The Recent Sell-Off Says a Stock Market Crash Could Be Ahead

With the recent sell-off in the stock market, investors are asking, what’s next? Is the price action foretelling a stock market crash ahead or is it time to “buy the dip?”

Mark my words: a broad market sell-off could be brewing. Stock investors, beware.

There are several things investors need to watch for.

Short-Term Trend Breaks; Could a Stock Market Crash Follow?

One of the biggest things to watch is stock market trends. Talk to any technical analyst and they will tell you that the trend is your friend until it’s broken.

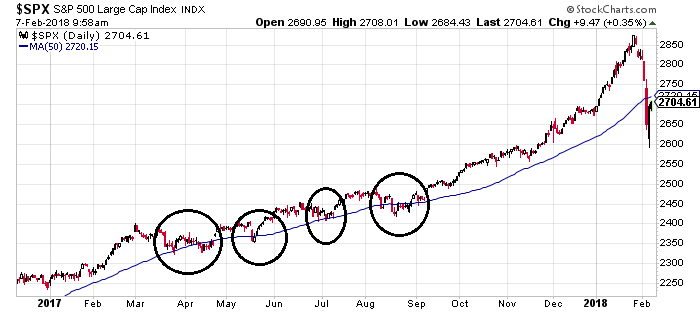

With this said, please look at the chart below of the S&P 500 and pay close attention to the blue line and circles drawn on the chart. The blue line represents the 50-day moving average of the index.

Chart courtesy of StockCharts.com

Notice something interesting?

Before going into any details, know that the 50-day moving average is regarded as an intermediate-term trend indicator. If an asset is trading above the average, it means the trend is pointing upwards. If this average is below the price, it means the trend is pointing downwards.

In the recent sell-off, we witnessed the S&P 500 break below its 50-day moving average for the first time in a year. At its core, this is telling us that the trend is broken. So there could be a sort of stock market crash scenario in the works.

Fear Index Suggests Investors Are Fearful

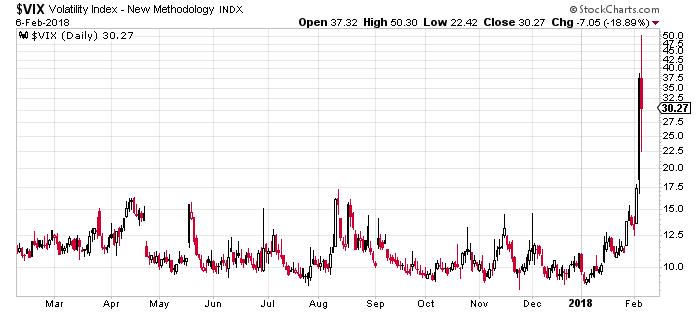

Investors should also pay attention to the Chicago Board Options Exchange Volatility Index (VIX), often called the “Fear Index.” This index is suggesting that a major stock market crash could be ahead.

Please look at the chart below:

Chart courtesy of StockCharts.com

In the beginning of 2018, the fear index traded as low as around 9.0. It now trades at above 30.0 and went as high as 50.00in the midst of the recent sell-off on the key stock indices.

That means the VIX has increased by 233% in a matter of weeks. The index is trading at its highest level since 2015. Don’t ignore this whatsoever. The VIX is saying that investors are fearful.

Where’s the Stock Market Headed Next?

Dear reader, if you listen to the mainstream stock pickers, they will have you convinced that the recent sell-off was not a buying opportunity. They may be right in the short term; markets could easily move to the upside, given what’s happening in assets like bonds.

But I can’t stress this enough: don’t get too complacent.

The fundamentals, such as stock valuations, remain very high relative to the historical averages. If stock market indices continue to soar and investors ignore everything, the next stock market crash could be immense and wipe out a lot of wealth.

I believe the recent sell-off we saw was just a taste of what’s to come. Investors panicked and ran for the exit. In this panic, we saw indices like the Dow Jones Industrial Average drop by 1,500 points intraday—a downward move that was one of the biggest in the history of the index. Mind you, this move happened on (relatively) not-bad economic data.

Now imagine how markets will react if we start to see data suggesting the U.S. economy is in a recession. You could expect the panic to be more severe, and we could have a stock market crash at hand very quickly.

I believe capital preservation is the key here.