Anyway you look at it, silver prices are cheap. And the best part is, no one is talking about it. This makes silver especially attractive for patient investors who practice the old investing adage “buy low, sell high.”

Silver…What’s the Big Deal?

Why am I so excited about silver?

Last year, for the first time in 14 years, silver production declined from the year before. And there is a deficit in the supply/demand equation for silver. The total supply of silver in 2016 was 1.007 billion ounces. Total demand was 1.027 billion ounces. This means there was a deficit of 20 million ounces in 2016.

Demand for Silver Keeps Rising

Where’s the demand coming from?

Silver is increasingly being used in consumer electronics. In 2016, 233.6 million ounces of silver were used for electronics; that’s almost 23% of the silver supply for the whole year. (Source: “Global Silver Mine Production Drops in 2016 for First Time in 14 Years,” The Silver Institute, May 11, 2017.)

Silver is also used in the healthcare industry to coat medical devices, textiles, and wound dressings; about three-to-10 million ounces of silver is used in this industry per year. With the aging demographics of the United States, the healthcare industry will only get bigger as the years pass. (Source: “Silver in medicine – past, present and future,” The Silver Institute, last accessed June 15, 2017.)

Bases Loaded for a Home Run in Silver Prices?

Dear reader; if there’s one thing I have learned over years of investing, it’s that, when investors ignore the fundamentals, they often end up missing out on big gains. With silver today, we see severe pessimism toward the metal, while the fundamentals say that demand will push silver prices up.

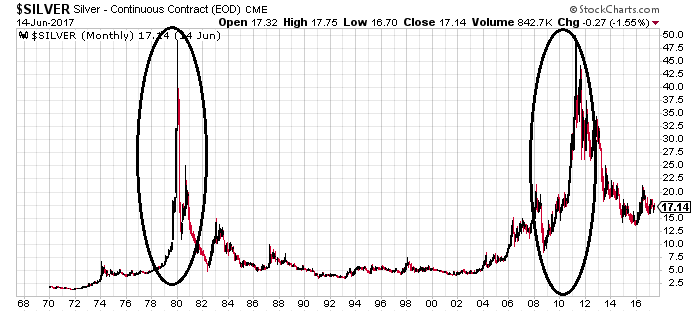

I now present the below long-term chart of silver prices. Pay attention to the circled areas.

Chart Courtesy of StockCharts.com

Notice something?

Silver prices have tended to escalate in a very short period, with the majority of the gains in the past 40 years usually taking place in periods of two to three years.

I’m predicting a massive jump in silver prices in the next few years, since all the bases are loaded for a run-up in silver prices.