Global Economy Could Be Heading Toward Slowdown, Dire Consequences Look Likely

The global economy could be getting really sick. A global economic slowdown could become reality sooner rather than later. If this is the case, it could have severe consequences.

You see, to get a gauge on the world economy, it’s important to pay close attention to companies that operate globally.

Why? If multinational companies are struggling or even complaining about the problems ahead, it tells us that things in the global economy may not be as rosy as they seem.

With that said, look at Caterpillar Inc. (NYSE:CAT).

Caterpillar is hands down one of the bellwether companies for what’s ahead in the global economy. It has a massive global presence and it does business in industries that are highly correlated with global economic strength.

So, if Caterpillar is facing headwinds, you at least have to question whether the global economy is doing fine.

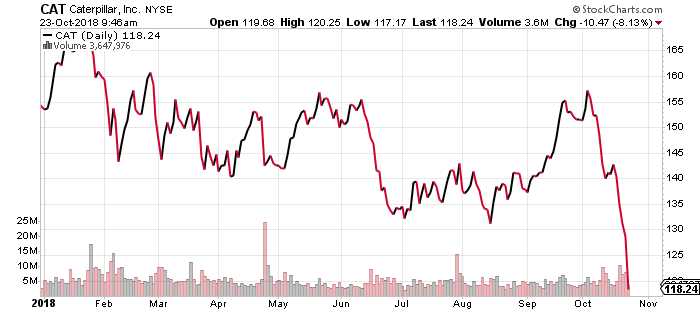

Now, look at the chart below of Caterpillar stock below. Year-to-date, the stock price has tumbled by more than 18%. If we assume that CAT stock just stops here and doesn’t drop any further, it would be the stock’s worst yearly performance since 2015.

Chart courtesy of StockCharts.com

Here’s something to keep in mind: if, on a yearly basis, CAT stock falls more than 20%, it means that a global economic slowdown could be brewing.

In 2015, Caterpillar stock dropped by more than 25%. At that time, global growth was stalling severely. In 2008, Caterpillar stock tumbled by close to 40%. A worldwide recession followed later.

In simple words, Caterpillar stock is saying that the global economy could be slowing down.

Another Company |Is Saying That Global Economic Health Should Be Checked

Don’t for a second think that Caterpillar is the only multinational company saying that global growth could be stalling.

Look at 3M Co (NYSE:MMM), another global player.

Year-to-date, the 3M stock price has tumbled by more than 14%. It currently trades at its lowest level since early 2017. It’s on track to report its worst performance since the 2008 financial crisis.

Chart courtesy of StockCharts.com

What Happens If the Global Economy Slows Down?

Dear reader, it’s important to watch what’s happening in the global economy.

I have said this before, but I will repeat it again: if the global economy sneezes, the U.S. economy gets the flu.

It has to be understood very clearly that the U.S. is not an isolated nation. It’s highly correlated with the world economy. This means that if global growth stalls, the U.S. economy can only diverge from that trend for so long. Eventually, the U.S. economy will slow down too.

I believe that the next slowdown in the U.S. economy might not be caused by internal factors, but rather by global growth slowing down.

I will end with some food for thought.

It will be interesting to see how the next global economic slowdown plays out. Don’t forget that central banks around the world don’t have many options to fight the next slowdown.

For example, the European Central Bank (ECB) is still keeping its interest rates low and printing money—something that should be done in times of economic scrutiny.

What will the ECB do if the eurozone suddenly starts to report dismal economic data?