Soaring Money Supply Could Mean Skyrocketing Gold Prices

Gold prices move higher when the value of money diminishes. Don’t ever forget that.

As it stands, globally, central banks have been destroying money. Certainly, this sounds like a harsh claim, but the data is very loud and clear about this. This phenomenon could send gold prices soaring immensely.

Economics 101: When you have a lot of something, its value declines. This is what’s happening to money these days. Central banks have been increasing their money supplies and, over the long term, it could be very positive for gold prices.

Look at any central bank you want, and you will see it increasing its money supply.

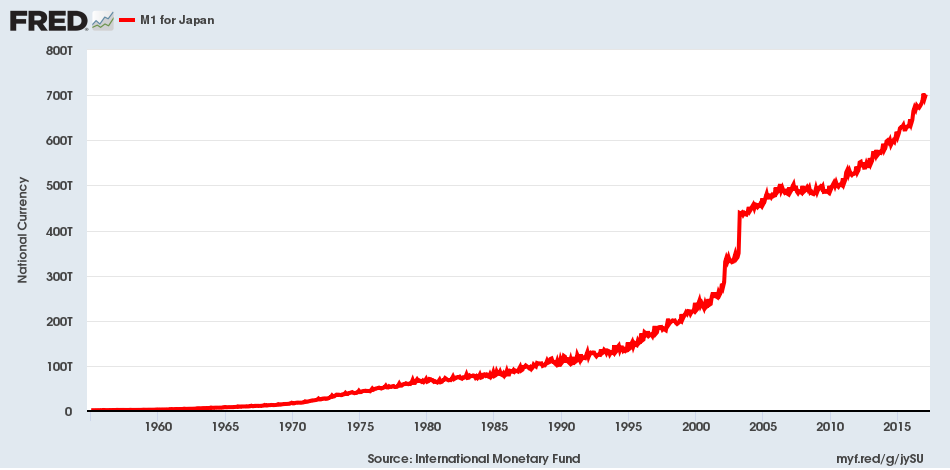

Look at the chart below of the M1 money supply of Japan. This is the most basic form of money in an economy. It’s the notes and coins in circulation and the money in demand deposits accounts.

(Source: “M1 For Japan,” Federal Reserve Bank of St. Louis, last accessed April 23, 2018.)

At the turn of the century, in 2000, Japan had an M1 money supply of ¥222.0 trillion. Now it’s ¥701.0 trillion. This represents an increase of over 215% in about 17 years! In 1960, Japan’s M1 money supply was just around ¥3.0 trillion. So that’s an increase of 23,266%!

How did gold prices do? As the money supply increased by 215% in 17 years, gold prices in Japanese yen jumped by about 300%.

Gold Is a Global Phenomenon

Don’t for a second think that this is the case for Japan only. Take a map, point to a country, and chances are that the country is witnessing a rapid increase in its money supply.

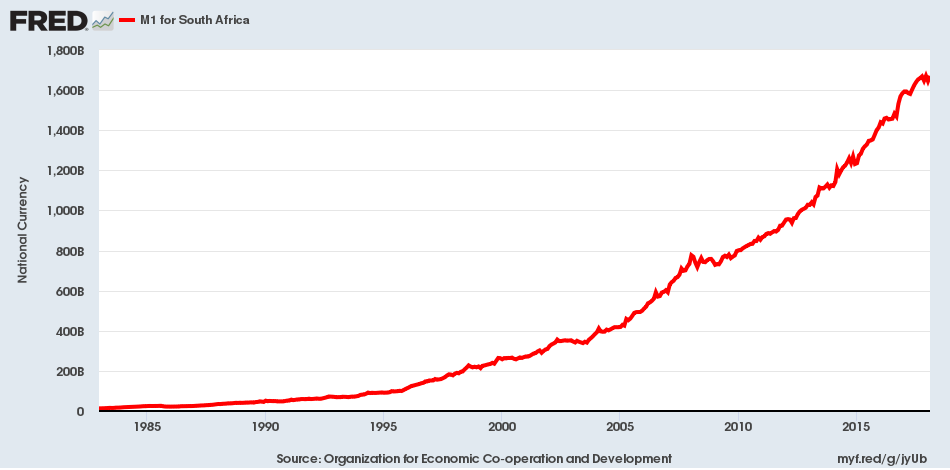

It doesn’t matter how big or small the country is. Japan is considered a major economy in the world. Let’s look at a smaller economy like South Africa.

(Source: “M1 for South Africa,” Federal Reserve Bank of St. Louis, last accessed April 23, 2018.)

In 2000, the M1 money supply in South Africa was R257.83 billion (South African rand). Now, it stands at R1.67 trillion. This represents an increase of close to 550% in the most basic money supply.

Gold prices have done well in South African rand terms as well.

I can’t stress this enough: the money supply is increasing across the world. The U.S. is in a very similar situation. So are Britain, Canada, Australia, New Zealand, China, Germany, France, Spain, and the list goes on.

Gold Could Be the Best Wealth Protector

Dear reader, central banks have printing machines so they can print an unlimited amount of money out of thin air in the name of “sound economics.” It doesn’t look like they are going to stop printing anytime soon.

Now, bring in gold to all this…

While money created by central banks is unlimited, gold is actually very limited. There’s a finite amount of the yellow precious metal that exists under and above ground.

With this said, it has to be asked, “What happens to gold prices in the midst of all this?” It’s not rocket science; if the money supply around the global economy continues to increase, gold prices could really skyrocket. The yellow precious metal has a very solid track record for increasing in value when money loses its value.

I can’t stress this enough: gold is being ignored these days for all the wrong reasons. Gold prices are down and out these days. But, over the long term, the yellow precious metal could be the best wealth-protecting asset.