TIVO Stock: Over-Concentrated?

I was quite intrigued when I came across a name like TiVo Corp (NASDAQ:TIVO) stock in the Soros Fund Management LLC portfolio. Under most pretenses, George Soros is known as the billionaire hedge fund manager who made a name for himself betting against the British pound. It is not difficult to acknowledge, based on his past successes, that he is a very smart and savvy investor. So when I came across TiVo Corp, I was a bit puzzled. My reaction was due mostly to the size of this position in the Soros Fund Management LLC portfolio. As of September 30, 2016, the fund contained 4,121,303 shares of TiVo stock, which is now valued at $76,656,235.80, making it the 6th largest position in the fund. (Source: “Soros Fund Management LLC,” Nasdaq.com, last accessed, February 2, 2017.)

I actually am finding this position concerning because the method I use to analyse investments and set appropriate trading strategies is suggesting that TiVo Corp is going to experience some negative returns going forward. These negative returns can manifest into something more sinister, because when a trend begins, it can continue for quite some time, suggesting that losses could mount.

I use technical analysis as my method to analyze potential investments. This method uses historical price and volume data to discern the direction of a trend and forecast the future potential price. It has served me extremely well, and I have been refining my skill using this method for nearly two decades.

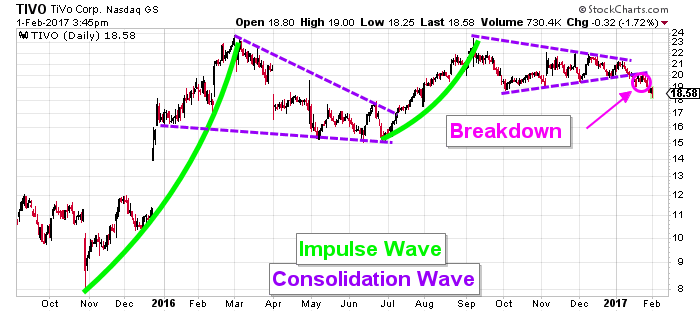

The following TiVo stock chart illustrates a bearish development that suggests lower prices are likely.

Chart courtesy of StockCharts.com

The price action on the TiVo stock chart above has been extremely constructive. Constructive price action is characterized by an impulse wave that propels price and a consolidation wave that unwinds any overbought/oversold condition, and then sets up the next impulse wave.

This constructive price action was instrumental in advancing TiVo stock from a low of $8.01 to a high of $23.70. The most recent consolidation wave could have broken in either direction, but when the stock exited the consolidation wave to the downside, it suggested that a new bearish impulse wave was in development. At first glance, the pattern is suggesting that Tivo stock could test the $17.00 range, but it is difficult to know if the extent of the selling will end there.

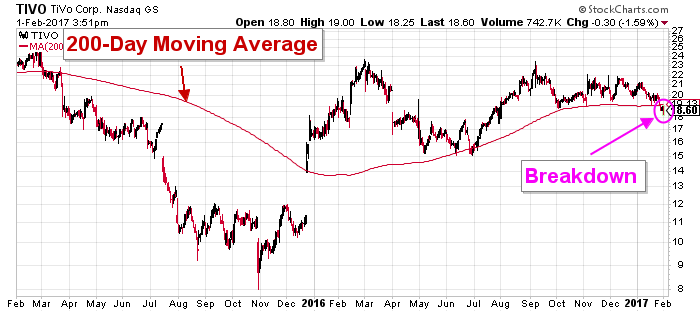

The following TiVo stock chart illustrates that bearish developments are mounting.

Chart courtesy of StockCharts.com

On January 27, 2017, TiVo stock closed below the 200-day moving average. The 200-day moving average is the dividing line between stocks trading in a bull market versus stocks trading in a bear market. When the share price is above the moving average, it is bullish. When the share price is below the moving average, it is bearish.

On the chart above, it is easy to see how the moving average has supported the price of TiVo stock. In December 2016, TiVo stock gapped above this moving average, and for a nearly a year, this moving average effectively supported the price of Tivo stock. Investors were more than willing to support the stock as it tested this moving average from above. When TiVo stock managed fall below this moving average in the past, quite a significant amount of selling pressure ensued. In March 2016, TiVo stock fell below the 200-day moving average and a violent sell-off followed where TiVo lost 63% of its value from peak to trough.

Now that TiVo stock is once again trading below this moving average, caution is warranted, because it can’t be ruled out that another violent sell-off, similar to the one that occurred in 2016, won’t happen again.

Bottom Line on TiVo Stock

Soros Fund Management LLC contains a large position in TiVo stock. The weakness suggested by the bearish developments on the stock chart suggests that this position could put a slight dampener on TiVo Corp’s performance in the coming months.