Extreme ETF Concentration May Be the Next Cause of Stock Market Collapse

As the bull run in stocks becomes aged, investors are wondering what the trigger for inevitable decline will be. After all, history proves that a sizeable stock market collapse occurs after such large run-ups 100% of the time. It’s part and parcel of how markets self-adjust themselves.

In 2000, it was the Internet bubble collapse. In 2008, crashing housing derivatives and rising adjustable interest rates knocked out consumer spending. In 2017 and beyond, the trigger is still an open question.

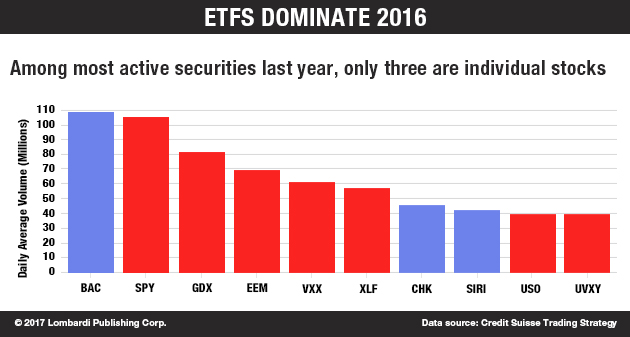

But according to Deutsche Bank AG (NYSE: DB) strategist Jim Reid, a liquidity crisis sparked by exchange-traded fund (ETF) over-concentration could be the next catalyst.

In a nutshell, Reid believes declining market liquidity caused by too much ETF ownership could cause the next stock market collapse. He reasons that with investors all herded into one side of the boat, there won’t be anyone to cushion the fall when investors decide to get out en masse. “(A lack of) Financial Market Liquidity…and changing market structure,” Reid explains. (Source: “Keep an eye on the $4 trillion ETF industry — it could start the next financial crisis,” Business Insider, September 22, 2017.)

Also Read: Stock Market Crash 2017? This Could Trigger a Stock Market Collapse

We at Lombardi Letter echo the sentiment.

For one, the performance resilience of extreme ETF concentration has never been proven under “crash” conditions. With $4.0-trillion in Assets Under Management (AUM) currently—up from $800.0-billion in 2008 (a fivefold increase)—we simply don’t know how ETFs will react once the red button gets pushed by millions of investors simultaneously. Will they crumble? Will they hold firm? It’s hard to model circumstances that have never occurred before.

There’s also the question of market structure. In the “old” days, exchange rules required market makers to support bid prices during market declines. This helped cushion extreme falls and had a “shock absorber” effect until rationality reentered the market.

In today’s world, no such regulations exist. They’ve mostly been stripped out by the high-frequency trading firms that lobby the exchanges. Some credible market data suggests that nearly 90% of all trading is algorithmic or program trading. Human traders are going the way of the dodo bird and bell bottom jeans.

So with vastly different markets structure in place, it’s unclear what happens when large and sustained selling takes place. After all, many (if not most) of these algorithmic trading programs run on volatility as opposed to directional trading. That is, if volatility is subdued, they keep buying the dips; if volatility increases over a certain threshold, they go “dark.”

This is precisely the reason why markets have been melting up for five years. Volatility has been grinding lower, allowing dip-buying momentum programs to keep purchasing stocks. On the sporadic occasions where volatility does spike, stocks get hammered in very significant fashion. The problem for the bears: high volatility hasn’t been sustained for more than a day or two, prompting the dip buyers to return. This leads to a continuation of the melt-up. Rinse and repeat.

By my question to the readers is this: What happens when volatility sustains itself for a week; two weeks; two months? Do investors believe stocks will keep engaging on the magic momentum ride? We don’t, especially when the data signals U.S. recession is here or imminent. Valuation bubbles and crashing earnings go together like oil and water.

In the end, Jim Reid’s thesis echoes our own. We believe that ETFs, far from being a diversified oasis like most investors believe, are actually traps where investors go to die. It doesn’t matter how “diversified” an investment product is; when too many people are herded on one side, the stomp to the exits will be crushing.