Auto Loans Market Could Be Worth Watching in 2018

In 2018, if there’s one phenomenon investors need to pay close attention to, it’s the auto loans market. It could create a lot of trouble this year. If you own automaker stocks, pay even more attention to this.

Currently, Wall Street is cheering about the fact that car sales in the U.S. economy are increasing.

Look at the chart below. It shows the annual rate of car sales in the U.S. In 2009, the annual rate dropped to around nine million. Now, it’s close to 18 million cars annually.

(Source: “Total Vehicle Sales,” Federal Reserve Bank of St. Louis, last accessed January 4, 2018.)

If the chart above is the only thing you are looking at, then everything looks great.

Sadly, there’s a lot going in the background that fails to get reported in the mainstream.

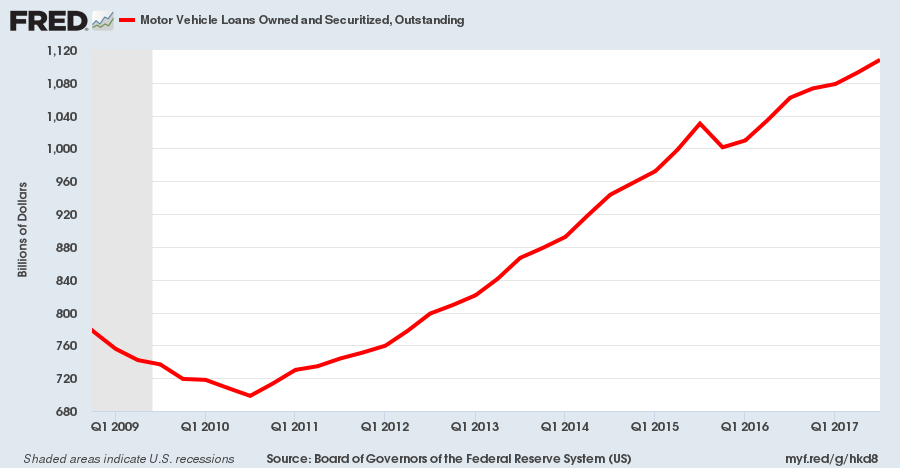

Over the past few years, car sales have skyrocketed on the back of increasing auto loans. Look at the chart below, it shows auto loans growth since the recession of 2007-2009.

(Source: “Motor Vehicle Loans Owned and Securitized, Outstanding,” Federal Reserve Bank of St. Louis, last accessed January 4, 2018.)

What’s so troubling about this? A lot of these loans were given out to those with poor credit (also called subprime borrowers) and made by increasing the length of the loans.

Giving some further perspective; since 2011, auto loans given out to those with credit scores of 620 or lower have increased 72%. In 2016, for example, 20% of all new auto loans were made to subprime borrowers.

Subprime Borrowers Starting to Default

With all this in mind, it’s important to understand what’s ahead.

After the financial crisis, big private equity (PE) firms jumped to offer auto loans to those with bad credit. Now, they find themselves in a very troubling situation. Delinquency rates on the loans made are soaring, new investments have dried up, and big banks are pulling back from auto lending business.

You see, the loans that were made to those with poor credit are starting to go “bad.” The defaults on these loans are being dubbed as “crisis level.”

Chris Gillock, managing director at Colonnade Advisors, a boutique investment bank, said regarding sub-prime auto loans, “The PE guys sailed into this thing with stars in their eyes. Some of the businesses have done fine and some haven’t.” He added, “it’s about as out-of-favor a sector as I can think of.” (Source: “Subprime Auto Defaults Are Soaring, and PE Firms Have No Way Out,” Bloomberg, December 21, 2017.)

What’s Ahead for Automaker Stocks?

Dear reader, if you bring all of this together, it foretells a dire tale for automakers.

The lenders, who gave out massive amounts of auto loans to subprime borrowers, could be rethinking their lending practices. With default rates soaring, and investments drying up, they could be putting brakes on auto loans.

What do you think will happen when auto loans freeze? Automakers may not be able to sell as many cars as before. With this, it’s not really rocket science. Their sales and profitability could plummet, and their stock prices could face a lot of scrutiny from investors.