Here’s Why Gold Could Be Setting Up to Be the Next Big Trade

Gold prices are too low to ignore. If you are looking for the next big trade, the yellow precious metal could be it.

Truth be told: gold protects wealth when the fiat currencies decline in value. This has been the case for several thousand years, and don’t be naive and think it will end anytime soon.

As it stands, we are seeing a significant amount of volatility in the currency markets around the world. Remember: gold is global. With this, you have to ask: won’t those who have money—and want to protect their wealth—look at gold as a hedge?

This could happen (if it’s not already happening) and it could send gold prices soaring.

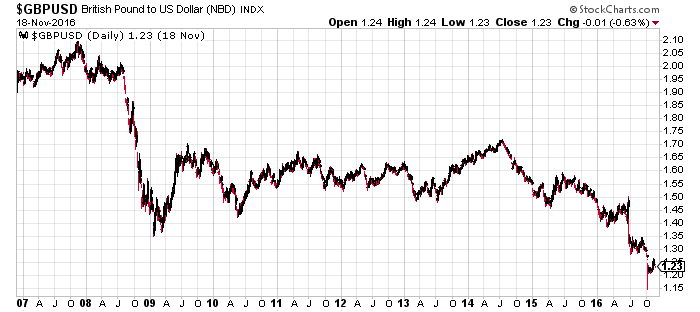

Please look at the chart below of the British pound relative to the U.S. dollar.

Chart courtesy of StockCharts.com

The British pound has collapsed close to 50% in value relative to the U.S. dollar!

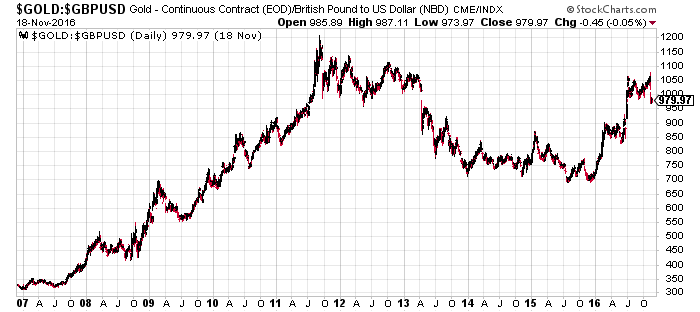

Now, look at another chart below. All this chart does is put gold prices in terms of British pounds.

Chart courtesy of StockCharts.com

Gold prices in terms of British pounds jumped 200% as the currency was halved against the U.S. dollar!

Still not convinced?

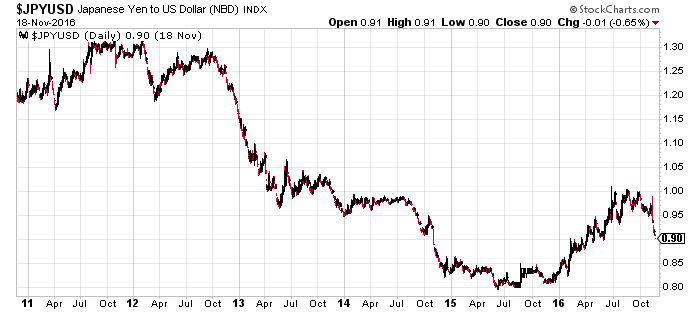

Look at the Japanese yen relative to the U.S. dollar. We see something very similar.

Chart courtesy of StockCharts.com

Since the highs of 2011, the Japanese yen has crashed approximately 30%.

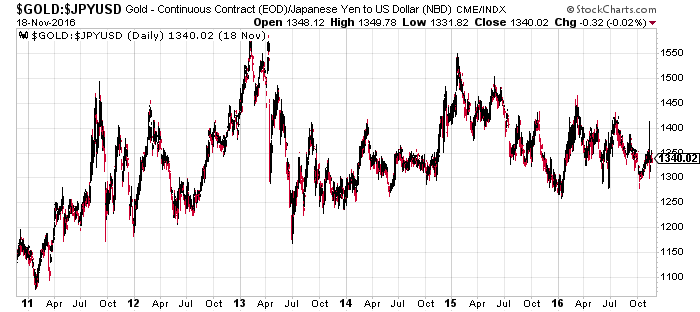

How did the gold prices do in Japanese terms? Look at the chart below;

Chart courtesy of StockCharts.com

Gold prices in Japanese yen terms increased roughly 25%. Yes, they didn’t increase as much as the currency collapsed, but gold would have reduced the losses immensely.

Gold Prices Outlook 2017 and Beyond

I believe that, going forward, currency volatility around the world will only increase, and don’t just think about the major currencies; pay attention to currencies that aren’t very well known. The biggest reason for this: central banks will try to manage economies by trying monetary policies that only hurt the currency value.

This phenomena will drive investors toward the precious metal, and we could see a massive rise in gold prices in the long term.

Understand that we are on track to show the first positive year in gold prices since 2012. If this holds, the yellow metal will gain a lot of interest from those who ran away from it. As a result, 2017 could be the year when gold prices rise even more than they did in 2016.

My long-term projection of gold prices: don’t rule out $2,500 just yet.

With all this said, pay attention to gold mining stocks. As gold prices move higher, the stocks could provide leveraged returns. Consider this; year-to-date, gold prices are up about 13%. If you look at a junior mining company like Richmont Mines Inc. (NYSEMKT:RIC), it’s up 100% in the same time. So, for every one percent increase in gold prices, RIC stock increased by more than 7.5%.

Now, doing simple math, if gold prices increase by 100% from where the currency stands, what would happen to mining stocks? Companies like Richmont Mines could increase 750%.

(Please note: Richmont Mines is not a recommendation to buy. It is just an example of the kind of opportunities investors should look for.)