Economic Slowdown Looms, Debt-Fueled Growth May Not Last Long

If you are optimistic about the U.S. economy, you may want to think again. An economic slowdown could likely be ahead, not economic growth.

Blame debt-fueled economic growth and higher interest rates for the upcoming economic slowdown in the U.S.

Let me explain.

In the third quarter of 2009—when the recession ended—the annual value of U.S. gross domestic product (GDP) was around $14.4 trillion. In the second quarter of 2018, it was $20.4 trillion.

Simple math: U.S. GDP increased by about $6.0 trillion (or over 41%) since the Great Recession of 2008–2009.

U.S. Economic Growth Was Fueled by Debt

If you look at GDP numbers alone, then yes, the U.S. has had solid economic growth. But it’s important to understand how this growth came about.

One word: debt.

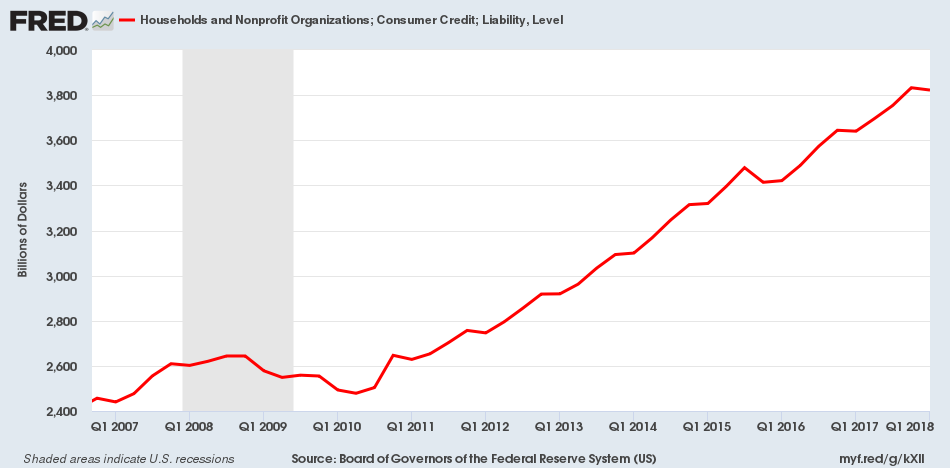

Consumers borrowed immense amounts. The chart below shows how much consumer credit has grown since 2007.

(Source: “Households and Nonprofit Organizations; Consumer Credit; Liability, Level,” Federal Reserve Bank of St. Louis, last accessed August 24, 2018.)

In the third quarter of 2009, consumer credit stood at around $2.6 trillion. In the first quarter of 2018, it stood at almost $3.9 trillion. That’s an increase of more than 50%.

Consumer credit includes things like credit cards, lines of credit, and other personal loans.

Overall household debt continues to increase as well. It stood at $13.3 trillion in the second quarter of 2018—the highest level on record—and has been increasing for 16 consecutive quarters. (Source: “Total Household Debt Rises for 16th Straight Quarter,” Federal Reserve Bank of New York, August 14, 2018.)

Business Liabilities Surged, U.S. Government Borrowed $9.0 Trillion

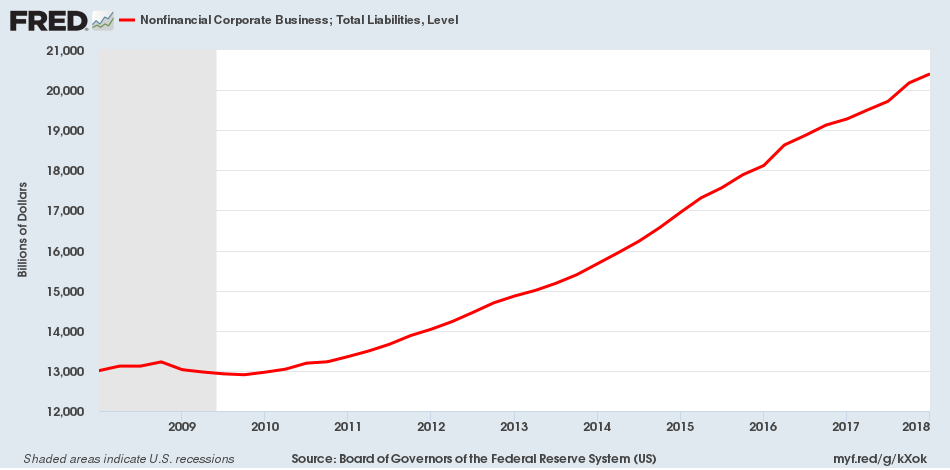

Businesses have borrowed a lot of money, too. Look at the chart below of total liabilities at non-financial companies in the United States.

(Source: “Nonfinancial Corporate Business; Total Liabilities, Level,” Federal Reserve Bank of St. Louis, last accessed August 24, 2018.)

In the third quarter of 2009, corporate liabilities stood at $12.9 trillion. In the first quarter of 2018, it was $20.4 trillion.

So, corporate liabilities increased by about $7.5 trillion or roughly 58%.

The U.S. government has mortgaged itself immensely. In the third quarter of 2009, U.S. national debt was about $12.0 trillion. In the first quarter of 2018, it was over $21.0 trillion. (Source: “Federal Debt: Total Public Debt,” Federal Reserve Bank of St. Louis, last accessed August 24, 2018.)

That’s about a $9.0-trillion increase in the government’s debt.

So What?

Dear reader, it’s important to focus on the figures.

Since the Great Recession, the U.S. economy hasn’t grown as much as government and business debt has. GDP only grew by $6.0 trillion, yet corporate liabilities and government debt combined increased by $16.5 trillion. One could say it took it took $2.75 to increase U.S. GDP by just $1.00.

Mind you, I am completely disregarding household debt.

This situation is dangerous. You see, debt is highly impacted by interest rates. And interest rates are going higher.

It really has to be questioned what’s next. Will extreme levels of debt, along with higher interest rates, cause an economic slowdown in the U.S. economy? It’s possible.