As it stands, there’s only one major central bank that’s trying to raise interest rates: the U.S. Federal Reserve. Across the globe, the majority of central banks are keeping rates low, while others are still practicing the art of paper money printing.

ECB Keeping Interest Rates Low

In a recent press release, the European Central Bank (ECB) said, “The Governing Council expects the key ECB interest rates to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases.” (Source: “Monetary policy decisions,” European Central Bank, June 8, 2017.)

In other words, the ECB threw out any chance of an interest rate hike. Mind you, the ECB is currently implementing a negative interest rate policy (NIRP) while still printing 60 billion new euros a month.

ECB Policies & the Value of the Euro

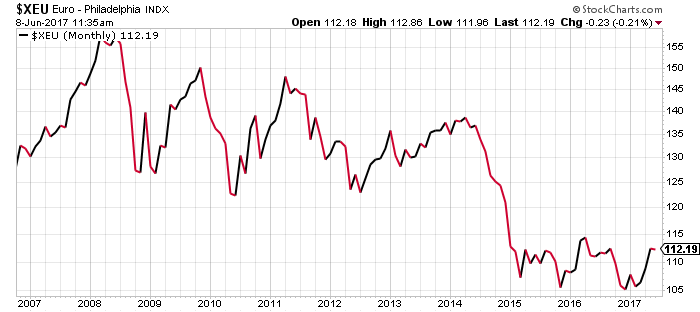

All those years of low interest rates and money printing are having the expected negative impact on the euro. This is visible in the chart below of the euro index, which shows the value of the euro compared to major global currencies.

Chart courtesy of StockCharts.com

As the ECB tried to bring growth to the common currency region by lowering interest rates and printing money, the value of the euro has deteriorated. I believe that the euro will fall a lot further in value against other world currencies.

Bank of Japan in on the Low Interest Rate/Money Printing Action

The ECB isn’t the only central bank doing this; we are seeing this phenomenon around the globe. For example, the Bank of Japan has implemented a policy of negative interest rates and money printing, too.

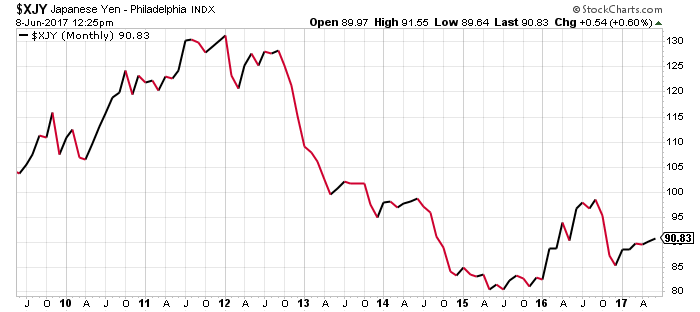

Look at the chart of the Japanese yen index below. It appears that the yen is in a free fall. It stabilized slightly in 2016, but, after that, we see it resuming its downward trend.

Chart courtesy of StockCharts.com

Central Bank Currency War Good for Gold!

Dear reader; don’t for a second think that central banks are going to stop their reckless behavior anytime soon. It’s a currency war. Central banks are under the impression that keeping interest rates low and printing money bring prosperity and economic growth to their countries.

But the reality is that they are failing to revive their economies, and their currencies have plummeted in value.

There’s going to be one currency winner over the long haul: gold. The yellow metal is disliked by the market right now for all the wrong reasons. But, with all this money printing continuing, it’s not a matter of if gold prices will hit $2,000 an ounce, but when.