Banking Rally and Record Insider Selling a Coincidence?

After languishing under a decade of near-zero lending rates, American banks have rebounded since the U.S. election. Despite soaring share prices, an exuberant Wall Street, and soaring investor sentiment, corporate insiders at America’s biggest banks are selling their shares at a record pace. With the broader indices all at record levels, do banking insiders know something most American investors don’t?

The biggest winners since Donald J. Trump won the U.S. election have been U.S. banking stocks. Between January 1 and November 7, shares in Bank of America Corp (NYSE:BAC) were up a princely 3.1%. Since the U.S. election, the bank’s share price has soared 37% to an eight-year high.

It’s been an equally impressive reversal of fortune for Citigroup Inc (NYSE:C). The bank’s share price was actually down roughly one percent in the first 10 months of 2016. Since Trump won the U.S. election, Citibank shares have jumped 21%.

After an abysmal first 10 months, shares in JPMorgan Chase & Co. (NYSE:JPM) have surged 26% since the U.S. election, while the price for Goldman Sachs Group Inc (NYSE:GS) shares has increased 35%.

After years of artificially low interest rates, which have cobbled corporate banking profits, investors have warmed to Trump’s business-friendly policies, which include lowering taxing, less regulation, and $1.0 trillion in infrastructure spending.

Should Trump’s economic action plan gain momentum and the U.S. economy improve, chances are good that the Fed will raise rates three times in 2017. Even if Trump’s economic expansion plans don’t totally work, rates will still rise to combat inflation.

With the S&P 500 in record territory, financials are the index’s best-performing sector. It’s win-win for American banks.

With so many bullish indicators, why are so many banking insiders, the so-called “smart money,” dumping their shares at a record pace?

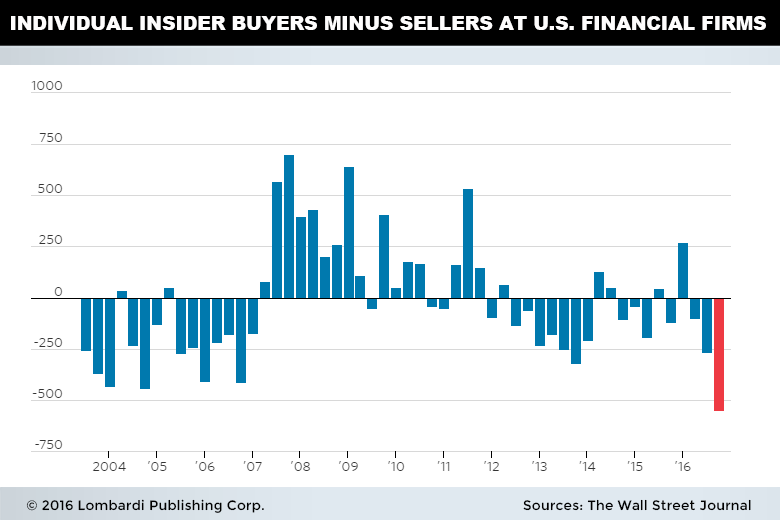

As if on cue, insiders at U.S.-listed banks, brokerages, and financial services companies are on pace to set records for the number of people dumping stocks and the dollar value of shares sold in the fourth quarter.

Bank Rally and Record Insider Selling a Coincidence?

There are two ways of looking at the record pace of insider selling. According to The Wall Street Journal, the rally in bank shares and record insider selling is a coincidence. And while it may look like a bearish signal, it isn’t. Not at all! (Source: “Insiders Send Wrong Signal on Bank Stocks,” The Wall Street Journal, December 8, 2016.)

Apparently, smart money insiders sell for many reasons that are beyond the comprehension of the average individual investor. Meaning they could be locking in profits or exercising options.

Either way, bankers, who generally like money, have decided that it’s better to take profits now than wait a little longer to make even more money. That’s because bankers live by the investing mantra, “sell today when you could make more tomorrow.”

Or record insider selling could indeed be a bearish signal that stocks have made too much of a run-up over the last six weeks and are overvalued. It could be a bearish signal that the U.S. economy is not doing as well as many think, and the smart money is running for the hills.

Fear not though, they’ll return when the markets crash. As you can see by the above chart, in the first quarter of 2016, when banking stocks were tanking, insiders were buying, and at the fastest pace in five years. Insiders were also purchasing when the bull market was in its infancy and selling as it gained steam.

It’s tough to predict the stock market, but banking insiders seem to be eerily well informed.