Stock Market Collapse Usually Occurs After Exhaustive Buying At The Top

Stock markets are no different than other markets when it comes to conforming to the laws of supply and demand. When frenzies occur, panic buying at the top is the telltale sign that buying interest has peaked. We may have recently seen this phenomenon play out with broad-based equity exchange-traded fund (ETF) buying. If so, combined with an economy that also looks to have peaked, a stock market collapse looks increasingly possible. Now, on to the evidence.

Global ETF assets totaled a record $3.913 trillion at the end of the first quarter of 2017. In March 2017 alone, over $66.0 billion poured into ETFs—a new monthly record. It was the 38th straight month of net inflows, and it nearly matched the total amount of inflows generated in the entire first quarter of 2016. Aggregate Q1 2017 inflows of $192.3 billion smashed new records as well, and it wasn’t even close. (Source: “ETF rides March inflows to fresh record level of assets,” MarketWatch, April 25, 2017).

Also Read:

Warren Buffett Indicator Predicts Stock Market Crash in 2017

Stock Market Crash 2017? This Could Trigger a Stock Market Collapse

Again, this insatiable appetite for ETFs is occurring right at peak equity valuations and right near the top of the business cycle. For just those two reasons alone, it’s hard to believe that this can end well.

There’s also mounting evidence that the Federal Reserve will keep raising interest rates to arrest wealth inequality and attempt to reign in asset bubbles caused by low interest rates. Why else would they be tightening monetary policy when growth is barely stall-speed and inflation is actually below target? It doesn’t really make sense, unless you view it from the perspective that the Fed is trying to give itself leeway to cut rates later to stimulate demand from an impending recession. The problem is, if the Fed keeps hiking, they will trigger a recession. The ultimate catch-22.

Recession and nosebleed valuations make terrible bedfellows.

Are Surging Exchange-Traded Funds Sewing the Seeds of the Next Market Crash?

Excessive purchasing of U.S. stock market assets, be it ETFs or individual stocks, makes the market vulnerable to instability. Some investors question whether ETFs could cause a market collapse because they’re diversified, but that’s misplaced confidence. It may have been true before, but not anymore.

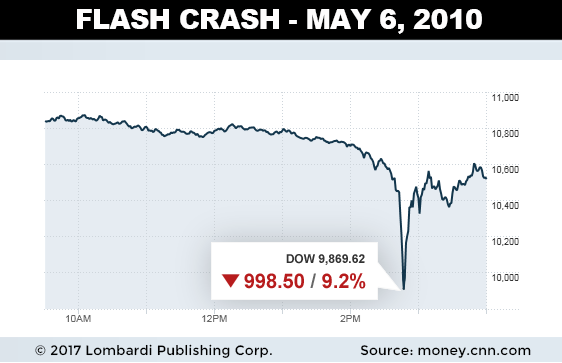

In an era when algorithmic program trading consists of two-thirds of all market activity, believing your portfolio is safe because it is “diversified” is dangerous thinking. When volatility and other parameters spike high enough, the bid can, and will, go dark. Perceived buy-side liquidity can vanish in an instant. We’ve seen this several times, in which flash crashes have shaved multiple percentage points off asset values in minutes. Just imagine when the real selling starts taking place. Buy-side program trading could go dark for hours; whole sessions could go basically bidless.

Clarity Financial’s chief portfolio strategist, Lance Roberts, worries about this too. He believes that investors should pay close attention to the fact that they are being “herded” into passively managed ETFs. The danger? A dislocation is occurring with individual stock values due to forced buying of ETF leaders in much greater volumes than otherwise warranted. It’s so serious that Roberts characterizes the market as “like a tanker of gasoline.” (Source: “Lance Roberts: This Market Is Like A Tanker Of Gasoline,” PeakProsperity, May 30, 2017.)

I hypothesize that the passive investing craze, which is manifested through record ETF purchases, is the primary cause for the record-low volatility we’ve seen in recent years. Low volatility has led to this market melt-up. Record ETF inflows and drip stock purchases through things like share buyback programs can keep the market marching upwards as long as selling pressure is subdued. Selling volatility and buying equities is one of the most crowded trades on Wall Street, but when large, sustained volumes show up again, watch out.

The same dynamics of record ETF inflows that caused record-low volatility can swing around quickly. Higher volatility means higher volume, which is extremely bearish for the market. When inflows change course to become record outflows, the dynamics of forced selling come into play. The market would then be forced to sell ETF leaders in much greater volumes than otherwise warranted, leading to a stock market collapse. The market is so tightly correlated that selling in one asset class could cause a cascade effect in other classes. ETF dumping would be the tip of the spear.

If your portfolio is not positioned for such change, yesterday would be a good time to start thinking about it.