Gold’s “Fear Hedge” Characteristics Buoy Our Gold Price Forecast This Month

It’s been awhile since gold’s “fear hedge” became a factor for investors. A booming stock market and historically low CBOE Volatility Index (VIX) readings saw to that. But a couple of imminent factors could prompt investors to rush into gold, as fear becomes a trending buzzword once again. Our gold price predictions for August take these factors into account.

The first logical question readers may ask is, “What is there to be fearful about”? If you pay cursory attention to international politics, this may escape you. But the situation with North Korea is far from normal. Not only is the rhetoric ratcheting up to a fever pitch, but so are the in-your-face intercontinental ballistic missile test launches. The situation threatens to pull multiple actors into a serious regional conflict.

In 2017 alone, North Korea has conducted 18 missile launches during 12 tests since February. Although North Korea is easily on pace to conduct more missile tests than ever before, that’s not the real story. The real story is the unprecedented threats to annihilate the enemy (America). Such threats have been heard before, but not to this degree.

For example, North Korean state media announced the country is developing plans to fire four “Hwasong-12” intermediate-range missiles over Japan and within 18 to 25 miles from Guam. This would mark the biggest escalation in the conflict since North Korea began its clandestine nuclear program. North Korea is “seriously examining the plan for an enveloping strike at Guam” and this signals “a crucial warning to the US,” according to a statement translation from South Korea’s Yonhap News. Of course, Guam hosts one of America’s biggest Asian-Pacific Air Force fleets. (Source: Lockie, A., “North Korea again threatens nuclear strike near Guam, mocks Trump’s ‘fire and fury’ threat,” Business Insider, August 9, 2017.)

Not to be outdone, President Donald Trump refused to back down. Trump said America would respond to more threats with “fire and fury” unlike the world has ever seen.

Not only is this very uncharacteristic talk for a sitting president, but the unpredictability of both men has military pundits concerned. It won’t be easy to walk back this scathing innuendo.

In a client note, Goldman Sachs Inc. (NYSE:GS) noted that although investors have yet to react to the North Korean threat in a meaningful fashion, it’s simmering. “We still suspect that investors are more concerned than markets reveal,” said Charles Himmelberg, Goldman’s chief credit strategist. (Source: Durden, T., “Goldman Is Amazed By The Market’s Non-Reaction To The Korean Crisis,” Zero Hedge, August 9, 2017.)

To be sure, investors are not apt to buy gold as a hedge against geopolitical risk. Call it the “never cry wolf” effect, which has seen political crises resolved peacefully throughout the decades. But the real threat of thermonuclear war—limited or otherwise—may jolt investors out of their normalcy bias slumber. The North Korea conflict has real potential for activating gold’s “fear hedge” qualities again.

The Upcoming U.S. Debt Ceiling Crisis

This under-the-radar catalyst has the real potential to power August gold price trends forward. Investors are taking for granted that the U.S. debt ceiling issue will get resolved, like always. Despite last-minute political maneuvering, the ceiling inevitably resets higher, and the issue is forgotten until the next budget negotiation. Same as it ever was.

But unlike in the past, the White House has never had a president so opposed by so many political factions. Factions that are actively calling for impeachment and overthrow by any means possible. It’s not just the Democratic Party; it’s also a good portion of the mainstream media, Hollywood, Republican “Never Trumpers,” open borders “globalists,” the political left, and climate changers. It’s abundantly obvious that Trump’s detractors would go to any length to jettison him out of office. Anti-president hysteria has never been spread so thick.

As such, is it possible these factions would band together to stonewall a U.S. debt ceiling limit raise to cause a domestic crisis? I’m not saying this will happen, but it seems well within reasonable possibility that it might. They already tried the hyped Russia scandal, and failed.

If there’s anything that could galvanize the public against a president, it’s an impact on their pocketbooks. A debt ceiling crisis would hurt the dollar’s purchasing power and the 401Ks of millions of Americans. Rightly or wrongly, they will ultimately blame Trump for the fiasco. The administration has failed to pass any meaningful legislation through Congress to date (despite a clear majority), and the House is deeply divided. It’s quite clear every legislative initiative for the next three-and-a-half years will be fought tooth and nail. Why would the budget and debt ceiling negotiations be any different?

Could Trump opponents take things to a whole new level? U.S. sovereign risk spreads are the highest since Lehman Brothers collapsed in 2009. We wonder if worry about U.S. debt ceiling brinkmanship is not the driving cause of this reality. We believe gold’s steady bid in August is due in large part to this important risk factor.

Gold Price Predictions for August

Gold price futures started August out on a soft note, falling around $10.00/oz in the first week. But since then, the gold monthly chart has rebounded. Gold is currently trading at $1,276/oz, up a modest 0.7% on the month. This is on the heels of a terrific July, which saw gold elevate from about $1,205/oz mid-month to where it is today.

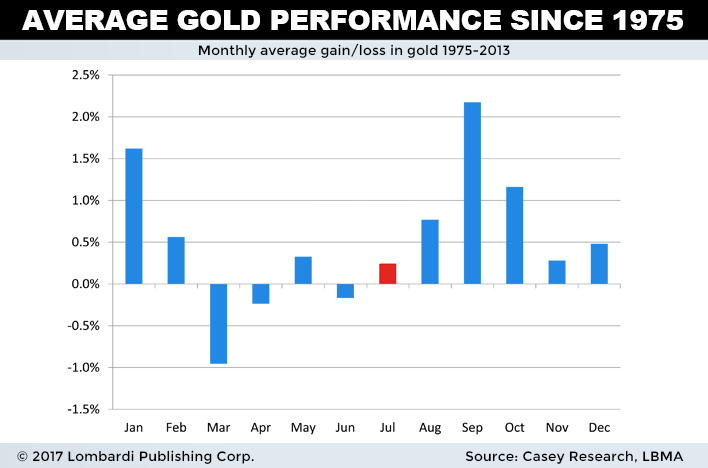

The move is particularly noteworthy considering July is historically gold’s third worst month in terms of price appreciation since 1975. Equity markets have also been humming on the backdrop of a rising rate environment and “sound” economy. Gold doesn’t really have a compelling “right now” fundamental reason to move higher.

Unless, the market is worried about something big coming its way.

So, given the current state of things, what are our gold price predictions for August?

We think gold will continue to catch a bid throughout August. Concerns about North Korea and the debt ceiling will not be resolved, so they will continue to provide price support. I believe a test of $1,300/oz is probable, with $1,350/oz a possibility (if not August, then September). An increase in the VIX from grotesque levels will also abet the gold price.

Our gold price forecast 2017 is mainly about economic concerns. But the dual specter of North Korea and U.S. debt ceiling agitations promise to upstage economic consideration near term.