We Examine Whether the Fed Triggers a Stock Market Crash in September

It’s that time of the month again. The brain trust known as the Federal Open Market Committee (FOMC) will meet to decide the fate of monetary policy in America. Most of the time, the meetings are fairly benign in terms of expectations. This time, though, there’s a twist keeping the economic intelligentsia off-balance and possible consequences that could portend a (mini) stock market crash.

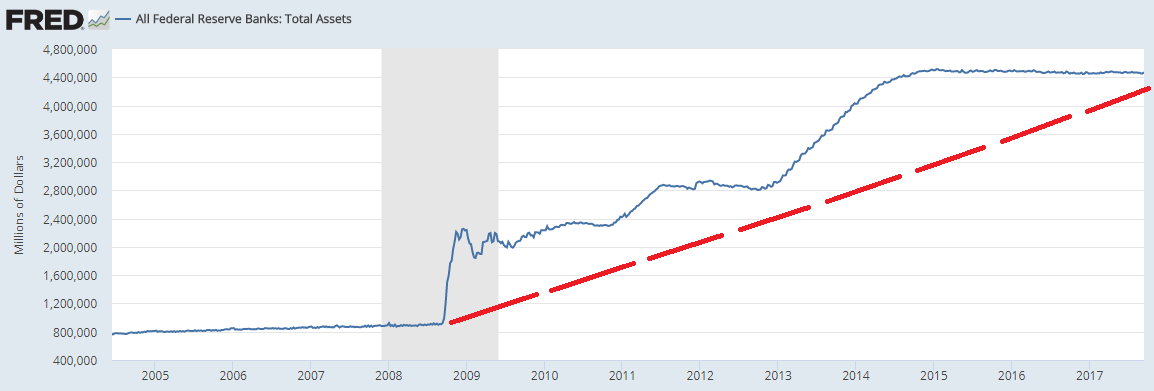

That something is the expected announcement of an October start to the Fed’s balance sheet normalization plan. That’s just a fancy way of saying that the Fed will start pulling liquidity out of the market, rather than adding to it.

Also Read: Warren Buffett Indicator Predicts Stock Market Crash in 2017

Why does that matter? If you’ve been a loyal Lombardi Letter reader, you already know.

But to recap, around 80% of the stock market move after the Great Recession earnings normalization is due to excess liquidity sloshing around the system. That is, quantitative easing (QE) has allowed central banks (not just in the U.S.) to purchase government securities from primary dealers in order to lower interest rates and increase the money supply.

Who are these “primary dealers”? Only the who’s who of investment banks. They include Goldman Sachs Group Inc (NYSE:GS), JPMorgan Chase & Co. (NYSE:JPM), and Deutsche Bank AG (NYSE:DB), among others. The economic elite, if you will.

These primary dealers—the ones who sell securities to the Fed—then take the money received from the sales and plow it back into the stock markets. That’s why the markets have been moving relentlessly higher, despite the lack of earnings growth and nosebleed valuations.

The rising liquidity tide trumps good old-fashioned valuation metrics and “cash on the sidelines.”

More than that, central banks actually are huge net direct purchasers of stocks.

According to Bank of America Corp (NYSE:BAC), world central banks now own $15.6 trillion of them (and $2.0 trillion year-to-date). Combine these purchases with record net inflows in several exchange-traded index funds—and non-existent multi-day sustained selling—and voila, a multiyear market melt-up is born.

However, as the great Bob Dylan once sang, “oh the times, they are a-changin’.” It isn’t a cultural revolution I’m talking about here, it’s an economic one.

Will the FOMC Meeting Trigger Another Market Correction?

What makes the FOMC meeting in September 2017 so interesting is really the precise timing of quantitative tightening (QT). The Fed has never attempted to drain its balance sheet anywhere near what it’s proposing. The market fears that removing liquidity will have the reverse effect that QE did. And we all know how effective that was at boosting risk asset prices.

Now, the Fed’s balance sheet normalization plan is expected to be modest in the beginning. Perhaps $10.0 billion/month or so to avoid spooking the market. But it could go up to $50.0 billion by the end of 2018. The effects of QT-light may not be felt right away. But felt, they will be.

(Source: “All Federal Reserve Banks: Total Assets,” Board of Governors of the Federal Reserve System, retrieved from Federal Reserve Bank of St. Louis, last accessed September 19, 2017.)

Almost the entirety of the bull market has been directly central bank-driven. What happens when the fuel runs out? Do you think Joe Public is going to come to the rescue? How about savvy hedge fund managers with billions under management? Do you think it’s more likely they’ll stake larger positions after the stock market crash, or before?

We’re pretty confident we know the answer.

In any event, the main highlight will be that aforementioned QT schedule announcement on Wednesday. But it’s not the only event taking place at the meeting.

Will the FOMC Raise Interest Rates?

The Fed will give its usual cryptic guidance on interest rate expectations for the remainder of 2017. They’re not expected to raise rates on September 20. But market analysts agree the Fed would like to raise rates once more in 2017. The likeliest date that happens is in December.

So for those worried about a surprise interest rate hike causing a stock market crash, rest assured—it’s not happening. The Fed will likely issue a statement about Hurricane Harvey/Irma-induced softness in growth. An interest rate hike now would not help growth.

Current odds for a December rate hike stand at 55%. They will likely move 10-25 basis points based on what Fed chair Janet Yellen has to say. They’ve already been inching up in recent weeks. Future interest rate expectations are the main reason why FOMC days tend to be more volatile than average in the market.

With further balance sheet reduction details added into the mix, I expect Wednesday will be no different.

Bottom Line

Market watchers have September 20, 2017 pegged as an important FOMC meeting schedule in17. As noted, the added dimension (outside of the usual interest rate guidance) will be further details on the Fed’s balance sheet normalization plan.

In my humble opinion, unless something unusual is disclosed about the details of the plan (i.e. a larger monthly balance sheet reductions than forecast), our stock market crash predictions are low. All the primary dealers communicate with the Fed on a regular basis, so surprises are rare. Especially since the Fed bends over backwards to avoid market shocks.

However, the real story will be the QT schedule. The resulting liquidity crunch won’t happen right away. Draining $10.0 billion/month (initially) when the S&P 500 alone is worth $20.0 trillion won’t cause it to crash.

But as the months roll on, and as QT ramps up higher, the effects will be cumulative. We all know where the market would be trading if the central banks stopped priming the pump. Stocks would trade much closer to intrinsic value.

That would be, by my estimate, perhaps 30%-40% lower. Other market tacticians, like John Hussman, argue that the figure is closer to 63%.

Regardless, central bank intervention is a part of today’s reality. It will be interesting to see how great the effects QT will have on the market will be. It’s never been done on this scale before. But there’s no doubt in my mind the effects will be resoundingly negative. It will just take a few months to manifest itself.