Charts and News Suggest EUR to USD Headed Lower in 2017

If you are not paying attention to the chart of the EUR to USD exchange rate, or the news coming out of the eurozone, you could be making a big mistake. Analysts say the euro could collapse another 20% against the U.S. dollar.

Before going into any details, know the basic rule of technical analysis: when support breaks, it becomes resistance. Once this happens, the prices usually don’t settle until they hit the next big support level.

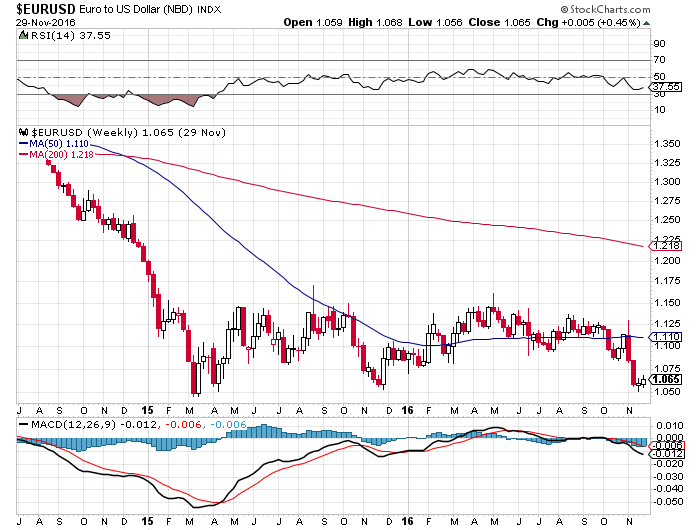

Now, pay attention to the daily chart of the EUR to USD exchange rate below. On the EUR/USD, there was a magic number that the currency pair tested, and bounced higher from, several times: 1.05. This was a support level. Buyers came in at this point.

Not too long ago, the EUR to USD exchange rate fell below 1.05.

Chart courtesy of StockCharts.com

Remember what I mentioned earlier: we have a broken support here. Don’t take it lightly. Now, don’t be shocked to see the EUR to USD exchange rate fall.

To figure how low the EUR/USD could fall, look at a very long-term chart of the currency pair below, and pay close attention to the lines drawn.

Chart courtesy of StockCharts.com

Here’s what you need to know: the next major support level where the EUR to USD could fall to isn’t until 0.85 at least. That’s 20% below!

While technical analysis suggests that bearish sentiment is pouring toward the EUR to USD, if you look at the fundamentals, you will see that they favor a major decline in the euro.

You see, over the past few years, the European Central Bank (ECB) has been running on the mandate of doing “whatever it takes to save the euro.” It has implemented a negative interest rate policy, and is printing money out of thin air, with no clear end in sight.

With this, one would assume that everything is getting under control, and things are getting better. The banking sector is healthy, and major economies in the region are marching ahead just fine.

Don’t be too quick to judge. The problems in the eurozone persist.

Just recently, Italy’s Banca Monte dei Paschi di Siena SpA, the world’s oldest bank, said it’s racing against time. It needs a government bailout or there could be a bank failure at hand. (Source: “BMPS stock tumbles as finance drive stutters,” The Local, December 21, 2016.)

Economic growth in the common currency regions remains subdued as well.

EUR to USD Outlook: Gruesome at the Very Best

Going forward, investors could really be questioning the future of the EUR to USD. Another financial crisis and dismal growth in the region will do nothing but more damage to the euro.

Saying the very least, being bullish on the EUR to USD could be detrimental to one’s portfolio.

I will be bold here and say this: the odds of the euro collapsing to 0.85 against the U.S. dollar are much higher now than any time in the last three years. It wouldn’t shock me to see the EUR/USD hit parity in early 2017, and then see investors’ sentiment turning more bearish, taking the euro a lot lower.