Top Investor Bank Warns Investors Could Get Blindsided By Market Correction

At least one top investment bank thinks investors are far too complacent. Societe Generale SA (EPA: GLE)—referred to as SocGen—is sounding the alarm on investor overoptimism. Fertile ground for a possible stock market correction.

In an investor note, SocGen warns investors are too relaxed about the Fed’s tightening path (interest rate policy). Risk sentiment is extremely subdued among investors, who continue to rush into the market in record numbers. (Source: “Overly complacent investors may soon be in for a rude Fed wake-up call,” MarketWatch, September 22, 2017.)

SocGen also dishes out its fair share of blame to the Federal Reserve for creating this mess, especially Fed Chairperson Janet Yellen, who has bent over backward to downplay any risks in the marketplace. The “I don’t believe we’ll see another crisis in our lifetime” comment made by Yellen in June 2017 springs to mind.

This isn’t just a case of another investment bank talking its book. SocGen has pared down its risk asset portfolio because of a trifecta of investor complacency, high valuations, and Fed/ECB “synchronized” tightening.

Speaking of the latter, it’s amazing how little attention investors are paying to central bank tightening policy.

We’ve documented time and again on Lombardi Letter that most gains in stocks have come via valuation expansion. That, in turn, was caused by the Fed pumping insane amounts of liquidity into the markets, via its primary dealers. It also caused extreme suppression of interest rates, which means money practically must flow into the markets since no other asset provides a decent yield.

It’s easy to get fat when you’re the only game in town.

Expectations vs. Reality

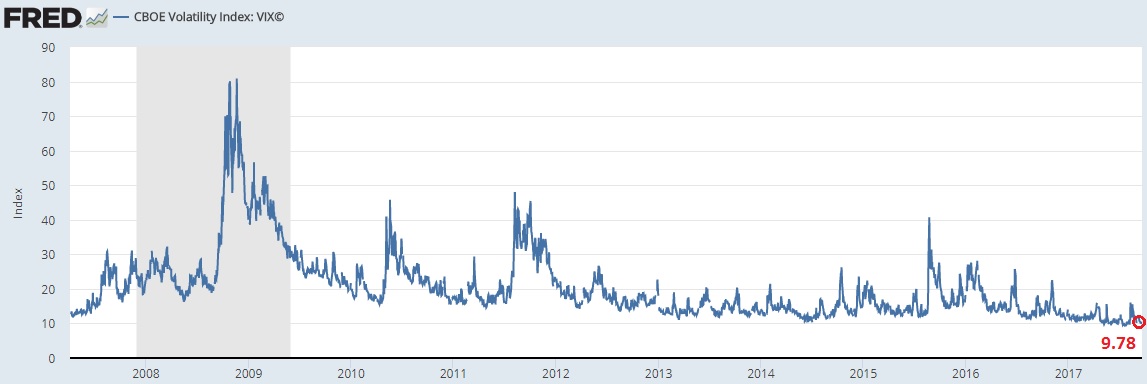

One of the main problems in the market right now is jilted investor expectations. Through the record low readings on the VIX (CBOE Volatility Index), we know investors are simply yawning away any and all risk factors. This includes the Fed liquidity “put,” backstopping the stock market from any significant fall. But will this continue?

(Source: “CBOE Volatility Index: VIX© (VIXCLS),” Federal Reserve Bank of St. Louis, last accessed September 25, 2017.)

If you believe what the Fed is saying, then it shouldn’t. The Fed balance sheet normalization plan announced at the September 20 FOMC meeting makes that abundantly clear. By the spring of 2018, the Fed will sell or decline to reinvest Treasury securities, effectively trimming its balance sheet. In layman’s terms, the Fed will shrink its balance sheet, thus acting to pull liquidity out of the marketplace.

One would think investors would get the message that the Fed no longer has their back. At least, not until the next crisis. But there’s little evidence investors are heeding the message. Market correction fears are non-existent.

For example, the third week in September saw the second-largest week of tech inflows…ever! It was a week that saw $2.7 billion flow into equities on aggregate ($1.0 billion into tech), offset by $18.0 million outflows from gold. (Source: “Second Largest Week Of Tech Inflows Ever,” Zero Hedge, September 22, 2017.)

The moral of the story? Despite the well-telegraphed and announced intentions of the Fed to trim its balance sheet, investors still show no fear. It’s like they actually believe the liquidity crunch won’t have any consequences.

Whatever your opinion on market direction, it’s hard to believe monetary tightening will have no effect on prices. Monetary easing is what pushed prices sky-high to begin with. Pulling liquidity will raise the odds of market correction.

If you believe the Fed’s characterization that monetary tightening will be “like watching paint dry,” we have a bridge to Brooklyn we’d like to sell you.