Short-Term Outlook For Gold Prices

In the month of November, gold prices dropped over eight percent. With this information, investors are asking where the yellow precious metal could go next. What’s the short-term outlook for gold?

Bringing in some perspective before going into details, the decline in gold prices in November was the biggest since June of 2013. Looking at the longer term, the biggest decline in gold prices in the month of November was registered in 1978, when the precious metal fell 14.99%. The average return on gold prices for the month of November since the 1970s has been around 1.50%.

With this said, please look at the chart below of weekly gold prices, and pay close attention to the lines drawn.

Since 2011, the price of gold has been trading in a channel pointing downward. In 2016, we started to see a move to the upside in the price of the yellow precious metal, and it hit the top of the channel. Gold prices have now retraced to roughly the halfway point of the channel.

Chart courtesy of StockCharts.com

This halfway point is coincidentally the top of a channel within the bigger channel. With this in mind, we question whether we will find support around the current levels on the precious metal in the short term, and then see the price move higher, beyond the channel.

If the precious metal prices don’t hold the midpoint of this channel, there could be a move below the lows made in late 2015.

But don’t jump to conclusions just yet. If gold prices do move low, you have to ask a few things:

- Will gold producers be able to produce the precious metal when prices are trading at $1,050.00 or lower? Understand that the costs of production have increased, and a large number of mining companies can’t produce at that price.

- Will investors look at gold and question whether it’s trading at too low a valuation?

- With demand for the precious metal remaining strong, and companies not being able to produce, wouldn’t that create a supply crunch in the market?

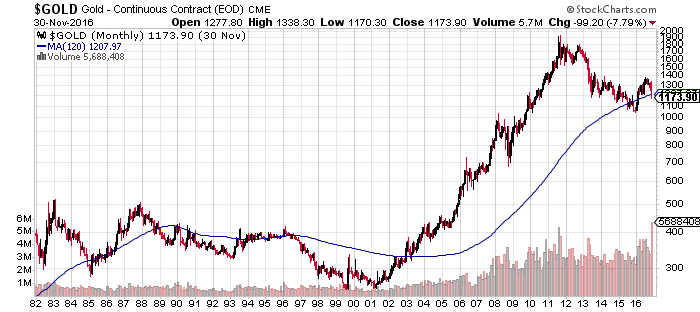

If you look at the long-term chart below, you will see that the trend that began in gold prices in 2002 remains intact.

Chart courtesy of StockCharts.com

The blue line on the chart above represents the 120-month (10-year) moving average . Currently, gold prices are trading above it. This suggests that the long-term trend remains intact.

Gold Prices Outlook: Short-Term Troubles, Massive Gains in Long Term

As it stands, there’s a lot of pessimism toward gold. But don’t be shocked if it’s just temporary. Over the past few years, we have seen November to be a bad month for the precious metal prices.

I am looking at gold for the long term, and it’s something that investors shouldn’t be ignoring. It could be the next big trade in the making, as I see it. In a few years, we could even be looking at gold at $1,200 as an extreme low price.

Also, as gold prices have come down in November, gold mining companies have faced severe scrutiny from investors. If gold prices rise, gold mining companies could be the biggest beneficiaries.