The Financial Crisis of 2008 had a severe impact on the average American. But nine years later, is the U.S. economy really better off, in respect to the standard of living of Americans? Take the rising stock market out of the equation and really look at our economy. Has it improved? The short answer is no.

U.S. Economy: The Truth

While the government parades before us an unemployment rate below five percent, the truth of the matter is: 1) the unemployment rate is skewed because it doesn’t include people who have given up looking for work, nor people who have part-time jobs but want full-time jobs; and 2) most of our job growth the past nine years has been in the low-paying service sector.

To see the U.S. economy improve, citizens need to earn more and save more. The saving part…it’s not happening. Americans are spending more by borrowing, not by dipping into their savings, because they don’t have any savings!

U.S. Consumer Debt: Recession Warning Sign?

In the first quarter of 2017, total U.S. consumer debt (which includes mortgages, credit cards, auto loans, and student loans) hit $12.72 trillion—the highest amount since prior to the 2008 Financial Crisis. (Source: “Household Debt Surpasses its Peak Reached During the Recession in 2008,” Federal Reserve Bank of New York, May 17, 2017.)

My concern: it’s getting too easy to borrow money again…just like it was back in 2007.

Take auto loans as an example. In the first quarter of 2017, roughly $26.0 billion of auto loans were made to people with credit scores that were considered risky: subprime. Back in the first quarter of 2010, this amount was just $12.0 billion.

Historically, debt has been one of the best indicators of an upcoming recession. Look back at any U.S. recession and you will see an extreme debt expansion prior to the economy falling apart. History is repeating itself today.

Chart Shows Loan-Recession Pattern

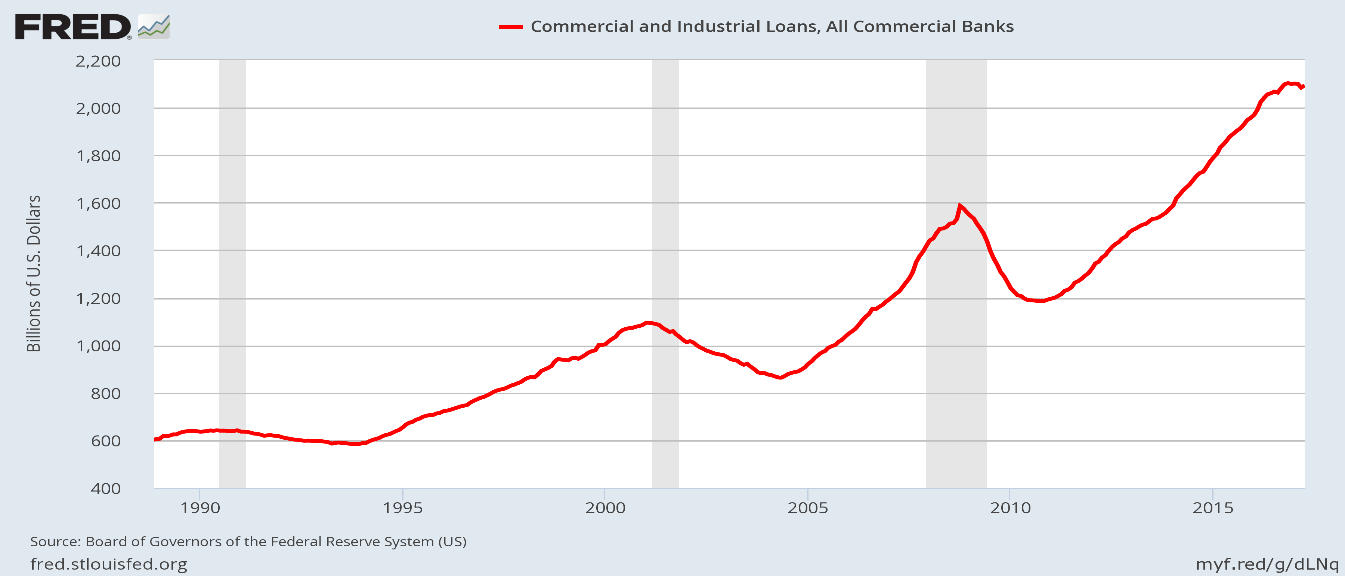

The chart below shows commercial and industrial loans at U.S. banks. The shaded gray area on the chart is a recession.

Notice something? Just prior to every recession, loans peaked first. Look at the very right side of the above chart. See how the red line is starting to trend downward? It’s just like before the recessions of the early 1990s, 2000s, and 2008/2009.

The Recession No One’s Talking About

Dear reader; these days, all I hear about finance from the mainstream media is the soaring stock market. I don’t hear anyone (except maybe me and my colleagues at Lombardi Letter) talking about out-of-control debt or recession risk. And that’s just wrong. We should be very worried about a recession later this year or in early 2018.

Investors have bought into the notion that key stock indices can only move in one direction: up. Investor sentiment indicators say that investors are extremely optimistic. That optimism will quickly send stock prices lower once investors find out that the U.S. economy is close to a recession.

The fact of the matter is that, during former President Barack Obama’s tenure of eight years, we didn’t have a single quarter of gross domestic product (GDP) growth of over three percent. The U.S. economy grew at only 0.7% in the first quarter of 2017—its weakest pace in three years.

I want to warn my readers now: at this point it will not take much to get two negative quarters of GDP—the technical definition of a recession. And the stock market, as a leading indicator, will top out well before that.