Respected Macroeconomic Researcher Believes It’s Time to De-Risk…Yesterday

The time to de-risk may be right now. This, according to Head of Macroeconomic Research at Wermuth Asset Management GmbH, Dieter Wermuth. That means shifting into assets such as cash and gold. This will help save your portfolio when the inevitable happens.

Wermuth’s research is based on the likely reactions of central banks going forward. He believes the monetary spigots will invariably shut down, sapping the stock market of its rocket fuel. “This reminds me of the goldilocks environments of the Greenspan and Bernanke years. At the time, the central bankers hesitated to take away the punch bowl… it could not last.” (Source: “Another stock market crash ‘gets likelier by the day’,” Trustnet, September 7, 2017.)

Wermuth doesn’t trust the central bank model that inflation will rise to reflect a tighter labor market. Technological forces and globalization of goods remain too much of a counter-balance. This will be reflected in 10-year bond yields over time, when they fall (and not rise) in defiance of popular logic.

Also Read: Stock Market Crash 2017? This Could Trigger a Stock Market Collapse

In particular, Wermuth views U.S. stocks as particular overvalued, going so far as to say, “Some stock markets, especially in America, are overextended and should be avoided.” (Source: Ibid.)

It’s hard to argue with that assessment.

On almost any measure, U.S. stocks remain overvalued. Whether looked at from the standpoint of price-to-sales, debt-to-equity, or good old-fashioned price-to-earnings metrics, American stocks are among the priciest in the world. If earnings growth has continued to press forward quarter after quarter, then fine, the moves could be justified. But that’s not what’s happening.

Earnings growth has barely risen since 2013. The rise in U.S. stocks is almost exclusively valuation-driven. Central banks continue accommodative policies—such as purchasing equities directly—so there’s little doubt the market will continue being supported.

But it’s times when investors believe the central bank has their backs that a crisis can happen. That’s when indiscriminate “piling-in” takes hold, where investors purchase stocks at whatever prices.

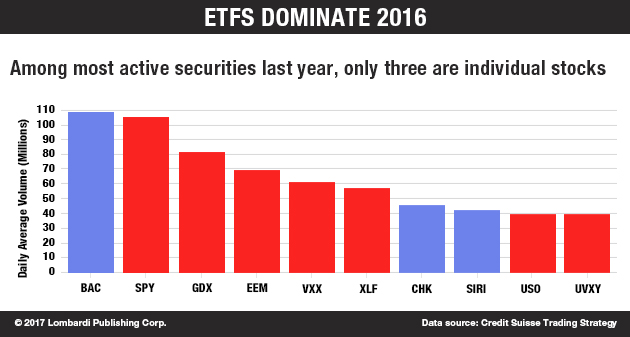

As we’ve talked about extensively, this is mainly occurring through passive index purchasing. Investors are being herded into overexposure in a few dozen big names, as industry giants received an outsized share of ETF allocation. When an investor purchases a Tech ETF, this triggers forced buying in the Apples and Googles of the world. As more money is funneled in, these companies get even bigger. Some might say, too big.

In the end, few argue that central banks will try and prop up world’s stock markets. But historically, they’ve haven’t been able to do this forever. When things look “can’t miss,” it’s time to head for the exits. We may be there right now.