Technical Analysis Suggests Downside Ahead For CAD to USD

The CAD to USD exchange rate is well off of its lows made in late 2015, but don’t get too excited about it yet. The Canadian dollar could plunge to as low as 0.62, which are the lows made in 2002.

There are several reasons to have bearish bias toward the CAD to USD exchange rate. What we see now could just be a dead-cat bounce.

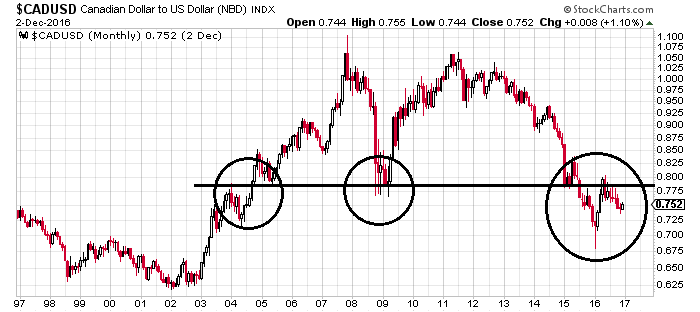

First thing investors need to know: technical analysis suggests there could be more downside ahead. Please look at the long-term chart of CAD/USD below, and pay close attention to the lines and circles drawn on the chart.

Chart courtesy of StockCharts.com

There are few things to watch on the chart above.

In technical analysis, there’s one rule that technical analysts usually agree on: when support breaks, it becomes resistance, and when resistance breaks, it becomes support. With this said, the CAD to USD exchange rate broke below a support level (circled areas) that was held three times since 2004: around 0.78.

What’s interesting to note here is that after CAD/USD broke below the support level, it retested and failed to break higher. This, in technical analysis terms, is called “confirmation,” a chart pattern that confirms that the support level is really broken.

Also, understand that the long-term trend on the CAD to USD exchange rate is pointing downward. Looking at this, keep in mind that the most basic rule of technical analysis: trend is your friend until it’s broken.

Keeping in mind a broken support level and a preceding downtrend, from a technical analysis point of view, it wouldn’t be shocking to see the Canadian dollar fall to 0.62 against the U.S. dollar.

But the price action on CAD to USD isn’t the only thing that tells us that worse could be ahead for the Canadian dollar.

Investors need to pay attention to the Bank of Canada as well. With its rhetoric, it appears that the central bank wants to lower the currency even further.

For instance, look at what Stephen Poloz, the governor of Bank of Canada, said not too long ago.

“Given the downgrade to our outlook, (the) governing council actively discussed the possibility of adding more monetary stimulus at this time, in order to speed up the return of the economy to full capacity.” He added: “However, we identified a number of significant uncertainties in the current context that are serving to widen the zone of balance within our risk-management framework.” (Source: “Bank of Canada was close to cutting interest rate Wednesday, Stephen Poloz reveals,” Financial Post, October 19, 2016.)

At its very core, the statement by Stephen Poloz suggests that there is talk about adding stimulus to the economy, but not yet. Adding more stimulus means lowering interest rates or printing money. This is going to be bad for the Canadian dollar.

CAD to USD Outlook for 2017: Grim Outlook Ahead

With all this in mind, it’s very hard to have any bullish bias on the CAD to USD currency pair. The outlook for the Canadian dollar is bleak at the very best. The technical analysis and the fundamentals are not with it. The Canadian dollar falling to 0.62 looks to be a likely scenario than hitting parity with the U.S. dollar.

Look out below on CAD to USD.