Major Car Manufacturers and Investment Funds Are Driving Cobalt Prices Higher

Ask the average mining pundit what they consider the hottest commodity these days (other than gold or silver). I would guess, based on my experience, eight times out of ten, the answer would be lithium. Surely, lithium is important; it’s a key ingredient in lithium-ion (Li-ion) batteries, which are used in electric cars.

But there’s another material of equal, if not greater, importance to Li-ion batteries: cobalt.

Electric cars are going to represent the future of personal transportation. Love it or hate it, Tesla Inc (NASDAQ:TSLA) has made electric cars cool and has fueled a new market. No matter how much you appreciate the sound of a naturally aspirated V-8 engine (as I do), there’s no point in challenging this course like a modern-day Don Quixote.

Every major mainstream car manufacturer has plans to offer electric cars. Even Maserati plans to launch a sleek new two-seater in the finest Italian tradition, powered exclusively by batteries. (Source: “Maserati’s electric Alfieri two-seater coming in 2020,” Autoblog, November 26, 2016.)

It seems that lithium has gotten all the attention when it comes to electric car batteries, but those batteries require various materials. A key material that many don’t realize is in Li-ion batteries is graphite. Cobalt, however, is more special. Simply put, cobalt is indispensable for manufacturing lithium batteries.

Lithium resources are well known and underexploited. Apart from the traditional sources of lithium, more have been discovered in China, where most Li-ion batteries are made. Indeed, China dominates the production of Li-ion battery components, controlling more than 75% of the market for electrolyte solutions. (Source: “China’s lithium-ion battery makers devour foreign rivals,” Nikkei Asian Review, September 19, 2017.)

In contrast, Cobalt is becoming rarer and more expensive. This puts the entire emerging electric car industry in peril. What’s going to happen when all the major car manufacturers, from Ford Motor Company to Honda Motor Co Ltd to Nissan Motor Co Ltd feature electric models in their showrooms?

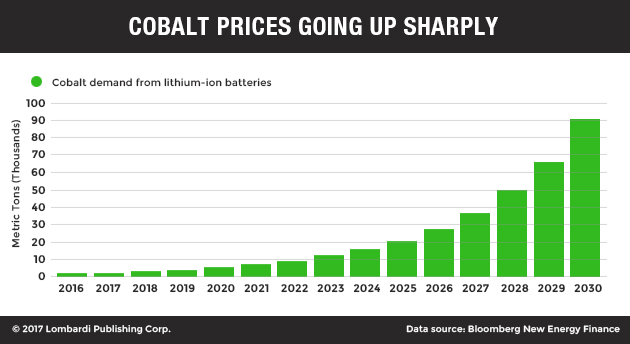

Demand for cobalt is rising at an exponential rate. Cobalt has become the new star of the London Metals Exchange, and prices have doubled over the past year. (Source: “London Metal Exchange eyes electric car revolution in shake-up,” Sky News, September 6, 2017.)

Cobalt is the “New Oil”

It’s easy enough to promote electric cars, claiming they are better for the environment (supposedly). But, to really make them popular, cost-effective, and efficient, much more needs to be done. In addition to installing charging columns and other infrastructure, finding the raw materials is key. Gasoline is to rechargeable batteries what unprocessed oil is to the raw materials for rechargeable batteries. Thus, the raw materials for batteries are the “new oil.”

In the charge forward to boost electric vehicle production, securing the proper materials is key. Lithium has gotten plenty of attention, but cobalt is also essential. In the electric car revolution, there will inevitably be a sharp increase in demand for cobalt.

Tesla needs cobalt just as much as any other Li-ion battery manufacturer. The company has already built the Gigafactory battery production facility in Nevada. The factory started operating last January, but it’s still at a fraction of capacity.

Volkswagen AG (VW), the world’s largest car manufacturer, has learned from its “Dieselgate” scandal. The company plans to offer a full range of electric vehicles to make Tesla shake. VW wants to make three million electric cars per year by 2025, and it plans to invest some $24.0 billion by 2030 to this effect. Accordingly, VW has asked cobalt producers to bid for long-term supply contracts starting in 2019. (Source: “Exclusive: VW moves to secure cobalt supplies in shift to electric cars,” Reuters, September 22, 2017.)

How to Profit from Cobalt Directly

Cobalt has yet to find a dominant mining player, leaving a wider door open for opportunities.

Unfortunately, there aren’t any specific cobalt miners in which to invest yet—at least not in the mainstream space. You see, much of the world’s known cobalt supplies are in the Democratic Republic of Congo. As with coltan (the original “blood metal”), which is essential for making cell phones and other electronics, cobalt comes from volatile, high-risk areas. Operating in those regions exposes publicly traded companies to excessive risks to their reputations.

One company that extracts cobalt from Congo is Glencore PLC (OTCMKTS:GLNCY), which is one of the world’s largest mainstream mining companies. Glencore supplies about a third of the world’s cobalt, and the company’s stock is trading at two-year high.

Look for the development of new cobalt sources as demand expands. Apart from Congo, which controls 65% of cobalt production, the resources exist in sufficient abundance in Canada, China, Russia, Australia, and Zambia.

If electric car manufacturers want to present themselves in a politically correct, sustainable light, they will source battery materials in the more regulated countries. Australia, and possibly Canada, will have priority over Congo or neighboring Angola for companies that want to go public.

Australia has taken a lead role in cobalt production. Clean TeQ Holdings Ltd. (ASX:CLQ) is a promising startup. The Canada-based Cobalt 27 Capital Corp. (CVE:KBLT) invests in cobalt, storing the resource in expectation of it appreciating in value.

Alternatively, in the new “cobalt rush,” you might consider a group of speculative funds that are betting on prices moving higher. The names of these companies tend to be obscure to anyone but the specialist, such as the Swiss firm Pala Investments and the Chinese hedge fund Shanghai Chaos Investment. (Source: “Electric car boom spurs investor scramble for cobalt,” Reuters, February 14, 2017.)

The combination of investment funds and car companies hoarding cobalt can only push cobalt prices up. What’s certain is that, at this point, they sit on a beautiful cobalt mountain, and prices should be rising considerably.