long-Term Outlook for Gold Prices

In the short term, there could be some downside. However, it’s important to keep the big picture in mind.

There are three things to consider.

- At the current gold price, mining companies are finding it hard to justify producing more.

Over the past few years, they have scraped off the easiest-to-mine gold. If we assume that gold will go to $1,050, a lot of mining companies won’t be able to produce sustainably at that price. So, we could really get a major supply shock.

In the previous sell-off, miners cut back on exploration and reached for higher-grade grounds. Now they already have low levels of exploration, and the grades in the ground aren’t that great.

- Demand for gold remains strong, yet the prices remain low.

Central banks continue to buy, and it doesn’t look like they are going to stop anytime soon. India’s and China’s gold demand remains robust. Also, don’t be surprised if other emerging markets like Turkey buy more gold, given the currency crisis in that country.

Basic economics: When demand remains strong and supply declines, prices go higher.

- Gold is an inflation hedge.

Gold protects wealth in times when inflation takes its toll. We are heading into a period of higher-than-normal inflation. This is not just the case for the United States; it’s the case across the globe. So, gold could really be needed by investors.

If Gold Goes Lower…

Dear reader, I remain bullish on gold. I am not too bothered by its recent price decline.

In fact, I am thinking differently. I believe that the lower that gold prices go, the better the opportunity that the precious metal becomes.

The downside in gold could be small, but the upside could be massive.