3 Indicators Foretelling A Stock Market Crash

If you want to know the best indicator for a stock market crash, look at how investors are feeling. If they are severely optimistic and complacent, it’s time to be careful, because a sell-off could be ahead.

As it stands, it looks like investors have completely lost touch with reality. The euphoria among them is erupting. They only expect stocks to go higher, and nothing else. This behavior causes a bump in stock prices at first, but as the optimism fades, it all comes crashing down.

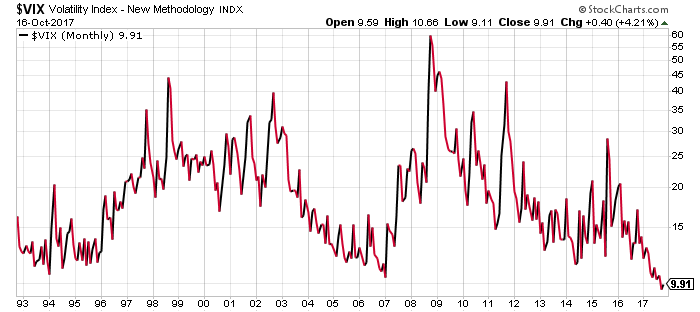

To give you some perspective on how optimistic investors are, look at the Chicago Board Options Exchange Volatility Index (VIX). This index is often referred to as the “fear index” because when it is soaring, it suggests investors are nervous and a stock market crash could be ahead. If investors are optimistic, however, the fear index drops.

The so-called fear index of the stock market sits at the lowest level in at least 25 years. It’s saying investors aren’t worried about a stock market crash whatsoever.

If this wasn’t enough, know this: the VIX futures shorts was the highest ever not too long ago. This means investors are betting the fear index will drop further. Essentially, they are saying a stock market crash isn’t a likely scenario. (Source: “Shorts of Volatility Futures Set a New Record,” Bloomberg, October 16, 2017.)

Chart Courtesy of StockCharts.com

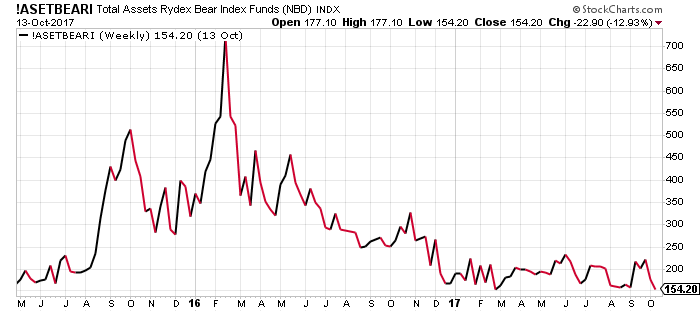

Look at the chart below. At its core, it shows assets in funds that bet on a stock market crash–bearish stock funds.

Chart Courtesy of StockCharts.com

Over the last one year, bearish stock funds have seen massive withdrawals. Again, this says a stock market crash isn’t even on investors’ minds right now. And they are making it very clear with their purchases that they are bullish on stocks.

Consider this: in the first eight months of 2017, stock mutual funds and exchange-traded funds (ETFs) witnessed inflows of $138.58 billion. And in the first eight months of 2016, there was actually withdrawals of $80.37 billion from these funds. (Source: “Summary: Combined Estimated Long-Term Flows and ETF Net Issuance Data,” Investment Company Institute, October 11, 2017.)

When Will the Stock Market Crash Begin?

Dear reader, there’s too much optimism among investors and other market participants these days. Let me ask this question: when was the last time you heard someone say anything against the stock market? Chances are you haven’t heard anyone even mention the phrase “stock market crash.”

At this point, I can’t help but remember a quote from Mark Twain: “Whenever you find yourself on the side of the majority, it is time to pause and reflect.”

For the next little while, as said earlier, I fully expect markets to soar. However, as investors start to get nervous and question if the returns are going to be great going forward, we could see a stock market crash.

I will make a bold prediction here, and I have said this before as well: the returns on the key stock indices for the next five years may not be like what they were in the five years prior. Be very careful if you are a long-term investor.