Bond Market Could Be Setting Up to Collapse

It can’t be stressed enough: the bond market could be setting up for a collapse. We may be nearing a very critical inflection point.

Mark my words: if there’s a collapse, there could be a significant amount of wealth destruction, and it could have severe impacts across the board. The U.S. economy, the U.S. government, corporate America, and the American consumer could all get in trouble.

You see, after the 2008 financial crisis, the Federal Reserve played with fire by lowering interest rates—and by buying bonds outright with printed money. This created demand for bonds, so their prices increased and their yields dropped.

Economics 101: When interest rates go lower, bond prices go higher and yields drop.

Bond Prices Crumbling, Yields Shooting Higher

Now that economic data is looking better and inflation is threatening the purchasing power of Americans, the Federal Reserve is raising rates and selling the bonds it has bought over the years.

What do you think is happening in the bond market? The complete opposite of what happened after the 2008 financial crisis. The bond market is facing a lot of scrutiny. Bond prices are now going lower and yields are dropping.

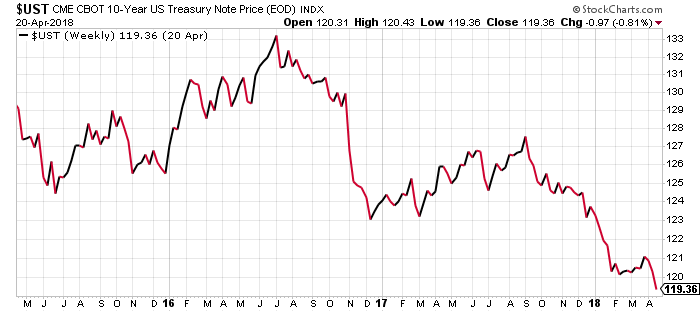

Look at the chart below; it shows the price of the 10-Year U.S. Treasury Note.

Chart courtesy of StockCharts.com

Since mid-2016, 10-Year U.S. Treasury Note prices have declined over 10%.

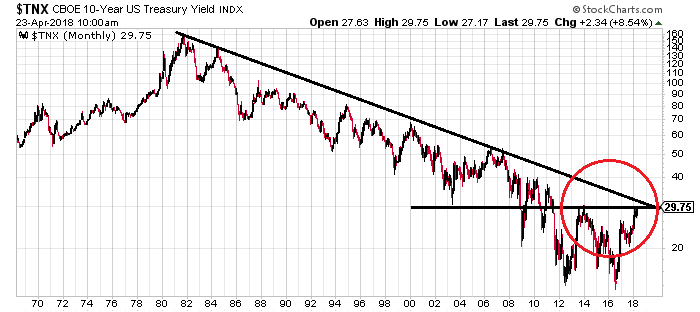

Remember, it’s always important to pay attention to the big picture. With this said, look at another chart below and pay close attention to the lines drawn and the circled area. It plots the yields on the 10-Year U.S. Treasury Note.

Chart courtesy of StockCharts.com

Since 1980, yields on 10-Year U.S. Treasury Notes were declining. Now we are at a critical level (the red circle). If the yields move above 3.5% (they are awfully close to that level), it would mean that the long-term downtrend in the bond market is broken.

So, the 3.5% level is critical to watch. If it breaks, we could potentially see much more selling in the bond market and yields surging immensely. If you hold bonds, they could significantly decline in value.

Why Does the Bond Market Matter?

Understand this: The bond market, at times, is more important than the stock market.

If someone is enrolled in a pension plan, chances are they could be impacted by the bond market. Pension funds tend to hold a lot of bonds. So, if bonds collapse, a lot of pension funds could get in trouble. A collapse in the bond market could put the retirements of many Americans on the line.

The U.S. government would be impacted, too. All of a sudden, the government could be forced to borrow at much higher interest rates. This would increase the government’s interest expenses and could send the national debt much higher.

Business could also pay a lot more to borrow.

American consumers would get hurt by a bond market collapse as well. For instance, mortgage rates are highly dependent on how the bond market behaves. If bond yields surge, so do mortgage rates. Need proof? While yields on bonds have been skyrocketing, the U.S. 30-year fixed-rate mortgages tracked by the Federal Home Loan Mortgage Corporation (Freddie Mac), have soared to four-year highs. (Source: “U.S. 30-year mortgage rates hit 4-year high – Freddie Mac,” Reuters, April 19, 2018.)

Dear reader, ignoring the bond market could be a big mistake. It spells trouble ahead.