Robust Move on Dow Jones Industrial Average Foretelling Stock Market Crash?

The Dow Jones Industrial Average has crossed above the 23,000 mark; a level not seen before.

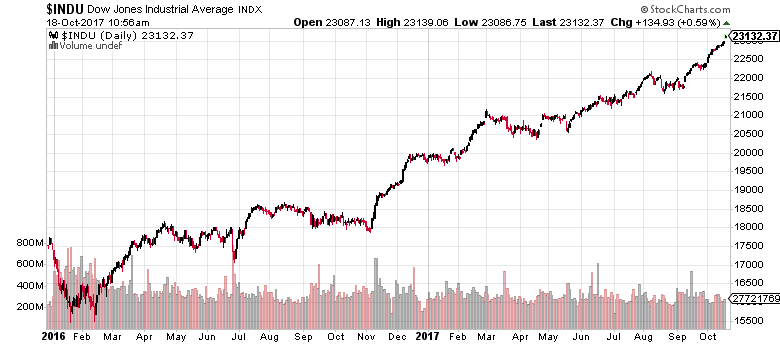

How long did it take the blue-chip stock index to get that far? It took the Dow 26 trading days to go from below 22,000 level to above 23,000.

Going back a little further, on February 11, 2016, the Dow Jones Industrial Average stood at around 15,500. So, in 425 trading days (February 11, 2016 to October 18, 2017), the index jumped 7,5000 points. This represents an increase of more than 48% in a matter of 20 months.

In this entire time, there was just one instance when the index dropped more than five percent. But, the losses were recovered very quickly. You could see the chart below of this remarkable move to the upside.

Putting all this in simple words, the momentum on the stock market is robust. Investors just want to buy, and any sell-off that happens is taken as a buying opportunity.

Chart courtesy of StockCharts.com

Looking at what has happened over the past 20 months or so, what’s next for the Dow? We are already hearing a lot of noise suggesting that reaching 25,000 could be possible soon.

Stock Market Today Reminding of 2006–2007

Dear reader, all of this reminds me of 2006–2007.

At that time, the Dow Jones Industrial Average was witnessing a robust move as well. Between July 2006 and October 2007, the index soared over 3,500 points, from around 10,500 to 14,000. And the mainstream media was buzzing about how the Dow could hit 15,000 next. It never did hit 15,000 in 2007, and a major stock market crash followed.

Could we be seeing history repeat itself?

First of all, looking at the Dow at 23,000 and saying we are at a market top is nothing but an irrational thought. Market tops are only known once they are in place.

Over the years, I have tried to study previous stock market crashes. With that in mind, one thing is certain: it’s very difficult to predict when the sell-off will kick in and market tops will form. But, prior to the sell-off, there are usually a few things that are very common.

One of the most common things that happens before a stock market crash (or before a top is formed) is that investors start to lose touch with reality. They expect nothing but gains going forward, and even the thought of a sell-off is ridiculed.

Also, the fundamentals slowly dissipate before market tops. The general economy starts to slow down and there are risks developing, but they are ignored in the midst of all the optimism among investors.

If you look now, we are seeing something similar. I have written several times in these pages that investors are euphoric. As they expect more gains, the U.S. economy is starting to look a little shaky. Valuations are ridiculously high, relative to historical averages, and earnings estimates are dropping. In addition to this, interest rates are rising and this could cause a lot of problems.

I am looking at the Dow Jones Industrial Average at 23,000 and asking if we are closing in on a market top, and whether there’s going to be a stock market crash sooner than many anticipate.