Gold Prices to Beat $1,300 in Next Half of 2017

Since the start of 2017, gold prices have not managed to beat the $1,300-per-ounce mark. The prices may not be stellar, but neither have they fallen below $1,200 per ounce for very long, as in 2016. In fact, the past few weeks’ performance suggests that gold has found a floor price of $1,200 per ounce. That’s encouraging, and a gold price prediction for the next six months of $1,300 or better seems realistic.

Gold prices per ounce hit this year’s lowest point earlier this month, when it fell to $1.212 per ounce on July 7. Investors, on that occasion, turned to risky assets, abandoning precious metal. They might regret it. Between Sean Spicer quitting the White House, and the current rising international political and economic tensions, nothing could be safer than gold. Indeed, gold prices today, less than three weeks after the year low, are back to about $1,255 per ounce.

Also Read:

Precious Metal Analysis: Keep Gold and Silver on Your Radar in 2017

The Gold Price Forecast 2018 Might Surprise You

The gold price history for 2017 has been less blustery than stocks, but that should change promptly. Gold prices have dropped and rebounded, especially in June—reaching a quarterly peak of $1,293.6 on June 6—which was the highest price in the last seven months. The Federal Reserve’s decision to raise interest rates was responsible for that. But, as noted below, gold is about to embark on a sustained uptrend.

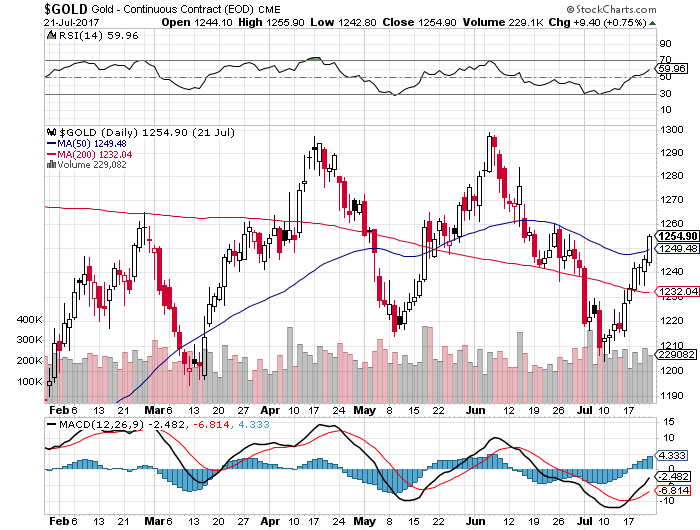

Chart courtesy of StockCharts.com

Gold Is Looking Good for 2017, and Excellent for 2018

It isn’t just the second half of the year that’s looking good for gold. The gold price forecast for 2017 and beyond looks promising. In the first few weeks of 2017, the gold price dropped dramatically. It seemed as if geopolitical tensions were dropping. After all, President Donald Trump won the White House on a non-interventionist platform. Instead, geopolitics is the matador that has come to slay the bull market.

But, as we expected at Lombardi Letter, the idea of tensions easing between the United States and Russia (or China, for that matter) was fantasy. Tensions are good for the defense industry.

Indeed, to get a better grasp on just how high international tensions have reached, take a look at Lockheed Martin Corporation (NYSE:LMT) stock. The largest U.S. defense contractor has reached the financial stratosphere. Its stock value hovers at the all-time record of of $290.00/share while similar companies—like Raytheon Company (NYSE:RTN), Northrop Grumman Corporation (NYSE:NOC), and Boeing Co (NYSE:BA)—are also flying on Wall Street.

Allegedly, Trump has agreed to let Russia manage the Syria file, but that does not imply that Moscow and Washington are cozying up to each other. Apart from the continuing and ever-evolving scenarios for alleged links between the Trump campaign and Moscow (in what some call “Russiagate”), the European Union (EU) has just hinted that it won’t simply refuse to go along with the new sanctions package. The EU will, in fact, retaliate against Washington, rather than against Moscow. (Source: “EU ready to retaliate against US sanctions on Russia,” Financial Times, July 23, 2017.)

The EU is not going to submit to U.S. demands on Europe’s energy companies. It’s unclear whether Trump will sign the legislation, but hints are that he will. The result is that the U.S. and the EU will split on the topic of sanctions against Russia, exacerbating economic competition between them. The EU could retaliate by making life more difficult for Silicon Valley companies like Apple, Google, and Facebook. The U.S would retaliate by imposing tariffs on the many imported European goods.

It Didn’t Take Long for Fed Hike Predictions to Fizzle Out

The combined effects of political and economic turmoil would leave a bearish mark on the stock markets on both sides of the Atlantic. Meanwhile, one of the main factors adding pressure against gold prices was the U.S. dollar’s gains in June, due to the Fed’s third consecutive rate hike.

Yet, Fed Chair Janet Yellen herself had to admit that the U.S. economy would need to show more strength before interest rates would be raised again. That calmed fears, pushing stocks higher and the dollar lower. In fact, the markets have been looking for any reason not to drop. The fact that, on average, stocks are trading some 22 times earnings compared to a 10-year average of 16.7. (Source: “Any Way you look at it, this Stock market is Overvalued, Goldman Sachs Says,” CNBC, July 24, 2017.)

It seems inevitable that a market correction is due, but it will be the kind of market correction that leads to a crash. Simply put, the market would collapse in a fragile global economic scenario. Many stocks are running on fumes and pure speculation. The necessary element of realism is missing.

The mix of overvalued markets and concerns about Trump’s ability to fulfill his promises is explosive. It’s a nitroglycerin-like mix that will blow stocks down to Earth. The Fed might even have to reverse the recent interest rate hikes, at the cost of confidence in the U.S. economy. The dollar could plunge, inevitably leaving gold as the best potential investment.

Market observers believe that gold prices cannot but continue rising in 2017. If further geopolitical tensions don’t weaken the market, allegations surrounding Trump will. After all, special FBI prosecutor Robert Mueller has started to investigate Trump’s business past. He may find ghosts, which—while acceptable in the context of the New York real estate scene—might not pass scrutiny.

In short, gold in the second half of 2017 should perform much better than in the first half, continuing a favorable course in 2018. The macroeconomic, market, and geopolitical risks are fueling a storm that will devastate stocks but prop up gold. The dollar, meanwhile, is going down and the Europeans have indicated that they will not alter the low—or zero, rather—nominal interest rate in order not to compromise economic growth.