Cost of Government Shutdown Risks More Than Most People Realize

Political gridlock could be coming to Washington D.C. Next month, a couple of agenda items will require serious and immediate attention: the debt ceiling problem and the 2018 budget negotiations. How this administration fares will be front and center on American minds. Should they fail, the cost of a government shutdown could be huge.

Debt ceiling crisis negotiations will be the most pressing issue in the fall legislative session. There are only 12 business days after the end of summer recess to strike a deal. If the administration fails, the government could shut down and Uncle Sam will be forced to prioritize its bill payments. As the federal government has thousands of outbound payment streams, this task won’t be easy. Errors in payment deliveries (time and/or amount) could spook the market and lead to a sovereign debt downgrade. This is one cost of a government shutdown.

Fitch Ratings Inc. is already warning of such a scenario. It stated that a failure to raise the U.S. debt ceiling “in a timely manner” would cause a U.S. sovereign rating review. What constitutes “timely manner” isn’t exactly clear, but it leaves the impression that Fitch could downgrade America’s Triple-A rating even before the September 30 deadline. This would be a disaster on many fronts, which Lombardi Letter has repeatedly documented in the past. (Source: “Failure to raise debt limit may put US rating under review: Fitch,” Financial Times, August 23, 2017.)

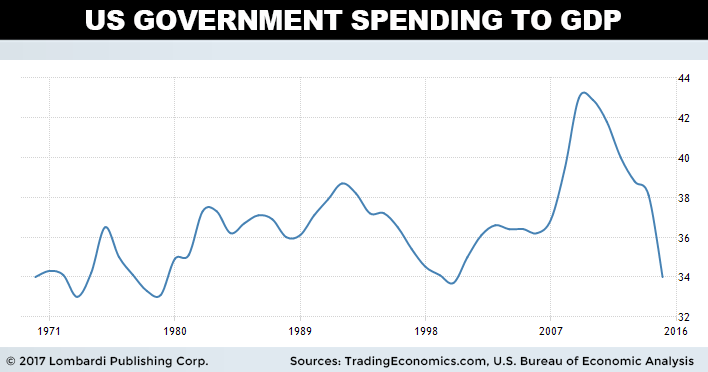

Another cost of a government shutdown is that it could lead the United States straight into recession. It’s common knowledge that the U.S. consumer accounts for about two-thirds of gross domestic product (GDP). But the U.S. government is responsible for the other third (34%). Should a prolonged shutdown take place, GDP is bound to take a meaningful hit. It won’t be enough to tilt the economy into recession on its own, but it could build momentum towards hastening a business cycle decline. Momentum has a funny way of building from something not expected.

How Much Will the Shutdown Cost the Economy?

The impacts and costs of the government shutdown are vast. Overall estimates are hard to predict, as some of the fallout is indirect. But we can all agree it won’t help the U.S. economy outlook for 2017. Fortunately, we can draw from the recent past to understand how the economy is impacted.

For example, the Bureau of Economic Analysis constructed an estimate of the direct impact of the 2013 government shutdown. It found the 16-day hiatus lopped about three-tenths of a percent off real GDP growth in Q4 2013. It also postponed the creation of an estimated 120,000 new jobs. Everything from Alaskan fisheries to State parks shut down, and tens of thousands of government employees didn’t get paid on time. (Source: “Another government shutdown? Here’s the cost,” CNBC, September 21, 2017.)

While the total impact seems minute in comparison to the size of the U.S. economy, a shutdown produces outsized effects. It creates delays in things like mortgage application approvals and defense contract awarding, which has negative downstream effects on the economy. At least those industries fully recover once the government reopens. Other industries, like the National Park Service, lost millions in fees that are non-recoverable. Businesses which rely on this tourism lost even more—over $500.0 million according to estimates.

Of course, if a major Credit Rating Agency (CRA) downgrades America’s credit rating, this will impact the consumer directly. It could weaken the U.S. dollar and spike bond yields, making debt servicing more expensive. I emphasize “could” because the opposite actually happened when S&P Global Ratings downgraded the U.S. credit rating to Double-A+ in August 2011 (the dollar rallied and bond yields fell). But those were different times. America has added several trillions in debt, has more political instability, and weaker economic dynamics today.

Will Trump shut down the government in September? It’s not entirely clear. But the ingredients for an extended shutdown are present. It’s not just that a government shutdown would grant Trump’s enemies ammunition to argue for his impeachment, it’s the unpredictability of Trump’s spending demand and experience with debt financing that make this proposition iffy. One can envision both sides playing chicken, except that no one moves out of the way.

It’s a collision the American people would rather avoid.