Death Cross for Silver and Gold ETF Miners

After years of declines, silver and gold prices rebounded in 2016. But since the U.S. election, gold and silver prices have fallen hard. The one-time darlings of the stock market are now both heading toward ominous death crosses, a warning sign that precious metal mining exchange traded funds (ETFs) could experience a correction.

But there are a number of reasons why investors shouldn’t worry about falling gold and silver prices.

Silver and gold have been shining stars in 2016, at least until Donald Trump won the presidential election. Silver prices advanced 53% in the first three quarters of 2016 while gold prices were up roughly 30%.

It was an even better time for precious metal ETFs. The ETF Global X Silver Miners (NYSEARCA:SIL) soared 187% over the same time frame while the Market Vectors Gold Miners ETF (NYSEARCA:GDX) was up an impressive 125%.

Gold and silver ETFs and other precious metals soared for the better part of 2016, thanks in large part to ongoing fears about the stability of the United States and global economies. Since the U.S. election though, silver and gold prices and precious metal mining stocks have fallen on the strength of the U.S. dollar, which is encouraging economic data, and there are expectations that the Federal Reserve will raise interest rates in December. All of which has a negative impact on silver and gold prices.

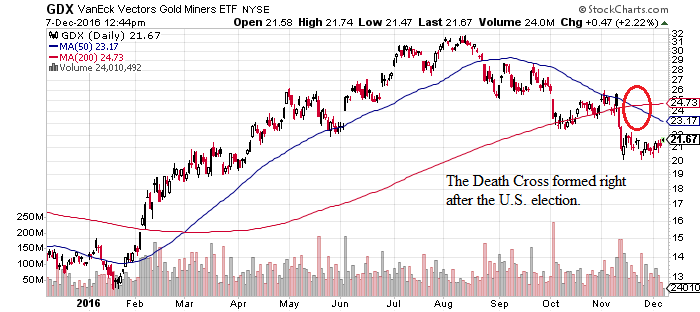

Precious metal prices have become so bearish that gold mining ETF GDX formed a death cross shortly after the U.S. election.

Chart courtesy of StockCharts.com

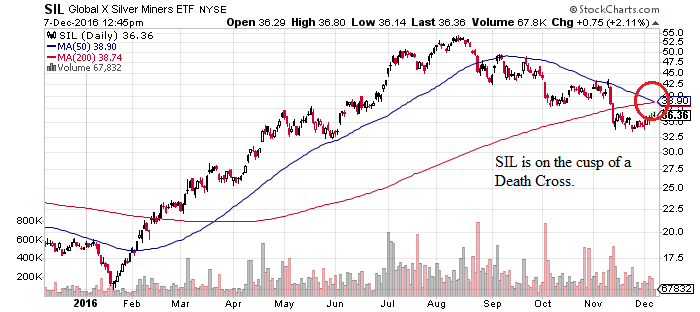

Meanwhile, SIL is on the cusp of a death cross.

Chart courtesy of StockCharts.com

A death cross is a bearish technical indicator that occurs when the 50-day (short-term) moving average of a stock or index crosses below the 100-day or 200-day (long-term) moving average.

Prior to the formation of a death cross, the long-term moving average acts like a support for the short-term moving average. Once the death cross has occurred, the long-term moving average becomes a resistance level.

A death cross is more ominous if it’s accompanied by high trading volume, which we are not seeing at the moment. Investors may be bullish on stocks after Donald Trump won the election, but they’re not entirely convinced that the U.S. and global economies are in the clear.

In fact, there are more than enough reasons to suggest that the sell-off in silver and gold is overblown and that the recent dip in precious metal prices could actually be an interesting entry point.

Reasons Not to Fear the Death Cross

For starters, silver and gold and precious metal miners have been shunned by overly optimistic investors who think that a Donald Trump presidency will magically right the wrongs in the U.S. and around the world.

Optimism is great; blind optimism not so much. Since early November, the S&P 500 has climbed 6.5% to a new record high. The Dow Jones Industrial Average (DJIA) is up eight percent, and is in record territory. The NASDAQ, NYSE, and Russell 2000 small-cap indices are also all in record territory.

Moreover, stocks continue to be seriously overvalued. According to the Case Shiller cyclically adjusted P/E (CAPE) ratio, which currently stands at 27.36 times average earnings, stocks are overvalued by 71%. The ratio has only been higher three times—1929, 1999, and 2007—just ahead of the Great Depression, the dotcom bubble, and the Great Recession. (Source: “Online Data Robert Shiller,” Yale University, last accessed December 9, 2016.)

Just after the election, Fortune predicted that the S&P 500 would hit 2,217 by the end of 2017, just 3.5% higher than where it closed on election day. Well, that number has come and gone. In a nutshell, the major indices have risen more in a month than what they do in an entire year. And they are already higher than some 2017 forecasts. (Source: “Prediction: This is Where the S&P Will Finish in 2017,” Fortune, November 15, 2016.)

Investors may like the idea of Trump’s proposed tax cuts and stimulus spending, which would be good for corporate America, but it comes in the midst of moribund earnings growth and rising interest rates. The markets tanked last January when the Fed prematurely raised rates. The U.S. has a huge debt burden, and tax cuts could add to that economic strain and even mean the introduction of additional quantitative easing.

Global economic prospects are also a little grim, with gross domestic product (GDP) growth expected to stagnate in Europe, the U.K., Japan, Canada, and Australia. The New York-based Conference Board said recently that geopolitical tensions, policy uncertainty, volatility in the financial markets, and technological advances will underpin global economic growth in 2017. (Source: “Global Economic Outlook 2017,” The Conference Board, last accessed December 7, 2016.)

Global GDP is now predicted to grow 2.8% in 2017, a slight increase over the 2.5% this year. That is in sharp contrast with rates above four percent in the mid-2000s, and the average 3.6% growth from 2010-2015.

Thanks to economic and geopolitical tensions and uncertainty, there continues to be strong demand from investors for physical gold and silver. Demand also remains strong from the jewelry, solar, and auto industries.

A death cross for silver and gold mining ETFs is not a death knell. With uncertainty all around, the fall in precious metals and silver and gold mining ETFs means it’s a great time to be bullish.